CME Group Partner Content: China’s growth is decelerating, it is loaded with debt and is involved in a high stakes trade war with the United States. Despite these issues, China’s economy appears to be holding up better than one might have expected. In fact, China’s growth could even accelerate in 2019 in response to aggressive monetary easing. However, that same monetary easing is piling on risks for the 2020s that could compound the ills of demographic changes and send markets on a rollercoaster ride. Our analysis of China’s economic situation will highlight a complex interplay of long-term demographic trends, the declining effectiveness of traditional policy tools and the impact of the current policy environment.

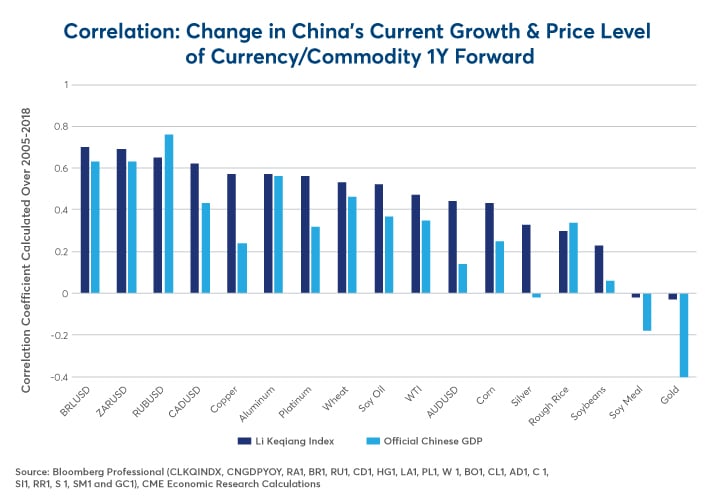

How China fares this year and during the next decade will go a long way towards determining how various markets perform, especially commodities and the currencies of commodity exporting nations. Many commodities and commodity-related currencies show strong correlations to Chinese growth, especially to narrow measures of growth in China’s industrial activity such as the Li Keqiang index, which measures growth in rail freight volumes, electricity consumption and bank loans.

Despite its narrowness, the Li Keqiang index is an intriguing complement to China’s official GDP number. Not only does the Li Keqiang index correlate more positively with nearly every currency and commodity, it also shows a much higher degree of variability in economic growth than the official number, which has ranged between 6.4% and 7.2% every quarter since 2012 (Figure 2) and has never surprised consensus estimates by more than 0.1%. When evaluating China’s 2019 and 2020 economic prospects, we will look at both numbers. Before getting into the details, however, let’s start by looking at the biggest of the big pictures: demographics.

Context matters, and we start with a brief review of the dominant long-term theme before we turn to the more dynamic issues of policy and trade war developments. Demographic trends suggest slower growth is in store for China in the 2020s. The issue is how economies cope with and adapt to low birth rates, an aging population and little to no growth in the working age population.

In 1990, the percent of the population over 65 years of age in China was 5.5%. Today, it stands at 11.3%, and by 2030 it will have risen to 17%. The impact of a larger population of retirees means the younger generations have a greater burden of support. In addition, the growth of the working age group cohort, defined by the U.S. Census as 15-64 years of age, is of huge importance to potential economic growth. If one thinks of growth potential as the sum of labor force growth and productivity growth, when labor force growth slows, it sets the same trend for real GDP growth subject to the variations in productivity. From 1990 to 2018, the population of 15 to 64-year-olds increased cumulatively by just over 30%. U.S. Census Bureau projections for 2018 to 2030 suggest that China may see a -4.66% cumulative decline in the population of the 15-64 cohort (Figures 3 and 4).

The relevance for real GDP over the next decade or so is simply that population demographics suggest a deceleration of economic potential that will be well beyond the ability of traditional policy measures to reverse. China has been experiencing a dramatic rural-to-urban population shift, which has effectively masked the impact of aging because the highly productive urban labor force has still been growing at 3%-plus per year. As the rural-to-urban migration diminishes over the next decade, the joint challenges of a rapidly aging population and actual declines in the working age population could potentially hit real GDP hard. In effect, if China can manage average real GDP growth in the 3% to 4% range in the 2020s, it will have done an exceptional job of adapting to its demographic challenges. Slowing population growth and diminishing gains from the urban to rural transition could make the other headwind facing China harder to manage: debt.

With the long-term demographic context suggesting growth will disappoint policymakers, we may also project that they may try a variety of policies to increase real GDP by influencing labor productivity. And, the main policy that falls into this camp is the extensive use of debt, both government and private sector. According to the Bank for International Settlements (BIS), China’s total credit to the non-financial sector is 253% of GDP for 2Q/2018, and for the US the number is 249% of GDP.

