Stockholm (HedgeNordic) – Amundi and alternative data specialist Preqin together produced and published a research on the alternative assets markets in Europe. According to their findings, as of 30 September 2017, Europe-based alternative assets under management reached €1.48trn, having grown by 8.8% year-on-year from €1.37trn.

Among alternatives, some €601bn were in hedge funds (40.6% of all alternative assets in Europe as of September 2017), €507bn in private equity, €131bn in infrastructure, €106bn in real estate, €108bn in private debt and the remaining in natural resources.

By country, the UK gathered 51.8% of alternative assets in Europe, followed by France, with 8.6%, Sweden with 5.3%, Switzerland (3.5%) and Germany (3.1%) at the end of September 2017.

Mixed news for hedge funds

Data analysed around hedge funds by Amundi and Prequin suggests mixed news for the hedge fund industry, remaining the largest alternative asset class used in Europe with €404bn of total capital invested by 1,101 Europe-based hedge fund investors in 2018.

It shows Europe-focused hedge funds have outperformed all hedge funds and public market indices by 6.33% over a five-year annualised period. Nonetheless, they have underperformed the rest of the market by 8.21% in Q1 2018.

Regarding Europe-based hedge funds’ net inflows, they amounted to €26.9bn over last year in contrast to the €32.7bn outflows observed in 2016. 52% of Europe-based hedge fund managers saw net inflows over Q1 2018 but despite of €8bn in outflows reported in the same period.

Other findings see Sweden as the second largest hedge fund market in Europe in terms of AUM, with approximately €36bn,

Preqin’s chief data officer Elias Lastis noted that the hedge fund industry is evolving as for the first time in 2017, with 190 liquidations of Europe-based hedge funds exceeded launches, which amounted to 179. The trend is likely to pursue in 2018, he added.

Other findings see Sweden as the second largest hedge fund market in Europe in terms of AUM, with approximately €36bn, roughly 0ne tenth of first ranked United Kingdom (€355bn) and just before France and Switzerland with €29bn and €25bn of local investors’ assets invested in hedge funds respectively.

The study also focuses on top performing hedge funds by country in Europe (see table below).

| Country | Top performing hedge fund | Company | 3-y annualised return (as of March 2018) |

|---|---|---|---|

| UK | Japan Synthetic Warrant Fund – USD Class | Dejima Asset Management | 34.21% |

| Switzerland | Teleios Global Opportunities fund | Teleios Capital Partners | 21.94% |

| Germany | Wermuth Eastern Europe L/S strategy | Wermuth Asset Management | 11.77% |

| Netherlands | Mint Tower Arbitrage Fund | Mint Tower Capital Management | 6.50% |

| Italy | Finint Bond Fund – Class A | Finanziaria Internazionale Investments | 7.44% |

| France | Orsay Merger Arbitrage Fund – USD Share Class 3 | Oddo BHF Asset Management | 11.21% |

| Sweden | Gladiator Fund | Max Mitteregger Asset Management | 13.99% |

| Spain | Ben Oldman Special Situations Fund | Ben Oldman Partners | 9.74% |

| Norway | AAM Absolute Return Fund – Class B (NOK) | Oslo Asset Management | 23.59% |

| Denmark | Danske Invest Hedge Fixed Income Strategies Fund – EUR | Danske Invest | 10.19% |

Source: Preqin, Amundi, 2018

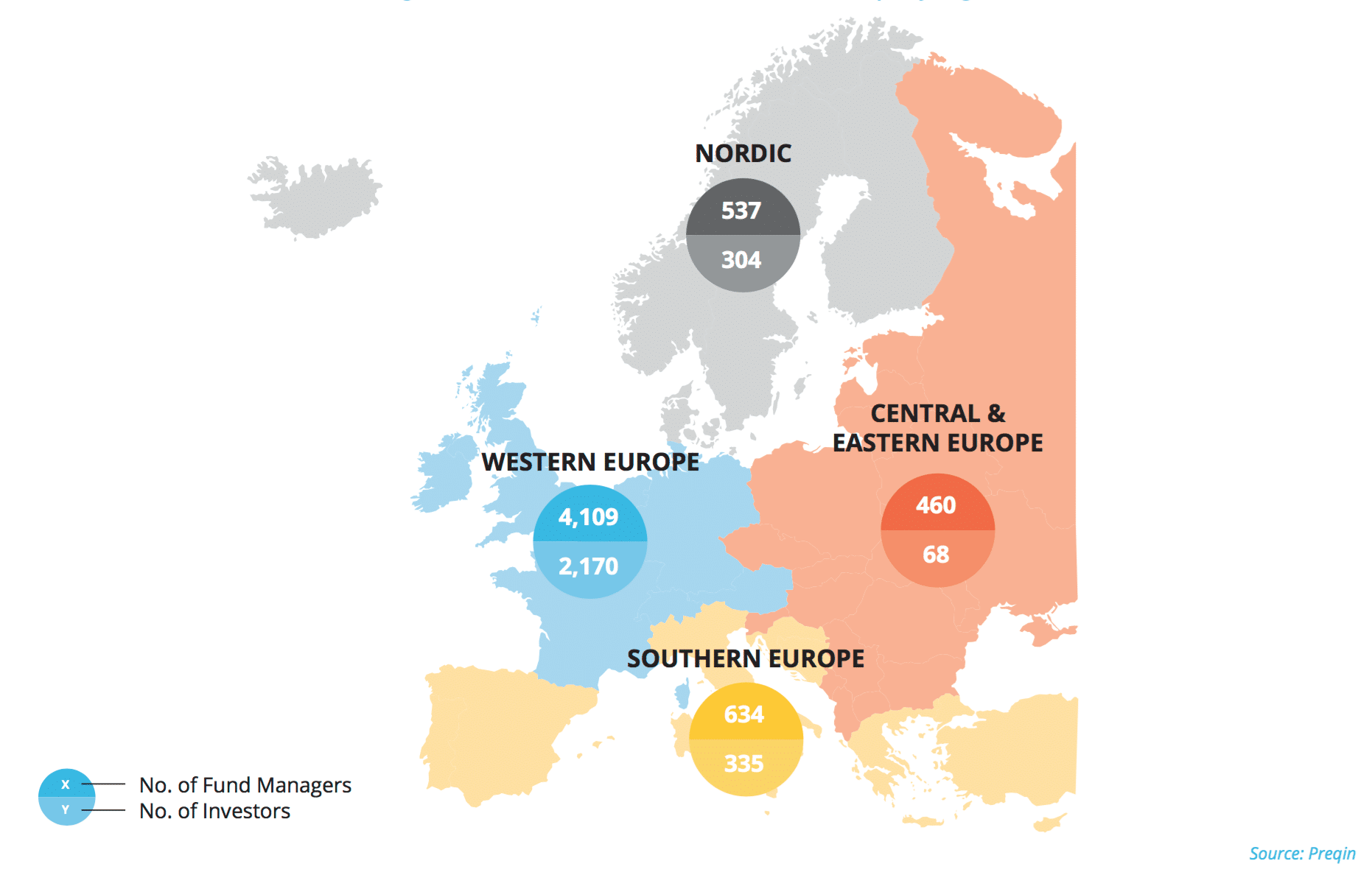

The map below shows the number of Alternative Assets Fund Managers and Investors Active in Alternatives in Europe by Region:

The entire study, Prequin Markets in Focus, is available here.

Picture: (c) donfiores—shutterstock.com