Stockholm (HedgeNordic) – After starting off 2019 on the wrong foot, most Nordic CTAs are recovering some lost ground this month according to preliminary estimates. Based on preliminary return figures for 11 members of the NHX CTA, six members of the group returned more than three percent month-to-date through Friday last week or Monday this week.

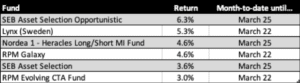

SEB Asset Selection Opportunistic, a more aggressive version of trend-follower SEB Asset Selection, is leading the pack with a 6.3 percent return this month through the end of Monday this week. The fund lost 7.7 percent in the first two months of 2019. SEB Asset Selection, meanwhile, gained an estimated 3.6 percent month-to-date. Both funds are managed by SEB’s Global Quant Team led by Hans-Olov Bornemann.

Systematic hedge fund Lynx Sweden, which trades liquid global futures markets across equities, fixed income, currencies and commodities, gained 5.3 percent this month through Friday last week. This month’s gain takes the trend-follower’s year-to-date return further into positive territory at 6.7 percent.

The two vehicles managed by Stockholm-based multi-CTA manager RPM are also performing strongly so far this month. RPM Galaxy, a multi-CTA fund allocating to large, established managers, was up 4.6 percent this month through the end of last week. The fund lost eight percent in the first two months of the year. RPM Evolving CTA Fund, a multi-CTA fund investing in CTAs in their so-called evolving phase, returned three percent month-to-date. The fund was down 8.7 percent in the first two months of 2019.

Quantitative trend-follower Nordea 1 – Heracles Long/Short MI Fund, managed by Metzler Asset Management’s fund manager Christoph Sporer on a mandate, advanced 4.6 percent this month through the end of Monday this week. This month’s gain will help the trend-follower recoup most of the losses incurred at the beginning of the year. The fund fell 5.3 percent during the first two months of the year.

Picture © ollyy—shutterstock