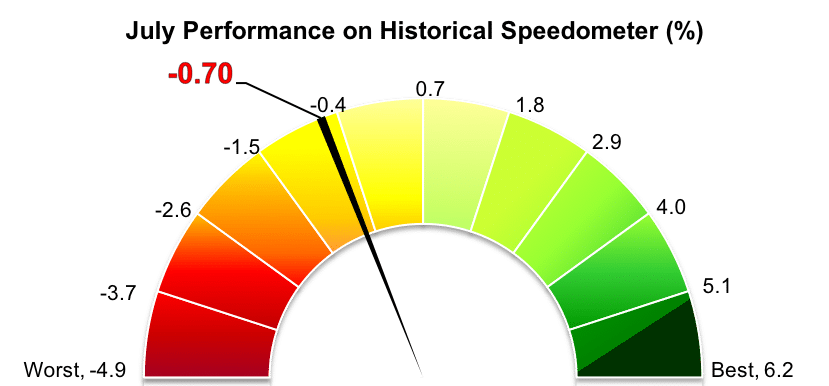

Stockholm (HedgeNordic) – Following the slight performance boost in June, Nordic CTA funds as a group suffered losses in July. The Nordic CTA Index was down 0.7 percent last month (91 percent reported), extending year-to-date losses through July to an ugly 3.0 percent.

Nordic CTAs performed largely in line with the largest international CTA indices last month. The Société Générale CTA Index, for example, fell 0.7 percent in July, taking the year-to-date performance through the end of July to down 5.3 percent. The SG CTA Index reflects the performance of the 20 largest CTAs by assets under management. The Barclay BTOP50 Index, which tracks the performance of the 20 largest investable CTA programs, was down 0.5 percent, bringing the performance for the first seven months of 2018 to a negative 4.2 percent. The broader Barclay CTA Index, however, gained 0.2 percent in July, cutting year-to-date losses to 2.0 percent. The index reflects the performance of all CTA programs in the database maintained by BarclayHedge. In general, profits came from long positions in equities and short positions in precious metals, whereas losses were derived from positions in currencies, fixed income and energies.

Most members of the NHX CTA Index incurred losses in July, with only five of the 21 NHX sub-category’s members posting positive performance. Aktie-Ansvar Trendhedge, which employs a systematic trend-following strategy, was the biggest gainer among Nordic CTAs last month, ending a five-month run of negative performance. The fund gained 1.5 percent in July, recouping a portion of their year-to-date losses. Innolab Capital Index A/S, an alternative investment fund run by artificial intelligence, was up 1.3 percent last month.

Alfa Axiom Fund, a trend-following CTA fund that booked a 10.2 percent gain in June (read more details), was down 3.4 percent in the subsequent month. The fund is up 1.6 percent in the first seven months of 2018. Estlander & Partners Presto and RPM Galaxy were down 2.8 percent and 2.0 percent in July, respectively.

Picture: (c) Rawpixel.com—shutterstock