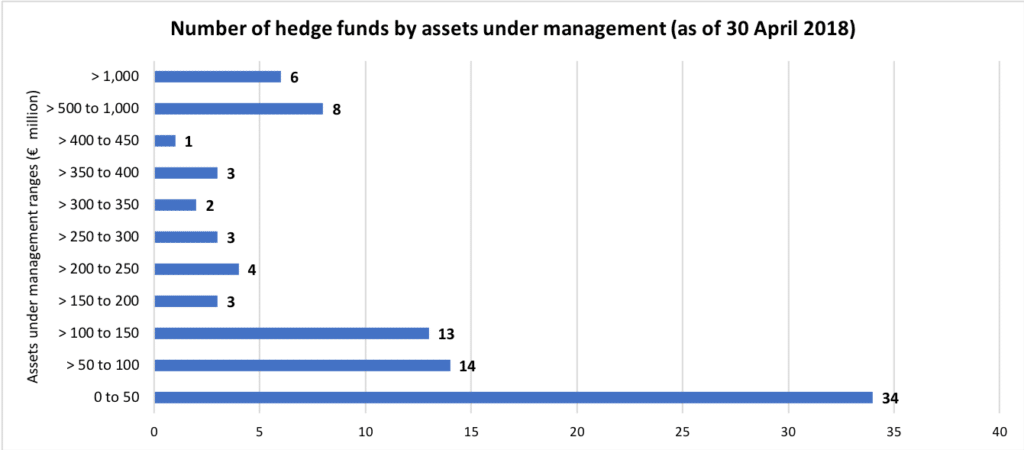

Stockholm (HedgeNordic) – Though relatively small, of course, in a global context, there are a couple of Nordic-based hedge funds with large assets under management (AuM) that can compete with international behemoths (at least in terms of size). The Nordic hedge fund universe currently consists of six hedge funds with capital over the €1 billion-mark, but the vast majority manages up to €200 million in capital. A total of 64 out of the 91 hedge funds that reported AuM data for April 2018 manage less than €200 million in AuM, with 34 of these funds managing less than €50 million.

The just-mentioned figures point out the hurdles we needed to overcome to design an index that accurately measures the development of the assets under management managed by the entire Nordic hedge fund industry. After all, if the assets under management of Brummer Multi-Strategy, the largest hedge fund player in the Nordics with €3.65 billion in capital as of the end of April 2018, would decrease by 5 percent in a given month, the monetary-amount decrease may well offset much of the combined increase in assets enjoyed by smaller players in the industry. For that reason, HedgeNordic has been calculating and publishing an index computed using an equally-weighted indexed-based compounding methodology, namely the NHX Asset Growth Index – NHX AGI.

