Stockholm (HedgeNordic) – After four consecutive quarters of hedge fund launches exceeding liquidations, more hedge funds closed their doors than opened up in the third quarter. According to data published by Hedge Fund Research (HFR), 174 hedge funds were closed, and 144 new funds were started in the third quarter.

Last quarter’s number of launches was the lowest quarterly figure for launches since the fourth quarter of 2008 when only 56 new funds joined the hedge fund arena. 148 hedge funds were started in the second quarter of this year, and 190 vehicles were launched during the third quarter of last year.

Hedge fund liquidations, meanwhile, increased in the third quarter after declining for four consecutive quarters. Last quarter’s 174 liquidations were higher than the 137 liquidations registered during the third quarter of last year and the 125 closures reported for the second quarter of this year. According to HFR president Kenneth J. Heinz, increased market volatility during the quarter led to decreased investor risk tolerance and an associated increase in fund liquidations.

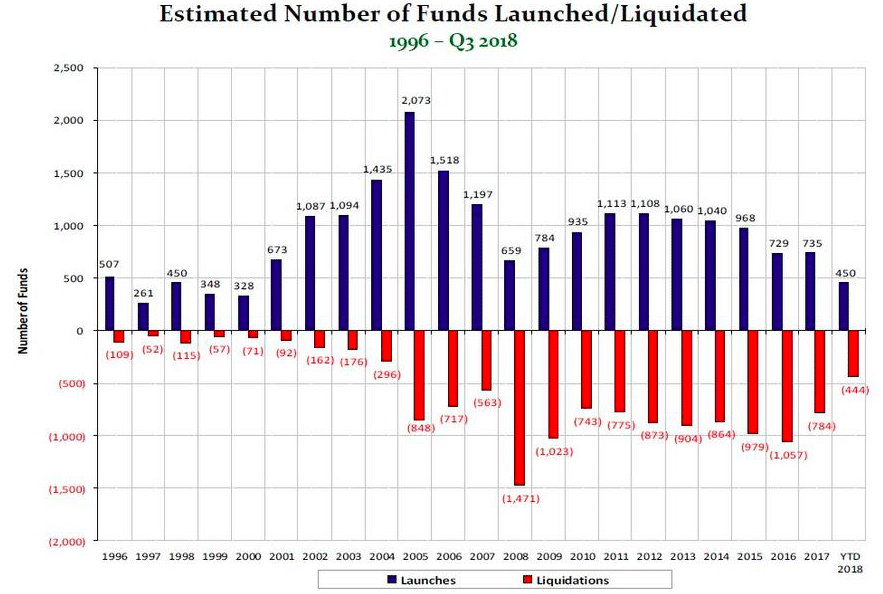

An estimated 450 new hedge funds were started this year through the end of September, narrowly outpacing the 444 liquidations recorded in the hedge fund space. Unless 210 or more hedge funds open up in the final quarter of the year, 2018 will mark the worst year for hedge funds in terms of new launches since 2001. The industry’s worst year for launches was 2008 when 659 vehicles came on the market.

A separate report by Eurokahedge shows that a total of 580 hedge funds shut their doors year-to-date through the beginning of December, compared to 552 new launches. The number of hedge fund closures in the Nordics is on the rise as well, but the closures are not solely related to poor performance. A couple of hedge funds relying on capital from the Swedish premium pension system (PPM), for instance, closed down or are expected to shut their doors after the Swedish Pensions Agency published new rules during the fall for funds seeking distribution via the PPM platform.

With around 15 hedge fund launches in the Nordics this year, six launches scheduled for next year and the number of finalised or planned closures in the single digits, the number of players in the Nordic hedge fund industry continues to increase. Lower-risk, lower-reward hedge fund products appear to receive more investor interest this year, as their assets under management have been steadily growing.

Picture © Shutter_M—shutterstock