Stockholm (HedgeNordic) – Most investors occasionally dream of finding multi-bagger stocks that can jack up invested capital. But investors are constantly warned against putting all their eggs in one basket. Warren Buffett, for example, recommends that investors consistently buy low- cost index funds, arguing that spreading money around via index investing is less risky and more rewarding over time. Inevitably, however, investors will always search for ways to outperform. Lately, there has been an increased focus on getting more portfolio exposure to factors such as value, size, momentum or other anomalies thought to offer a little extra return, contributing to the rise of factor-based investing.

Factor investing has attracted increased attention, partly because the past performance of traditional active managers appears to have been attributable to the exposure to certain factors such as size and momentum. This has led to increased investor demand for smart-beta products, often termed factor-based investments. These products, typically a cheaper alternative to active managers, depart from the conventional method of weighting components by their market capitalization to provide investors with more exposure to securities with certain characteristics that can beat the market over time.

New investment approaches build on the practice of investing in risk factors have been developed. The concept of alternative risk premia investing is seen as an extension of the factor-based investing approach, and is applied employing long/short and leveraged portfolio construction to better capture a particular risk factor or a set of risk factors. Smart beta and alternative risk premia investing bring many years of academic research to investors, with both approaches helping investors to capture sources of extra return stemming from risk factors such as value, carry, quality, and momentum. Peter Lindahl, a portfolio manager of a Finnish hedge fund that pursues market-neutral factor investing, says: “At Evli, we regard both [alternative risk premia and smart beta]as factor investing strategies, as they harvest similar academic factors like momentum and value.”

Going to the Core of ARP and Smart Beta Investing: Risk Premia

Factor-based investing represents an investment process designed to harvest certain risk premia from exposure to specific risk factors. Most investors are well aware of traditional risk premia such as the equity risk premium, which is the reward associated with investing in equity markets. The term premium – the reward investors receive from the added risk of owning longer-term bonds – and the credit premium – the reward investors obtain from holding riskier bonds issued by entities other than governments – are also understood by many. However, research has found other sources of risk premia, clustered under the “alternative risk premia” label.

Alternative risk premia are systematic sources of return that arise after breaking down an asset class such as equities into common drivers of return supplementary to the market beta, the traditional equity risk premium. Some alternative risk premia can be viewed as risk premia in a strict sense, while others can only be viewed as market anomalies. Many categorize alternative risk premia into two camps: skewness risk premia or pure risk premia, which stem from size or value risk factors; and market anomalies, risk factors stemming from behavioral biases. However, this distinction is not always completely objective as some risk factors can be viewed as both risk premia and market anomalies.

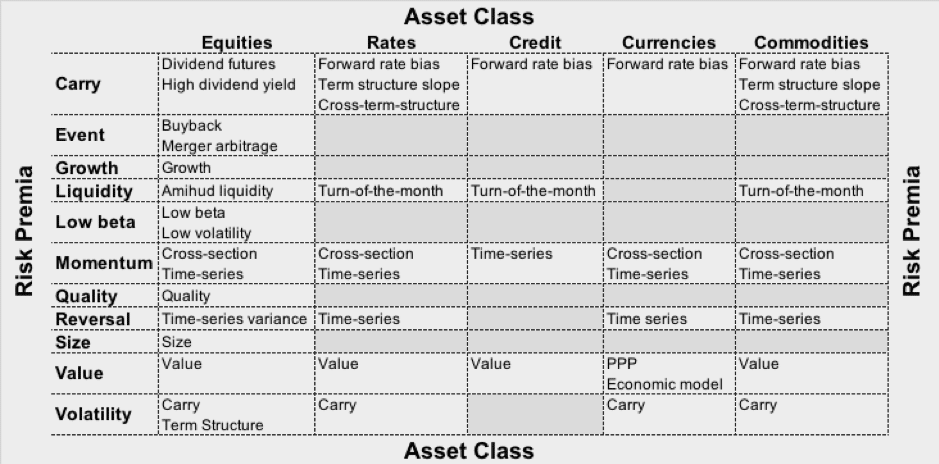

One example of alternative risk premia is the so-called cross-section momentum equity risk premium, which can be harvested by going long on past best-performing stocks and short on past worst-performing stocks. The carry currency risk premium serves as another example. The premium can be exploited by going long on the currencies of countries with high interest rates and short currencies of the countries with low interest rates. In a research paper from April 2017 titled “Alternative Risk Premia: What Do We Know?”, Amundi lists the following categories of risk premia: carry, event, growth, liquidity, low beta, momentum, quality, reversal, size, value, and volatility. Carry, value, and momentum are considered by Amundi as the most relevant alternative risk premia as they are present across all asset classes. Peter Lindahl, a portfolio manager of Evli Factor Premia Fund, corroborates Amundi’s opinion. “In our view, value, momentum and carry work across asset classes, and are among the most harvested factor premia in ARP strategies,” Lindahl told HedgeNordic. “Quality, low volatility, and size are also harvested but are equity specific. Trend – also called the cousin of momentum and the prime strategy of CTAs – is another popular one. Short volatility strategies are also factor risk premia, but are not always included in portfolios due to their riskier nature.” The figure below presents a classification of alternative risk premia by asset class, according to Amundi.