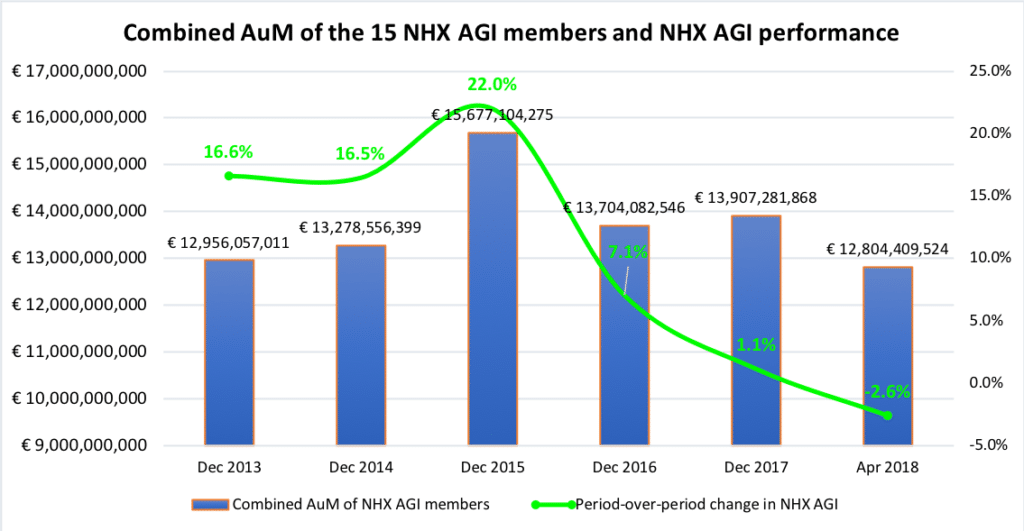

The NHX AGI Index currently contains 15 hedge funds, which have combined assets under management of €12.80 billion as of the end of April 2018. This figure constitutes approximately 55.4 percent of the combined assets managed by the 91 hedge funds that reported AuM figures for the month of April. The collective assets of the 15 members of the NHX AGI peaked at €15.68 billion at the end of December 2015 before dropping by €1.97 billion during the following 12 months to €13.70 billion at the end of 2016. The assets managed by these 15 hedge funds dropped by €1.10 billion in the first four months of 2018 from the figure of €13.91 billion recorded at the end of December 2017. Much of the decrease is attributable to declines in the capital managed by Brummer & Partners-backed Nektar, Excalibur, and Brummer Multi-Strategy.

Structure of the Nordic hedge fund industry

The majority of the Nordic hedge fund industry comprises small-sized funds, with a little more than one-third (around 37 percent) of the 91 hedge funds with reported assets under management data for April holding assets of less than €50 million. On average, the 34 small-sized hedge funds manage €19.66 million in capital, with older funds of more than five years old holding assets of €26.96 million on average. From the pool of smaller-sized funds, mid-age hedge funds with an operating life between two and five years manage €14.33 million in assets on average. According to Figure 2, a total of 14 hedge funds of the 91 funds manage between €50 and €100 million in assets as of the end of April 2018, while 14 funds hold between €100 and €150 million in assets. As mentioned above, six Nordic hedge funds manage more than €1 billion in assets and there is a total of eight funds managing between €500 million and €1 billion.

Relation between hedge fund size and performance

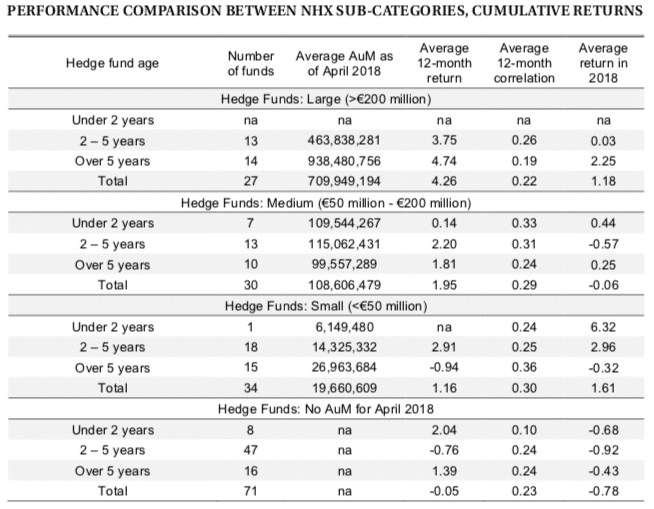

Some past research studies find that small hedge funds tend to underperform larger funds on average due to higher total expense ratios. The performance of Nordic hedge fund players in the past 12 months represents one tiny piece of evidence confirming that finding. For instance, the 27 Nordic hedge funds with assets of more than €200 million as of the end of April 2018 enjoyed an average 12-month return of 4.26 percent. Meanwhile, the 34 hedge funds with less than €50 million in capital had an average return of 1.16 percent for the past 12 months, whereas the 30 funds with assets in the range of €50 and €200 million recorded an average 12-month return of 1.95 percent. The remaining 71 NHX members with no reported AuM data for April had an average 12-month return of -0.05 percent. One should note, however, that these statistics represent a one-year snapshot and a more in-depth analysis may be warranted to reach accurate conclusions.

