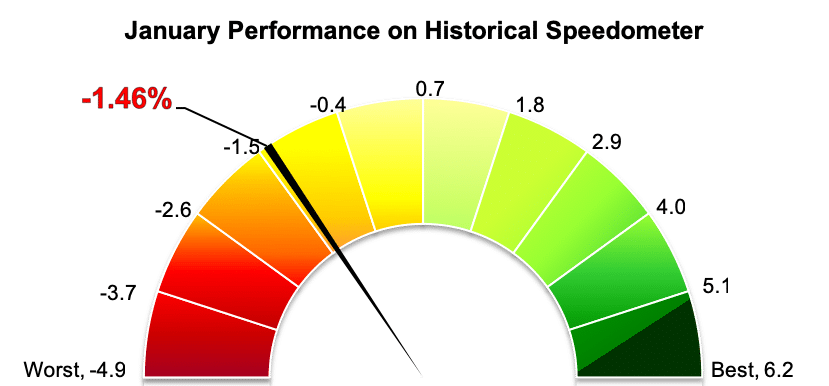

Stockholm (HedgeNordic) – Nordic trend-following hedge funds started off 2019 on the wrong foot, as both stock and crude oil prices reversed the negative trends shaping up in the latter part of last year. Nordic CTAs, as expressed by the NHX CTA, had the worst month of all sub-categories in January, falling 1.5 percent on average.

The world’s largest CTA vehicles did not enjoy a great start to the year either. The Société Générale CTA Index, which tracks the performance of the largest 20 CTAs in the world including three members of the Nordic Hedge Index (NHX), declined 1.9 percent in January. The Barclay BTOP50 Index, composed of a slightly different group of large CTA funds, fell 1.8 percent. The broader Barclay CTA Index, which incorporates 541 vehicles, was down an estimated 0.4 percent, based on data from 72 percent of the group.

One in every three members of the NHX CTA registered positive returns in January. IPM Systematic Currency Fund and Innolab Capital Index were two of the biggest gainers. IPM’s Systematic Currency strategy gained 4.5 percent, reflecting substantial gains from its developed markets currency portfolio. The vehicle’s short Swiss Franc (CHF) and long Pounds Sterling (GBP) positions were the main contributors to last month’s performance.

Innolab Capital Index, which uses an autonomous investment robot to predict market movements in major stock market indices, was up 3.2 percent last month. Estlander & Partners Presto, which employs systematic short-term trend-following models, gained 2.3 percent. Its short-term focus helped the fund gain 8 percent last year when most trend-followers struggled. Runestone Capital Fund, which invests in US equity index volatility on a one-day forward basis based on statistical probabilities, gained 1.2 percent in the first month of the year.

Picture © Ollyy—shutterstock