Stockholm (HedgeNordic) – Market observers may have different views on where we are in the business cycle, but those finding themselves in a typical slowdown phase of the cycle may be interested in finding out which hedge fund strategies perform best during this phase. In a recently published report, asset manager Fidante Partners lays out an analysis of the behavior of a range of hedge fund strategies during the late stages of a business cycle covering a period of 20 years.

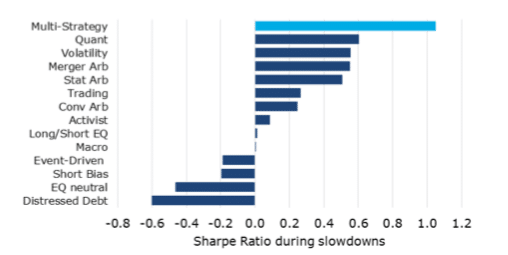

Although every business cycle is different in its own way, the four widely recognized phases of a business cycle are: recovery, expansion, slowdown, and recession. According to Fidante Partners, we are currently in the late stage of a business cycle characterized by flattening or even inverting yield curves and deteriorating growth prospects. Whereas various hedge fund strategies tend to generate similar returns over a long enough period of time, there is huge performance dispersion among strategies in the more challenging environment of a late stage business cycle. Because of more frequent corrections in equity markets and increased market volatility, macro-focused and short-biased hedge funds tend to perform better than their long-term averages in the late stage of business cycles.

Event-driven and long/short equity strategies, meanwhile, are found to struggle during the late stages of a business cycle as financial markets get choppy. Merger arbitrage, statistical arbitrage, and equity market-neutral hedge funds tend to perform in line with their long-term averages during this stage of a business cycle. That said, equity market-neutral and arbitrage strategies behave as expected in the late-cycle phase. Equity market-neutral hedge funds, for instance, aim to produce returns which are independent of broader equity markets and thus largely independent of changes in growth prospects or interest rates. Returns produced by arbitrage strategies are also expected to be largely independent of the prevailing interest-rate environment and growth prospects.

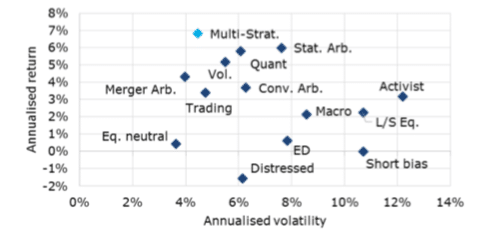

Merger arbitrage, statistical arbitrage, quantitative and volatility hedge fund strategies are found to deliver superior risk-adjusted returns across the entire cycle, with this subset of strategies also performing strongly during the late stage of a business cycle.

The paper titled “Hedge funds in the late stages of a business cycle” can be found below:

Picture © leungchopan—shutterstock.com