Same, Same, but Different

These alternative risk premia represent the raw material used to build smart beta and alternative risk premia strategies. Alternative risk premia and smart beta can sometimes, mistakenly, be lumped together and used interchangeably, but there are a number of important distinctions between the two. Whereas smart beta is usually captured using long-only investment strategies, alternative risk premia are harvested using more complex long-short strategies, sometimes market-neutral strategies. But perhaps the main distinction between the two hinges on the fact that smart beta strategies have exposure to both traditional and alternative risk premia. As Lindahl explains, “the difference between alternative risk premia and smart beta is that the latter is a long-only strategy, where the main risk exposure you get is traditional equity risk premia, and then factor premia [or alternative risk premia]on top of that.” “With ARP, the aim is usually to avoid traditional asset class risk and get as high a factor exposure as possible,” he adds.

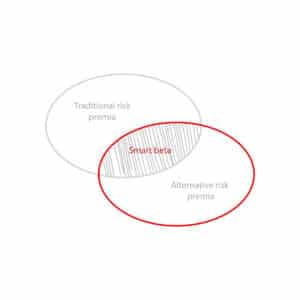

A value-oriented smart beta portfolio, for instance, will be fully invested in a basket of value stocks (with high book-to-market ratios, which have been found to provide higher returns at lower risk compared to growth stocks), which means the long-only smart beta portfolio will exhibit a fairly high degree of correlation to equity markets. The exposure to the value risk premia, however, will be partial only. By eliminating the effect of market directionality, alternative risk premia products provide a purer exposure to the return potential of the risk premium stemming from value. The graph below sketches the relation between traditional risk premia, alternative risk premia, and smart beta strategies.

Both alternative risk premia and smart beta investing have their own merits, and one can find a role for both strategies in the same portfolio. Peter Lindahl reckons the two strategies can serve as supplements “since they are used differently in an asset allocation.” “A smart beta strategy works well in a long-only equity allocation, while an ARP strategy may provide diversification benefits to the broader asset portfolio, due to its tendency of having a low correlation with traditional asset classes,” says Lindahl.

There is very little doubt that alternative risk premia strategies can offer better diversification benefits to portfolios greatly exposed to market directional risks, as they can capture alternative risk premia more efficiently than smart beta strategies. However, the benefits of smart beta investing include greater capacity and limited use or complete absence of leverage, shorting, or derivatives. More importantly, the distinction between alternative risk premia and smart beta investing has clear implications for fees. Long-only smart beta strategies can be accessed inexpensively, whereas alternative risk premia strategies seek to capture alternative risk premia only via more sophisticated approaches associated with higher fees. Although alternative risk premia products might be expensive in absolute terms, they are often viewed as inexpensive in relative terms: compared to more expensive hedge funds offering similar exposure to alternative risk premia and compared to less expensive smart beta products offering not-so-pure exposure to the same premia.

Conclusion

In summary, alternative risk premia products are also factor-based but differ in a number of ways from smart beta products. First, alternative risk premia can be applied in multiple asset classes, with equities representing only a minority of risk exposure. Smart beta, meanwhile, is equity-focused only. Second, alternative risk premia products can offer exposure to many more risk factors and their associated risk premia than smart beta. Third, unlike smart beta, alternative risk premia strategies employ leverage and short factors that are less desirable. All in all, alternative risk premia products offer investors the possibility to isolate the desired alternative risk premia while limiting the exposure to market beta and other alternative risk premia.

Investors have always had exposure to these alternative risk premia through hedge fund strategies such as quantitative equity strategies, macro-oriented strategies, or managed futures. But “there seems to be continued strong demand for ARP strategies,” says Lindahl. “Investors have bought into what academic research of the past decades has shown: factors are alternative sources of returns and may provide attractive investor benefits, like superior risk-adjusted returns and improved diversification,” he adds. In addition, the opportunity to diversify the sources of return and risk at costs far below the fees charged by alternative managers such as hedge funds also boosted investor demand for ARP products. Nonetheless, “this demand may have slowed down a bit in 2018 due to less favorable factor returns over the past six months or so,” observes Lindahl.

Picture: (c) By-PicMy—shutterstock.com