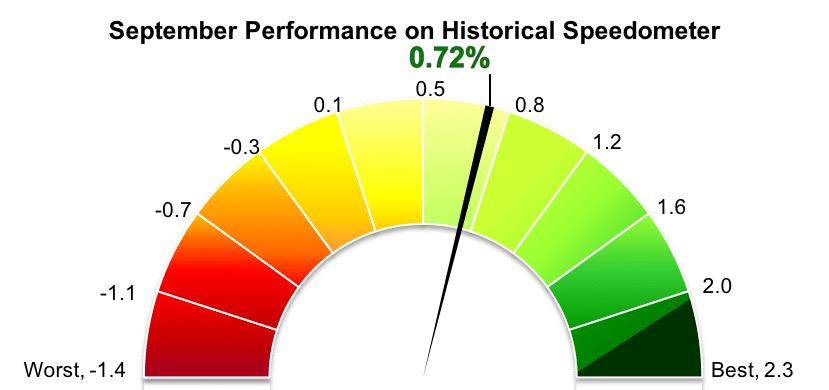

Stockholm (HedgeNordic) – September turned out to one of the best months of the year for Nordic fixed-income hedge funds, with the NHX Fixed Income gaining 0.7 percent last month (93 percent reported). The fixed-income members of the NHX are up 1.8 percent on average year-to-date through September.

Nordic fixed-income hedge funds slightly outperformed their global counterparts last month. The Eurokahedge Fixed Income Hedge Fund Index, an equally weighted index of 325 fixed-income hedge funds, was up 0.5 percent in September, bringing the year-to-date performance to 1.5 percent. The HFN Fixed Income Index (non-arbitrage), tracking the performance of fixed-income vehicles in eVestment’s database of hedge funds, gained 0.1 percent. The HFN index also increased by 1.5 percent in the first three quarters of 2018.

The majority of the funds included in the NHX Fixed Income reported positive returns for September, with only three vehicles incurring minor losses. KLP Alfa Global Rente, a market-neutral hedge fund seeking to exploit mispricing in interest rate curves, relative differences between interest rate curves on a country level, and currencies, is continuing its strong run of performance with a gain of 2.6 percent in September. The fund is up 4.6 percent in the first three quarters of 2018 and is yet to record a down year since launching in January 2008.

Nykredit EVIRA and MIRA, two vehicles managed by Nykredit Asset Management, closely followed suit after gaining 2.5 percent and 2.2 percent, correspondingly. Nykredit MIRA, a relative-value fund focusing on Danish mortgage bonds, has not recorded a negative year since launching in late 2008 either and gained 4.7 percent year-to-date through September. Nykredit EVIRA, which focuses on European corporate bonds instead, is down 5.6 percent this year.

Picture © Who is Danny—shutterstock.com