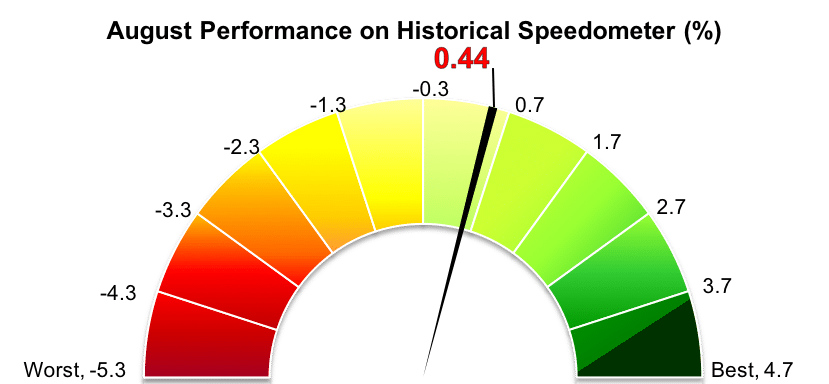

Stockholm (HedgeNordic) – Nordic equity hedge funds gained 0.4 percent in August (90 percent) even though European and Nordic equity markets fell during the month. The group of equity-focused funds is the best performing among the five categories of the Nordic Hedge Index (NHX) in 2018, with the NHX Equities Index having gained 2.2 percent year-to-date.

The equity-focused members of the NHX outperformed European and Nordic equity markets in August, but underperformed global equity markets as a whole. The Nordic equity market, as measured by the VINX All-share index which includes all the shares listed on NASDAQ OMX Nordic Exchanges and Oslo Börs, posted a negative net return of 0.1 percent in August. Global equity markets, as expressed by the FTSE World Index, rose 1.5 percent in Euro terms. Eurozone equity markets, as measured by the FTSE Eurozone Index, fell 2.6 percent due to concerns over the growing trade war, Turkey’s currency crisis and its possible contagion impact, and the high Italian government debt. North American equities, meanwhile, had a strong month after gaining 3.6 percent in Euro terms as U.S. equities pushed towards a new record. The gains were mainly attributable to upward-revised second-quarter GDP data and strong growth in corporate profits as a result of the new tax cuts.

Nordic equity hedge funds performed broadly in line with their international peers. The Eurekahedge Long Short Equities Hedge Fund Index, comprised of a little over 1,000 members, was up 0.1 percent in August, extending its year-to-date gains to 1.1 percent. The Barclay Equity Long/Short Index gained an estimated 0.7 percent last month, with the preliminary figure based on reported data from 233 funds. The index is up 2.6 percent in the first eight months of 2018. The HFN Long/Short Equity Index, which includes equity hedge funds from eVestment’s database, advanced 0.6 percent in August and is up a similar 2.6 percent year-to-date.

Half of the Nordic equity hedge funds which reported August figures posted gains last month, with HCP Focus Fund delivering the biggest gain among them. The Helsinki-based value-oriented fund investing in a concentrated portfolio of high-quality large- and mid-cap stocks soared 8.3 percent in August, taking its year-to-date performance to 25.9 percent. This makes HCP Focus Fund the best-performing member of the NHX year-to-date. The fund managed by Helsinki Capital Partners (team pictured) generated a compounded annual return of 22.0 percent since launching in December 2012.

Rhenman Healthcare Equity L/S is enjoying another strong year after gaining 34.5 percent in 2017. The fund rose 6.9 percent in August and is up 23.4 percent year-to-date through August. The healthcare-focused fund managed by Rhenman & Partners Asset Management AB delivered a compounded return of 21.8 percent per annum since its inception in June 2009. Atlant Edge and Borea Global Equities, meanwhile, were up 4.7 percent and 3.8 percent in August, correspondingly.

Despite the NHX Equities Index gaining 0.4 percent, a number of funds experienced sharp losses last month. DNB ECO Absolute Return, a market-neutral fund focused on renewable energy sectors, was down 5.2 percent, bringing the year-to-date performance further into negative territory at minus 6.0 percent. HCP Quant, which runs a value-oriented quantitative investment strategy, lost 5.1 percent in August and is down 2.6 percent year-to-date.