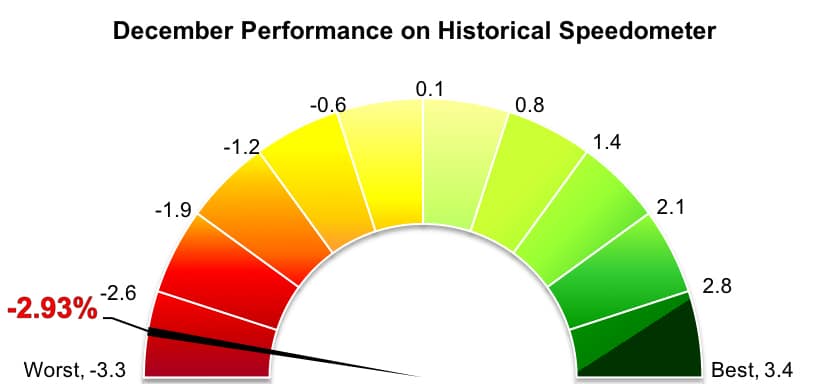

Stockholm (HedgeNordic) – The last month of 2018 saw Nordic equity hedge funds suffer their worst month in seven years as equity markets plummeted across the globe. The equity-focused members of the Nordic Hedge Index (NHX) lost 2.9 percent in December (89 percent reported), which brought their collective performance for the year further into negative territory at down 3.6 percent.

In spite of their poor performance on an absolute basis, Nordic equity hedge funds beat Nordic and global equity market indices in December. Nordic equities, as measured by the VINX All-share index, delivered a negative net return of 4.7 percent in Euro terms last month. The index, which includes all firms listed on NASDAQ OMX Nordic Exchanges and Oslo Börs, posted a net return of minus 5.9 percent for the year. Global equity markets, as measured by the FTSE World Index, fell 8.0 percent in Euro terms last month, which took the performance for the year to down 4.2 percent. Eurozone equities declined 5.8 percent in December, while North American equities tumbled 9.8 percent in Euro terms.

Both Nordic-based and international equity hedge funds took big hits to their last year’s returns in December. The Eurekahedge Europe Long Short Equities Hedge Fund Index, which tracks the performance of 174 European vehicles, declined 2.1 percent last month, extending the loss for the full-year to 6.2 percent. The Eurekahedge Long Short Equities Hedge Fund Index, which comprises 969 global equity hedge funds, was down 2.7 percent in December, ending the year at down 6.4 percent. The Barclay Equity Long/Short Index fell an estimated 2.1 percent in December and was down 3.4 percent for the year. The HFN Long/Short Equity Index, which reflects the performance of equity hedge funds in eVestment’s database, declined 3.5 percent last month, which took the return for the entire 2018 to down 6.4 percent.

Only five of the 61 members of the NHX Equities achieved positive returns in December. Systematic market-neutral fund QQM Equity Hedge gained an estimated 2.1 percent last month, which halved the fund’s loss for 2018 to 2.1 percent. Europe-focused equity hedge fund Bodenholm, meanwhile, was up 0.8 percent in December. The Brummer & Partners-backed vehicle gained 6.6 percent last year. Long/short equity fund Arcturus gained 0.4 percent in the last month of 2018, which reduced its full-year decline to 7.6 percent.

Picture © Shutter_M—shutterstock