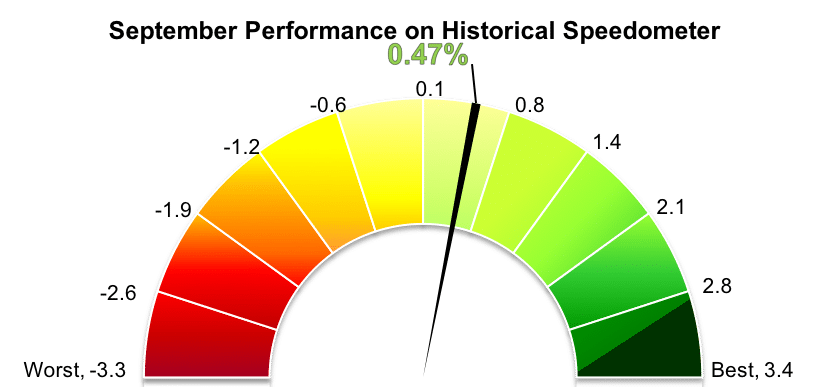

Stockholm (HedgeNordic) – Nordic equity hedge funds ended the third quarter on a good note after gaining 0.5 percent on average in September (90 percent reported). After three consecutive months of positive performance, the group of equity-focused funds in the Nordic Hedge Index (NHX), as expressed by the NHX Equities, is up 2.8 percent year-to-date through September.

The equity-focused members of the NHX performed broadly in line with global equity markets last month but trailed Nordic equities. Global equity markets, as expressed by the FTSE World Index, rose 0.8 percent in Euro terms in September. Nordic equity markets, as measured by the VINX All-share index which includes all firms listed on NASDAQ OMX Nordic Exchanges and Oslo Börs, produced a net return of 1.5 percent in Euro terms last month. Eurozone equity markets, as measured by the FTSE Eurozone Index, declined 0.2 percent in September after a sharp decline on the last day of the month as the Italian government announced plans for a wider budget deficit likely to be in breach of common rules on fiscal responsibility. North American equities, meanwhile, gained 0.6 percent in Euro terms last month.

Nordic equity hedge funds appear to have enjoyed a slightly better September compared to their international peers. The Eurekahedge Long Short Equities Hedge Fund Index, which includes around 1,000 equity hedge funds, fell 0.3 percent in September, cutting year-to-date gains to 0.5 percent. The Barclay Equity Long/Short Index, meanwhile, gained an estimated 0.5 percent last month, with this preliminary figure reflecting data from less than half of the universe tracked by the index. The Barclay index is up an estimated 2.7 percent in the first three quarters of 2018. The HFN Long/Short Equity Index, which reflects the performance of equity hedge funds from eVestment’s database, declined 0.2 percent in September. The index is up 2.2 percent year-to-date through September.

Roughly half of the Nordic equity hedge funds included in the NHX reported positive performance for September, with Adrigo Small & Midcap L/S topping last month’s list of best-performing funds in the NHX Equities with a gain of 6.6 percent. The long/short equity fund focusing on Nordic small- and middle-sized companies returned 21.9 percent net of fees since launching in November of last year, compared to the 11.9 percent gain delivered by the Carnegie Small Cap Return Index Nordic over the same period. The fund managed by Staffan Östlin is up 14.9 percent year-to-date through September.

Long/short equity fund Norron Select and Atlant Edge, an aggressive hedge fund implementing equity derivatives strategies on the OMX Stockholm 30 Index, gained 3.4 percent and 3.1 percent last month, correspondingly. Atlant Edge gained 18.3 percent year-to-date, currently ranking as the fourth-best performing member in the NHX Equities this year.

*September performance figures not reported.

Solidar Smart Beta Trend, which employs a systematic-based model to capitalize on major upturns in equity markets and protect capital during market downturns, fell 2.5 percent in September, which brought the year-to-date performance into negative territory at down 1.2 percent. DNB ECO Absolute Return, meanwhile, was down 1.8 percent last month, extending year-to-date losses through September to 7.7 percent.

Picture © 2jenn—shutterstock