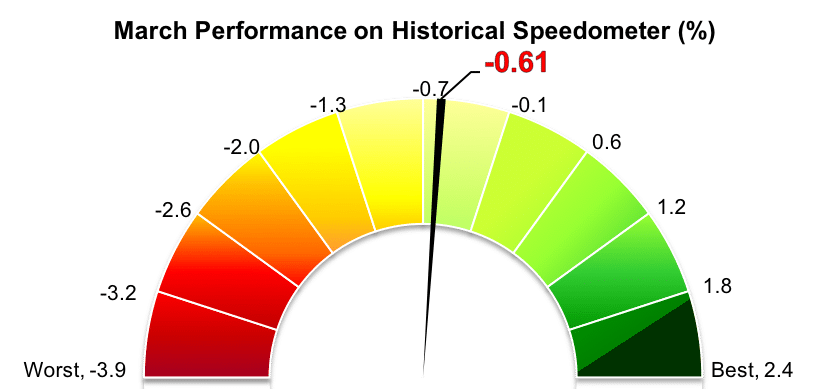

Stockholm (HedgeNordic) – Nordic funds of hedge funds were down 0.6 percent as a group in March (100 percent reported), marginally trailing the Nordic hedge fund industry. The NHX Fund of Funds Index, an equally-weighted NHX sub-index tracking the performance of 23 Nordic FoHFs, was down 1.1 percent in the first quarter of 2018.

However, Nordic FoHFs performed in line with their international counterparts in March. For instance, the Eurekahedge Fund of Funds Index, which tracks the performance of 402 funds that exclusively invest in single-manager hedge funds, was also down 0.6 percent in March. The index ended the first quarter 0.1 percent in the red. Similarly, the HFRI Fund of Funds Composite Index slipped 0.5 percent in March, which brought the performance for the first quarter down to 0.3 percent.

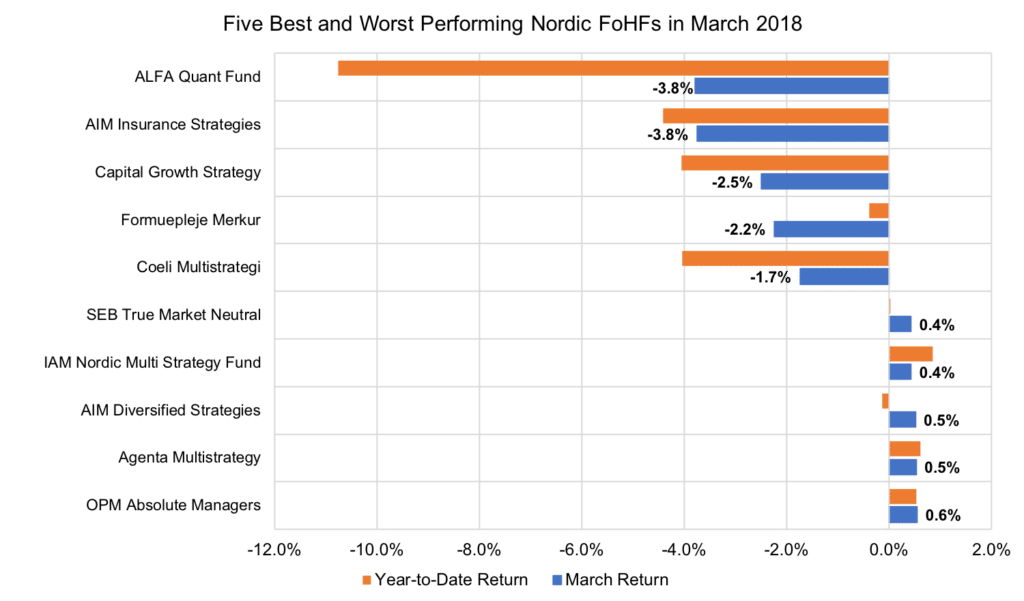

14 of the 23 funds of hedge funds included in the NHX Composite posted losses in March. Glancing at the list of gainers, OPM Absolute Mangers, which invests in a pool of international UCITS hedge funds, gained 0.6 percent in March and was up 0.5 percent for the first quarter. Meanwhile, Agenta Multistrategy, which invests in both Swedish and international hedge funds, advanced 0.5 percent in March, bringing the first-quarter performance up to 0.6 percent. Finnish FoHFs AIM Diversified Strategies also gained 0.5 percent, reducing the first-quarter losses to a negative 0.1 percent.

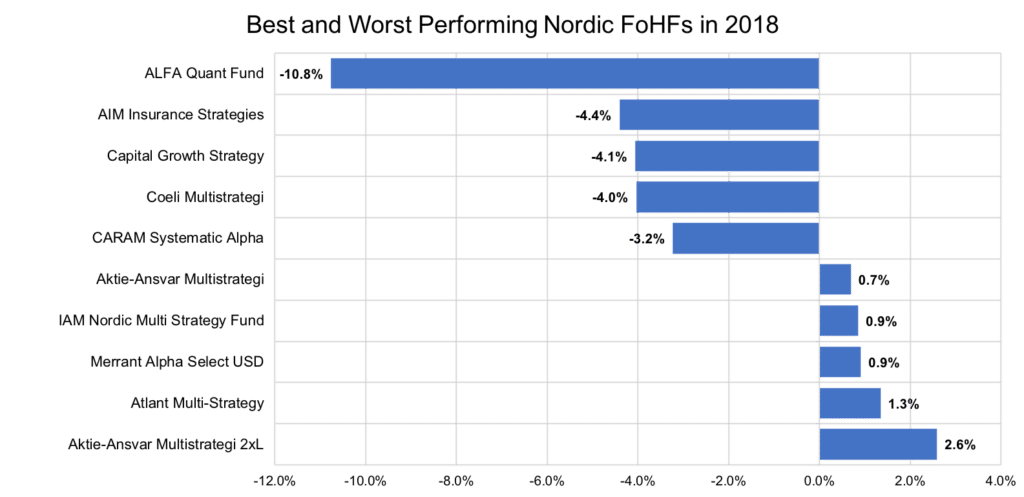

Alfa Quant Fund, which invests in Alfakraft Fonder’s single-strategy funds, topped the list of underperformers yet again, after tumbling 3.8 percent in March. The fund has not enjoyed a great start to the year, after having lost 10.8 percent in the first quarter. AIM Insurance Strategies and Capital Growth Strategy were down 3.8 percent and 2.5 percent, correspondingly (down 4.4 percent and 4.1 percent in Q1).