When the US and the Eurozone reached 250% debt-to-GDP ratio, they experienced severe financial crises. Those who are concerned that China might follow suit now that it has achieved analogous levels of debt should remember that high debt levels alone did not ignite that great Western debt crisis. While high levels of debt provided the tinder that fueled the crisis, the spark that set it off was central bank tightening. Between June 2004 and June 2006, the Fed hiked rates 17 times, raising its policy rate from 1% to 5.25%. Between 2005 and 2008, the European Central Bank raised rates from 2% to 4.25%. This tightening of monetary policy slowed growth and made the debt burden unsustainable.

For the moment, China is taking the opposite approach. The Peoples Bank of China (PBOC) cut rates five times in 2014 and 2015 and has since been slashing its reserve requirement ratio – essentially attempting to solve a debt problem with more debt. For the moment, with Chinese inflation quiescent, the PBOC can ease policy without too much trouble. When they eventually begin to tighten policy, however, China’s economy could face significant risks.

China has opted for cuts to the reserve requirement ratio rather than interest rate cuts for one simple reason: cutting the reserve requirement ratio stimulates debt creation without putting downward pressure on the currency. Cutting interest rates, by contrast, would increase pressure for capital outflows.

The country’s demographic issues won’t help either. High levels of debt can be managed under two circumstances: 1) extremely low interest rates, and 2) high rates of economic growth. The first assures that the debt can be financed in an affordable manner. The second guarantees that more cash will be available to service the debt in the future. The problem begins when one of these two things is no longer true.

The bottom line is that China may be nearing the upper end of its sustainable debt loads. Adding more debt may no longer grow the economy at a faster rate as additional lending may only serve to finance the existing debt rather than adding growth through spending and investment. The key takeaways here are that China’s favored policy tool for economic management – pushing new bank loans into the economy – may begin to hit the wall of diminishing returns and no longer work as well as it once did.

Against a backdrop of an aging population and excessive use of debt, one might argue the U.S.-initiated trade war came at a tough time for both countries. While it is tricky to put a date on the start of the trade war, we place it in May 2018. At the end of May, the tit-for-tat tariffs hit U.S. soybean prices hard. Also, the U.S. steel and aluminum tariffs went into effect at the end of May. Our judgment about the start date is that actions outrank threats; however, dating the start a few months earlier is not going to change the conclusion that the trade war has slowed China’s growth.

Here are a few selected statistics related to the trade war from May 1, 2018 through January 25, 2019. The U.S. S&P500® Index has seen some impressive ups and downs yet is flat during that period, while the Shanghai Composite is down 16%. China has seen export growth slow down. The latest data, for December 2018, showed a -4% year-over-year decline, compared to +11% growth for April 2018 compared to April 2017. China’s latest real GDP data showed only a small decline, yet the reality is that the trade war is taking a toll. Our research has indicated that the initial direct effects of the trade war were relatively small, even for China. As the trade war fallout started to bite, indirect effects and behavioral feedback loops have kicked in and made the picture a little worse for both countries.

With the pressure building, the US and China made a show at the G20 meeting in Argentina late last year to offer a path to negotiations. The US put a March 1 deadline on those negotiations to demonstrate progress. The canary in the coal mine that best reflects progress is the value of the Chinese Renminbi (CNY), which had rallied to 6.74/USD as of January 25, 2019, compared to its weakest point of 6.97/USD on October 31, 2018. By this measure, market participants are sensing that the pain is high enough in both countries to offer the possibility of a compromise. Equity markets may not behave well if progress to ease trade war tension does not come to pass. Other markets, such as soybeans and copper may also be negatively affected if trade talks break down.

For China, the main policy tool, as already discussed, is pushing new loans into the economy. The effectiveness of that tool has been substantially mitigated by the colossal runup in debt. China managed round one of the trade war relatively well, even if it has sustained a little more damage than the U.S. economy. China’s challenge is that if the trade war were to intensify, it will not be able to cushion its impact as well as it did in 2018.

That said, the best indicator of China’s economic growth – the yield curve— is showing signs of life. China’s yield curve went flat in mid-2017, heralding a coming slowdown in growth that hit both the official and alternative growth numbers. It recently steepened again. As such, it is possible that the PBOC’s extreme monetary easing may show results one more time: stabilizing and even increasing China’s growth rate in 2019 but at the expense of rising financial fragility and greater risk of a financial crisis in the 2020s. Commodity investors who might take heart in improved economic growth should also be warned: China’s easing monetary policy to stoke growth might be akin to robbing Peter to pay Paul. It will bring forward modest economic benefits in 2019 but at potentially great expense during the next decade.

The U.S.-China trade war is damaging, but demographic trends and debt levels constitute a far more critical threat to China’s economic wellbeing during the 2020s. A slowdown in the rural-to-urban transition and outright negative growth in the working age population threaten China’s ability to manage its growing debt burden. The fact that the central bank is reducing the reserve requirement ratio to encourage more lending may, however, might support China’s growth rate in 2019. Will be it be a last hurrah before the chickens come home to roost in the 2020s? The risks are growing and stronger short-term growth followed by much slower economic progress in the 2020s could send commodity prices and the currencies of commodity exporters on a wild ride.