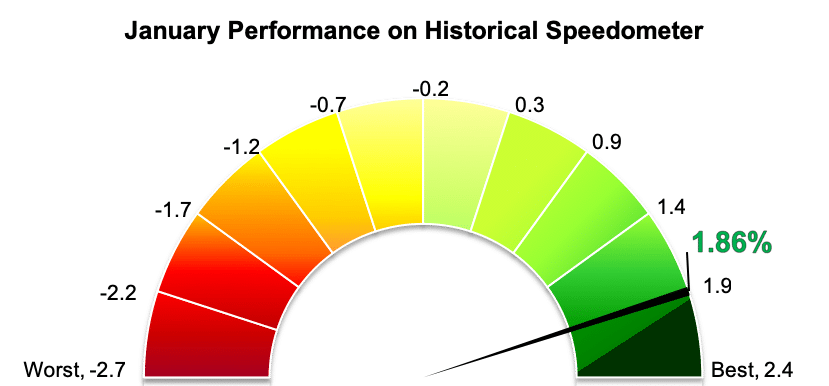

Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds kicked off 2019 with strong gains, achieving the group’s second-best January on record. The NHX Multi-Strategy, the most diverse and inclusive strategy category in the Nordic Hedge Index (NHX), gained 1.9 percent last month (98 percent reported).

The NHX Multi-Strategy comprises hedge funds that cannot be easily assigned to any of the other four strategy sub-categories: equities, fixed income, CTAs or fund of funds. Most members of the multi-strategy group, however, contain hedge funds that invest across a range of asset classes or strategies in attempts to achieve their return and other investment objectives.

Similar to their Nordic counterparts, international multi-strategy hedge funds enjoyed good gains in January. The Eurekahedge Multi-Strategy Index, which reflects the average performance of 282 multi-strategy hedge funds, was up 2.3 percent last month. The HFN Multi-Strategy, which includes multi-strategy funds from eVestment’s database of hedge funds, gained 1.8 percent. The Barclay Multi-Strategy Index, meanwhile, advanced an estimated 2 percent in January, based on reported data from 99 funds.

Around 80 percent of the funds part of the NHX Multi-Strategy reported gains for January. UB Real REIT, an alternative investment fund investing in listed real estate investment trusts (REITs), property development companies, as well as fixed-income instruments issued by these companies, gained 12.4 percent in January, erasing much of last year’s decline of 13.4 percent. This was the fund’s best month since its inception in June 2012.

Four multi-strategy hedge funds managed by Danish asset manager Formuepleje completed the list of top five performers. Formuepleje Penta and Epikur, both nominated for the EuroHedge Awards 2018 that took place in January, were up 10.1 percent and 10.4 percent, respectively. Formuepleje Safe and Pareto, meanwhile, advanced 8.5 percent and 6.7 percent, correspondingly.

Picture © Vintage-Tone—shutterstock