Stockholm (HedgeNordic) – The group of Nordic fixed-income hedge funds outperformed each of the remaining four strategy categories tracked by HedgeNordic both in 2017 and 2016. Although fixed-income vehicles seem unlikely to enjoy a similarly strong performance in 2018, their resilience during the market turmoil of October helped cement their position as the best performing category within the NHX year-to-date through the end of October (despite trailing equity-focused hedge funds prior to October). This article provides a snapshot of the fixed-income corner of the Nordic hedge fund industry.

Where do fixed-income vehicles in the NHX come from?

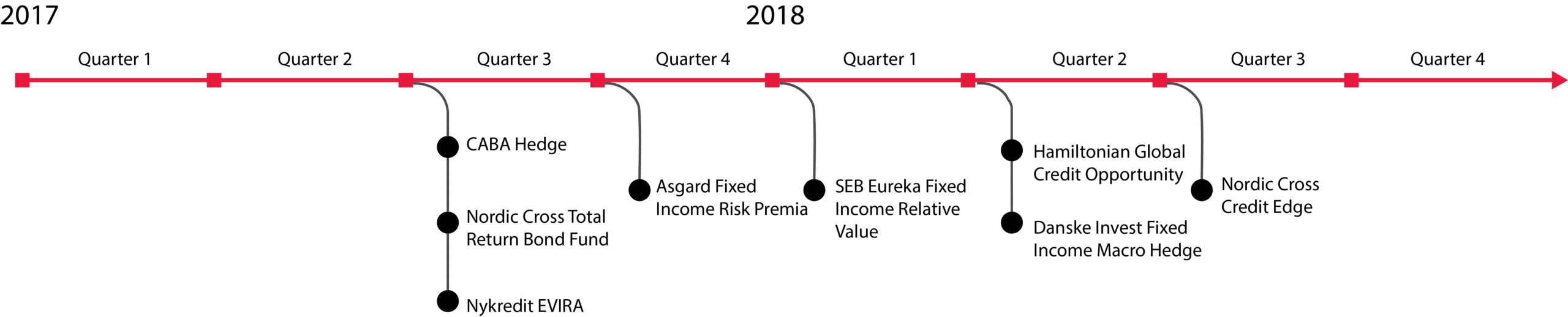

There are 29 fixed-income hedge funds in the Nordics as of the end of October, five more vehicles than at the same point last year. Of the 13 Nordic hedge funds launched thus far in 2018, four are investing in the fixed-income space. As shown in the timetable below, SEB Eureka Fixed Income Relative Value was launched during the first quarter of the year, Hamiltonian Global Credit Opportunity and Danske Invest Fixed Income Global Value took off during the second quarter, whereas Nordic Cross Credit Edge was started during the previous quarter.

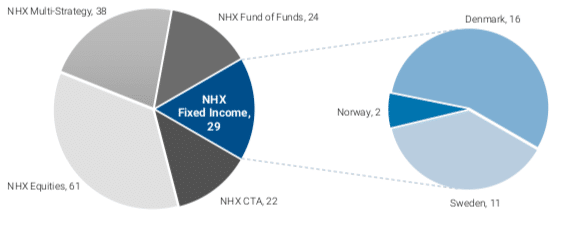

One in every six members of the Nordic Hedge Index (NHX) run investments strategies that focus on fixed-income markets. A little more than half of all fixed-income hedge funds included in the NHX are based in Denmark, which is not surprising given the sheer size of the Danish mortgage market. Denmark’s mortgage bond market is one of the largest and most liquid bond markets in the world. The complexity of this market, characterized by an extensive variety of issuances with very different characteristics, has allowed many local managers to develop a competitive edge in the pursuit of exploiting market inefficiencies. Of the 34 Danish hedge funds included in the NHX, 16 are employing fixed-income strategies. The NHX universe also includes 11 Swedish fixed-income funds and two Norwegian funds. There are no Finnish-based fixed-income vehicles in the NHX family.

How big are Nordic fixed-income hedge funds?

