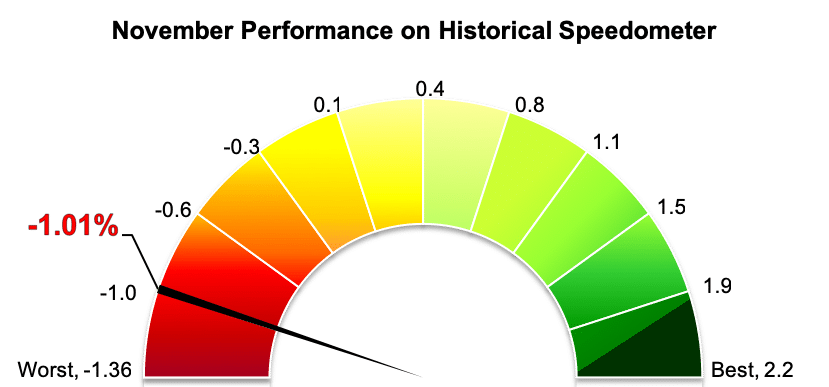

Stockholm (HedgeNordic) – In November, Nordic fixed-income hedge funds recorded their worst monthly fall in the past three years, as credit spreads widened and liquidity in bond markets dried up. The NHX Fixed Income was down 1.0 percent last month (93 percent reported), cutting the category’s year-to-date gains to 0.2 percent.

Nordic fixed-income hedge fund slightly underperformed their global counterparts in November, but both groups have been performing in unison in recent months. The Eurokahedge Fixed Income Hedge Fund Index, which tracks the performance of 337 global fixed-income hedge funds, fell 0.6 percent in November, taking the year-to-date performance through November to 0.4 percent. The HFN Fixed Income Index (non-arbitrage), an index that reflects the performance of fixed-income vehicles in eVestment’s database of hedge funds, was down 0.7 percent last month. The HFN index gained 0.6 percent this year through November. Credit spreads on both global high-yield bonds and investment-grade bonds increased during November after a similar increase in October, which led to a deteriorating in bond prices that hurt both Nordic and global fixed-income hedge funds.

Most funds included in the NHX Fixed Income reported losses for November, as only three vehicles posted gains for the month. Direct lending fund Scandinavian Credit Fund I gained 0.5 percent in November, which brought the fund’s year-to-date gains to 6.8 percent. The alternative investment fund providing direct loans to small- and medium-sized companies is the best-performing member of the NHX Fixed Income this year.

Formuepleje Fokus and HP Hedge, two vehicles investing in Danish mortgage bonds, were up 0.3 percent in November. Formuepleje Fokus is up 1.7 percent year-to-date and HP Hedge gained 5.0 percent this year. Nykredit EVIRA Hedge Fund, which maintains a concentrated portfolio of lower-rated European corporate bonds of strong companies with improving credit quality, incurred a loss of 7.3 percent last month. The fund fell 15.4 percent year-to-date through November.

Picture © alexskopje—shutterstock