Older and larger Nordic hedge funds also performed strongly in the first five months of 2018, with the 14 old and large hedge funds having returned 2.25 percent on average year-to-date. Mid-age small-sized hedge funds performed even better year-to-date, as the group of 18 such funds gained 2.96 percent on average in the first five months of the year. The 71 hedge fund vehicles with no reported AuM data in our database for April were down 0.78 percent on average year-to-date. In addition, medium-sized hedge funds were also down so far in 2018, with the 30 medium-sized funds having returned a negative 0.06 percent in the first five months of the year.

Figure 3 also shows that the older hedge funds among the large vehicles in the Nordic industry manage a lot more assets on average. From the pool of those 27 large hedge funds with reported AuM data, funds operating for five years or longer manage €938.48 million in assets on average, whereas younger funds manage a much lower average figure of €463.84 million. One interesting observation is that older medium-sized hedge funds manage less assets than younger funds. For instance, old medium-sized hedge funds hold €99.56 million in assets on average, while mid-age medium-sized funds manage a larger average figure of €115.06 million.

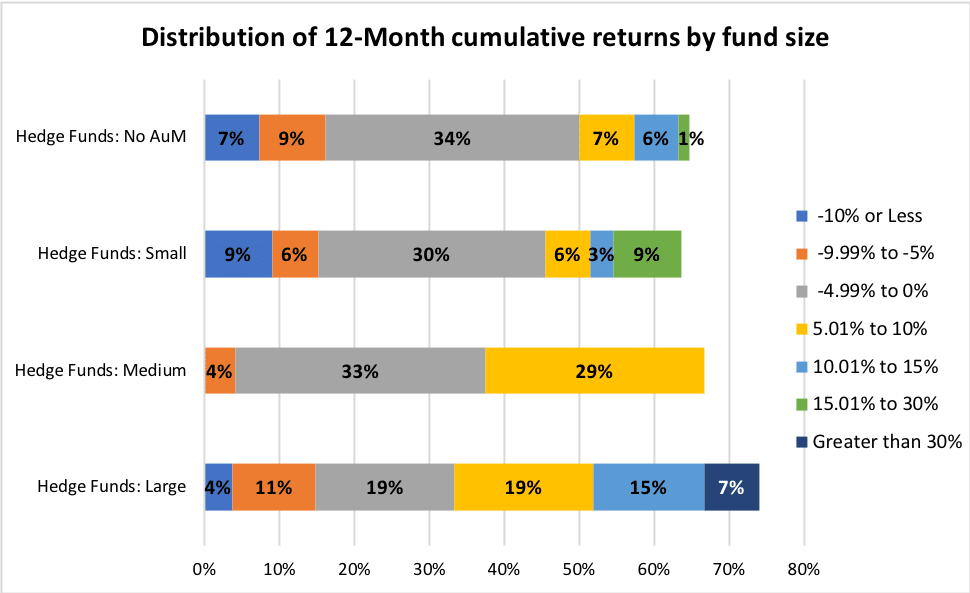

As shown in Figure 4, the percentage of large and medium-sized Nordic hedge funds with losses greater than 5 percent in the past 12 months was lower than the percentage of small hedge funds with losses of such magnitude. In fact, there was only one large hedge fund with a 12-month loss of more than 10 percent. Meanwhile, the number of small hedge funds with negative 12-month returns of more than 10 percent reached a total of four. In addition, there were no medium-sized hedge funds with a negative 12-month return of more than 10 percent and there was only one medium-sized fund with a 12-month loss of more than 5 percent. Moreover, two large hedge funds have a 12-month return of more than 30 percent, accounting for roughly 7 percent of the number of large funds. Meanwhile, approximately 9 percent of small hedge funds enjoyed returns above 15 percent in the past 12 months.