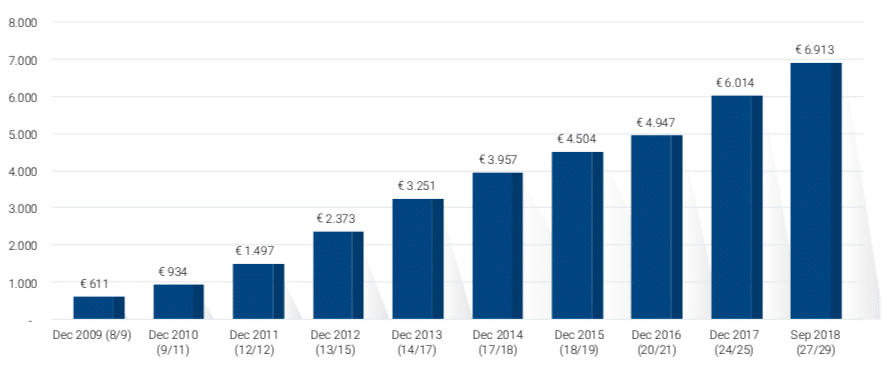

The universe of Nordic fixed-income hedge funds oversees €6.91 billion in assets under management as of the end of September based on data for 27 of the 29 members of the NHX Fixed Income. Danish-based vehicles account for around two-thirds of this figure, whereas Swedish funds represent 29 percent of all assets. The two Norwegian fixed-income funds account for six percent of the nearly €7 billion-figure.

Eight out of the nine fixed-income hedge funds that were operating at the end of 2009 collectively managed €611 million at the end of that year, with these eight vehicles managing €2.63 billion in assets as of the end of September of this year. The 12 members of the NHX Fixed Income which were up and running at the end of 2012, meanwhile, had €2.37 billion in assets under management at the end of that year. These 12 vehicles oversee €3.70 billion in capital as of the end of September. All Nordic fixed-income hedge funds launched in 2016 and onwards managed €1.35 billion in assets at the end of September of this year.

There are eight fixed-income hedge funds in the NHX with an operating life of less than two years, with this young group managing assets of €143.1 million on average. The Nordic hedge fund space also includes ten mid-age fixed-income hedge funds with an operating life between two and eight years, and an additional 11 vehicles with an operating life that exceeds eight years. Mid-age fixed-income hedge funds manage €279.8 million in capital on average, whereas the more veteran fixed-income vehicles in the NHX oversee €311.7 million in assets on average.

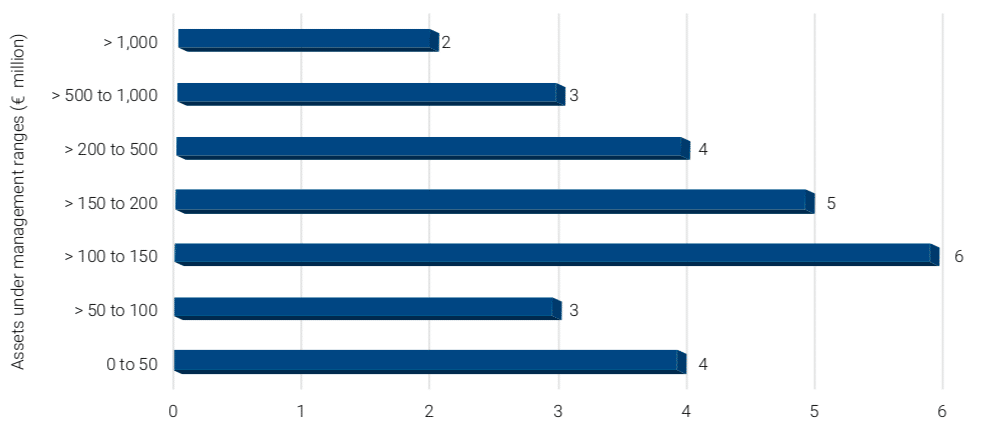

The majority of the Nordic hedge funds employing fixed-income strategies oversee less than €200 million in capital (18 out of the 27 vehicles that reported assets under management figures). Eleven of these hedge funds manage less than €100 million. Four of the 27 vehicles oversee between €200 million and €500 million in capital, whereas five of them manage assets in excess of €500 million. Nordkinn Fixed Income Macro Fund and Danske Invest Hedge Fixed Income Strategies are the largest fixed-income hedge funds in the Nordics, both managing in excess of €1 billion.