Stockholm (HedgeNordic) – Having had another challenging year so far in 2018, the CTA industry is slowly healing its wounds from the massive sell-off that was seen in February when many managers suffered double digit losses in just a matter of days. Most CTAs have spent a majority of the year in the red, but the industry has recovered in recent months approaching positive territory for the year. By the end of August, the Baclayhedge CTA index stood at approximately -2.0 percent while the SG CTA Index was down 2.8 percent.

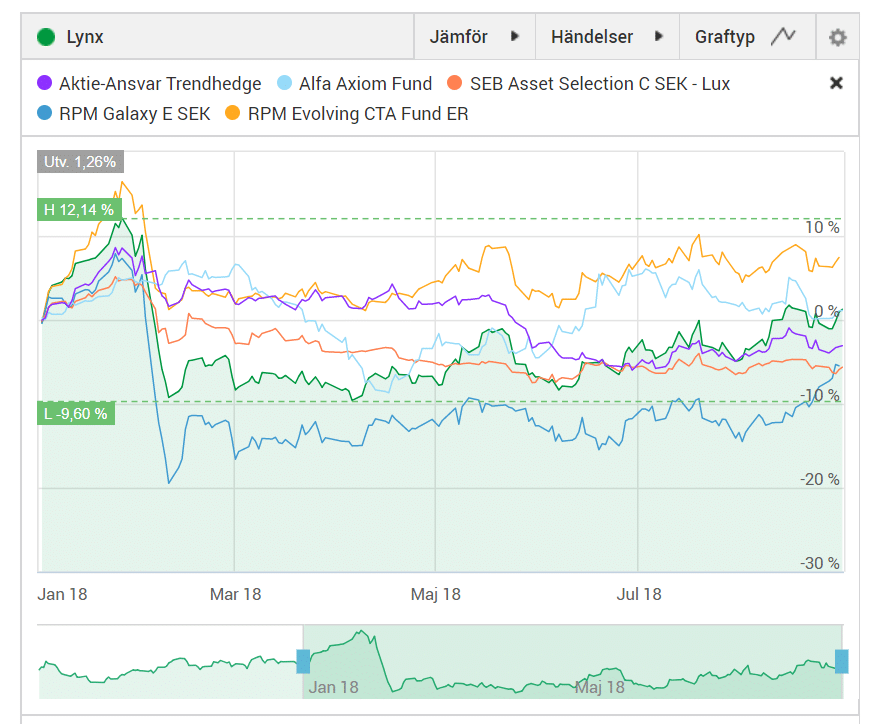

From the early numbers we have been able to gather from the Nordic CTA universe for the month of August, there is some evidence that the recovery is gathering pace here as well. Most notably, industry giant Lynx has managed to crawl back to positive territory for the year putting in a strong gain of 6.4 percent in August alone, estimates suggest. The fund shows a year-to-date return of +1.3 percent.

Another strong performer during the month of August was the multi-manager CTA fund RPM Galaxy that gained 7.8 percent. The fund is however still firmly down on the year (-6.7%). The other fund from RPM – the RPM Evolving CTA Fund – remains strongly positioned for the year with a gain of 7.4 percent, adding 1.7 percent in August. As can be seen from the below chart, RPM Evolving managed much better compared to the industry in the February sell-off which is largely explaining the performance difference for the year.

Alfakraft’s Alfa Axiom Fund, a fund that has much shorter holding periods compared to the average trend following CTA, shows a similar pattern where the downturn in February seemingly went unnoticed for the manager. Since then, the manager has had a somewhat of a rocky ride posting a string of losses between March – May only to recover strongly in June gaining 10.2 percent. By the end of August, the year to date return for Axiom stood at +1.1 percent.

Among managers that remain in negative territory for 2018 are SEB Asset Selection and Aktie-Ansvar Trendhedge (which is managed by Estlander and Partners).

Whether the recent uptick in CTA performance is a sign of a more trend-friendly environment to come is of course difficult to judge. According to the most recently published strategy report from French managed account platform provider Lyxor, there is reason to be optimstic. Lyxor has initiated an overweight stance from previously being neutral to the strategy siting improved trend following conditions and well contained risks for a significant trend reversal.

“In terms of investment recommendations, we have maintained a neutral stance on CTAs until now. But we consider that there are supportive factors which suggest that an overweight stance might be deserved. Trend following conditions have improved over the course of August. Across asset classes, positioning is not overextended and the risk of a significant trend reversal appears well contained. The main risk would be a significant rise in bond yields in Europe and Japan, which would hurt long bond positions. But declining energy base effects suggests inflation might have reached a peak for some quarters, hence limiting the downside risk for CTAs”, Lyxor writes.

Picture (C): donfiores – shutterstock