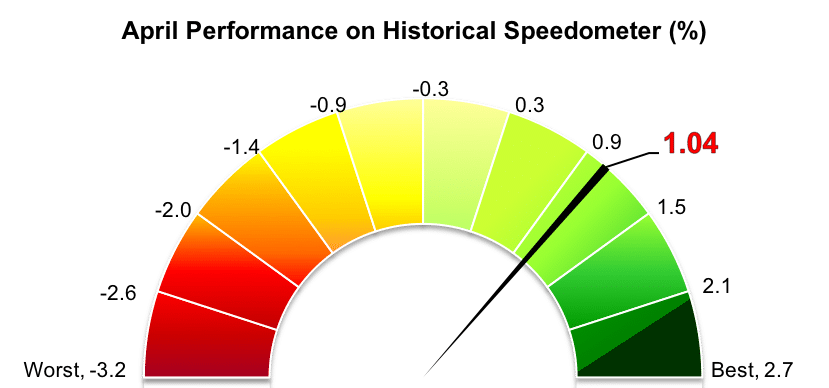

Stockholm (HedgeNordic) – Last month, Nordic hedge funds as a group enjoyed one their best months in the past 12 months or so, and multi-strategy hedge funds were no exception. Nordic multi-strategy hedge funds, the most diverse and inclusive NHX sub-category, gained 1.0 percent in April (94 percent reported), recovering strongly from the losses suffered in the early part of the year. Following the April performance, the NHX Multi-Strategy Index moved back into positive territory for the year at 0.4 percent.

Nordic multi-strategy hedge funds considerably outperformed peer funds in the global universe. The Eurekahedge Multi-Strategy Hedge Fund Index, an equally-weighted index tracking the performance of 263 global multi-strategy hedge funds, gained only 0.3 percent in April (81 percent reported as of May 24), taking the performance for the first four months of 2018 to a positive 0.1 percent. Meanwhile, the Barclay Multi Strategy Index was down 0.1 percent last month, maintaining the losses for the first four months of the year at 0.4 percent.

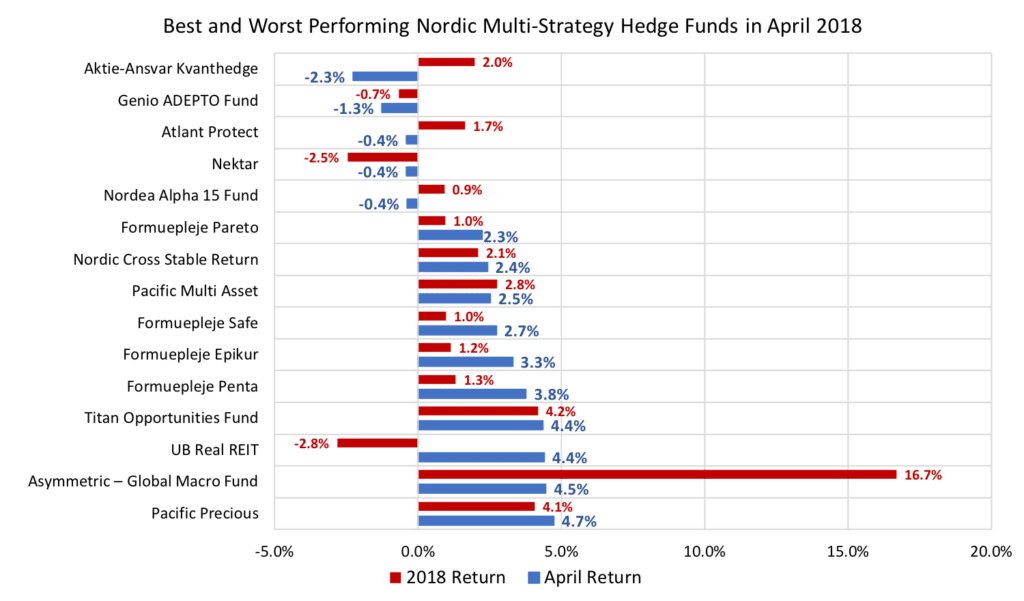

25 out of the 35 multi-strategy hedge funds included in the NHX posted positive returns for April, with four funds delivering a monthly return of more than four percent. Pacific Precious, a precious-metals-focused multi-strategy fund managed by Eric Strand (pictured), was April’s best performer within the NHX Multi-Strategy Index after gaining 4.7 percent. Pacific Precious climbed well into positive territory for the year following last month’s performance, with the fund returning 4.1 percent in the first four months of the year.

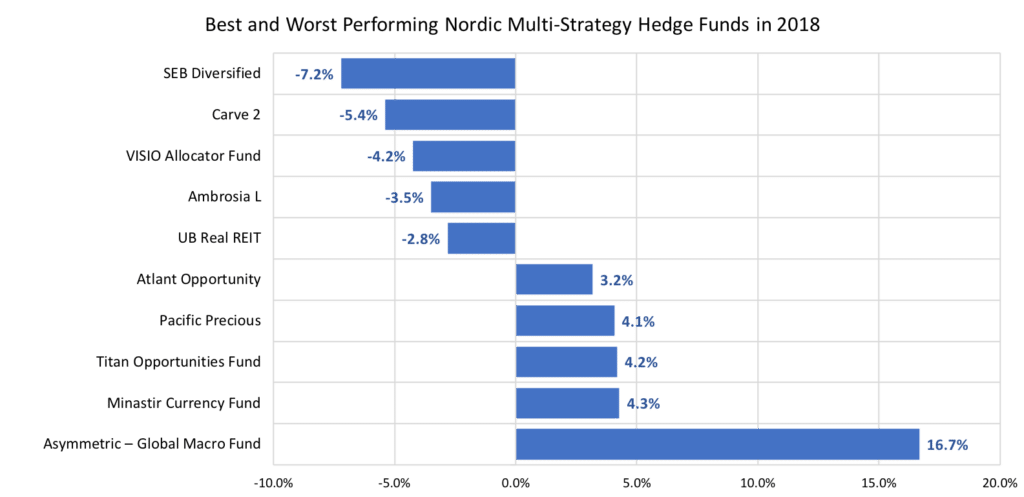

Asymmetric Global Macro Fund, an Oslo-based fund focused on identifying asymmetrical risk/reward opportunities in foreign exchange, fixed-income, and equity markets, is enjoying a great start to 2018 after having returns of more than 3 percent in each of the last four months. The fund gained 4.5 percent in April, extending this year’s gains to 16.7 percent. Asymmetric Global Macro Fund is the second-best performing hedge fund in the NHX this year.

After suffering a poor start to 2018, real estate-focused UB Real REIT continues to deliver strong performance for a second consecutive month. The alternative investment fund investing in REITs and property development companies was up 4.4 percent in April, cutting 2018 losses to 2.8 percent. Titan Opportunities Fund, a new member of the NHX family that invests in equity- and credit-related securities within cyclical and commodity-related sectors, also advanced 4.4 percent. The fund co-founded by Norwegian-born Espen Westeren is up 4.2 percent in the first four months of 2018.

April’s list of poor performers in the NHX Multi-Strategy Index is significantly shorter than the list of strong performers, with Aktie-Ansvar Kvanthedge and Genio ADEPTO Fund returning a negative 2.3 percent and 1.3 percent last month (up 2.0 percent and down 0.7 percent YTD). The remaining six funds incurred losses of less than a half a percent.