Stockholm (HedgeNordic) – Catella Hedgefond, which aims to generate stable returns at low risk regardless of market conditions, faces difficulties in achieving its return target of 3-5 percent in the prevailing market without taking on additional risk. The fund is 0.1 percent in the red year-to-date through August and generated a cumulative return of 5.9 percent in the past three years. Despite the recent underwhelming performance, Catella Hedgefond produced a compounded annual return of 4.8 percent since its inception in early 2004, very close to the upper end of its target range.

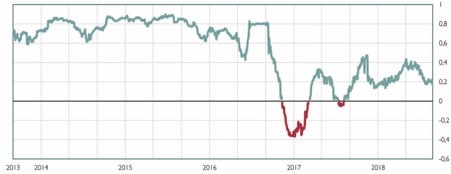

Catella Hedgefond invests in Nordic fixed-income securities and equities, as well as using derivatives both to protect capital against downturns and increase return opportunities. The fund aims to exhibit low correlation with equity, credit and bond markets, with its portfolio management team successfully achieving this goal in recent years. The correlation between Catella Hedgefond’s performance and the SIX Return Index, for instance, has decreased meaningfully starting from late 2016.

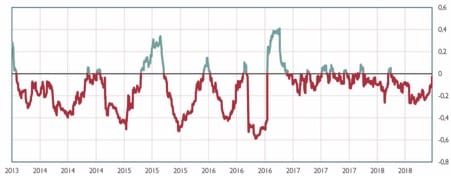

The degree of correlation between the fund’s returns and the OMRX Treasury Bond Index, meanwhile, has been very low for a longer period of time. This low degree of correlation is partly attributable to Catella Hedgefond’s way of structuring its portfolio, which involves the emphasis on diversifying risk. The fund’s portfolio management team makes sure that no individual holding or factor has too much influence on the overall performance. The fund’s five largest long positions, for example, account for only 7.4 percent of its assets under management.

Despite the low degree of correlation with traditional asset classes, Catella Hedgefond’s return so far in 2018 has been disappointing. With low bond yields reducing return opportunities, most of the returns in the fund’s fixed-income portfolio come from riskier high yield corporate bonds. The increased risk, however, is offset by extensive diversification between sectors, as well as holding a large pile of cash and cash-equivalent investments.

Catella Hedgefond’s portfolio management team points out several explanations for the below-target return in 2018. First, the fund’s fixed-income portfolio was positioned with negative duration to capitalize on rising interest rates, with the fund anticipating European central banks to follow the U.S. Federal Reserve in scaling back on expansionary monetary policy and raising interest rates. Interest rates have not risen as growth expectations and inflationary pressures have faded somewhat. Second, Catella Hedgefond is invested in a bond of mobile virtual network operator Lebara that has plunged in price amid investor concerns about its reporting practices. And third, some of the fund’s equity positions in value-oriented underpriced stocks have underperformed during the spring and the summer. The fund’s current portfolio of equity positions includes 57 unique names on the long side and 22 on the short side, supplemented with hedge positions in equity indices and stock index options.

Although Catella Hedgefond delivered an underwhelming performance in 2018, the fund has fared very well since its inception in March 2004. The fund generated a compounded return of 4.8 percent since inception through August of this year, reporting only three down years in its 15-year history. Catella Hedgefond lost a mere 4.7 percent in 2008, registering a maximum drawdown of minus 7.0 percent during 2008 and 2009. Catella Hedgefond oversees SEK 10.8 billion in assets under management as of the end of July 2018 and is currently managed by Thomas Elofsson, Martin Jonsson, Martin Nilsson, Anders Wennberg, and Stefan Wigstrand.