Stockholm (HedgeNordic) – Swedish hedge fund group Atlant Fonder AB, which manages a suite of eight hedge fund vehicles, has seen its assets under management increase by around 33 percent to SEK 4.5 billion at the end of October from SEK 3.4 billion at the end of last year. Exactly one-fourth of the SEK 1.1 billion year-to-date increase in assets occurred in October, a scary month for investors as equity markets tumbled across the globe.

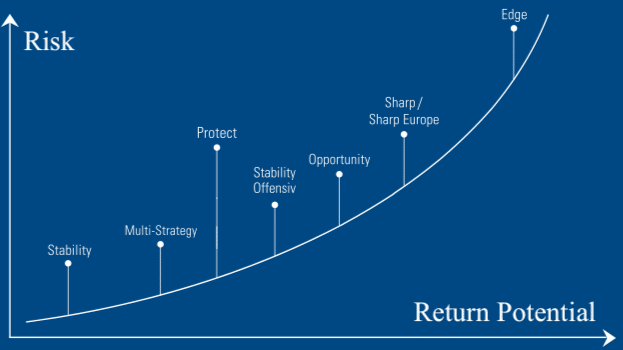

Atlant Fonder’s three market-neutral funds – Atlant Stability, Atlant Stability Offensiv, and Atlant Opportunity – pursuing positive returns no matter what happens to financial markets held up relatively well during the turbulent month of October. Atlant Protect, a vehicle designed specifically to protect against market crashes, gained 3.1 percent in October, clinching the title of last month’s second-best performing member of the Nordic Hedge Index (NHX).

The asset manager’s equity-tilted hedge funds designed to provide exposure to equity markets at lower volatility – Atlant Edge, Atlant Sharp and Atlant Sharp Europe – incurred mid-single digit losses, yet all outperformed their benchmark indices. Atlant Multi-Strategy, the fund of funds investing in Atlant Fonder’s hedge funds, was down 0.4 percent in October. On an asset-weighted basis, the asset manager was flat to marginally negative at 0.1 percent last month.

Atlant Fonder’s range of funds oversees a collective SEK 4.46 billion in assets under management as of the end October, up from SEK 4.18 billion at the end of September and SEK 3.35 billion at the end of 2017. As portfolio manager Taner Pikdöken tells HedgeNordic, “When investors go through a period of market turmoil, and our peers in the absolute return segment fail to deliver results, our range of funds often sees an increase in capital inflows.” The asset manager’s flagship hedge fund, Atlant Stability, saw its assets rise to SEK 2.89 billion at the end of October from SEK 2.43 billion at the end of last year. After ten years of existence, the low-risk market-neutral fund is yet to record a negative year (read more details).

The asset manager’s smaller vehicles enjoyed a much steeper increase in assets under management. Atlant Multi-Strategy manages SEK 282.7 million in assets as of the end of October, up from SEK 39.50 million at the end of 2017. Atlant Opportunity, meanwhile, saw its assets under management jump from SEK 59.59 million at the end of last year to SEK 309.65 million at the end of last month. Atlant Protect manages SEK 119.09 million, compared to SEK 14.70 million at the end of 2017.

Picture © mageFlow—shutterstock