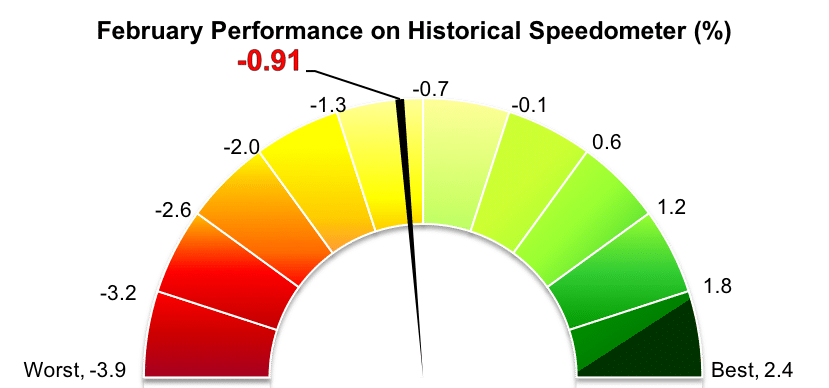

Stockholm (HedgeNordic) – In a similar fashion to the entire hedge fund industry, Nordic funds of hedge funds suffered one of the worst months of performance in the past several years. Around two-thirds of the 23-member NHX Fund of Funds Index posted negative returns in February, with the index falling 0.9 percent last month (100 percent reported).

Despite the historically bad monthly performance, Nordic funds of hedge funds outperformed their international peers by a wide margin in February. To illustrate, the Eurekahedge Fund of Funds Index, an equally weighted index of 422 investment funds that exclusively invest in single-manager hedge funds, tumbled 1.4 percent in February. Similarly, the HFRI Fund of Funds Composite Index was down 1.3 percent last month, bringing the performance for first two months of 2018 down to 1.0 percent.

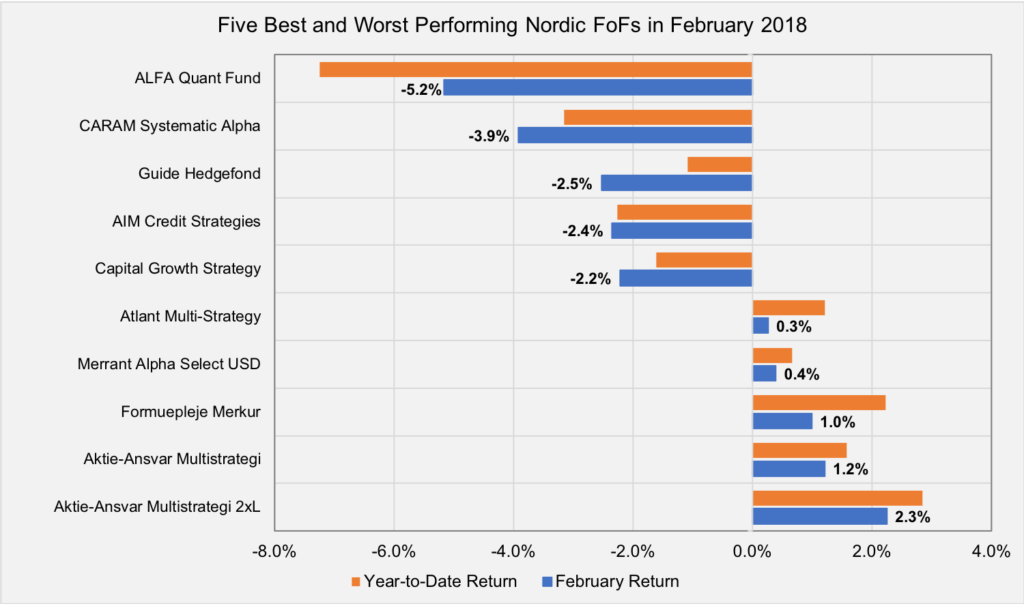

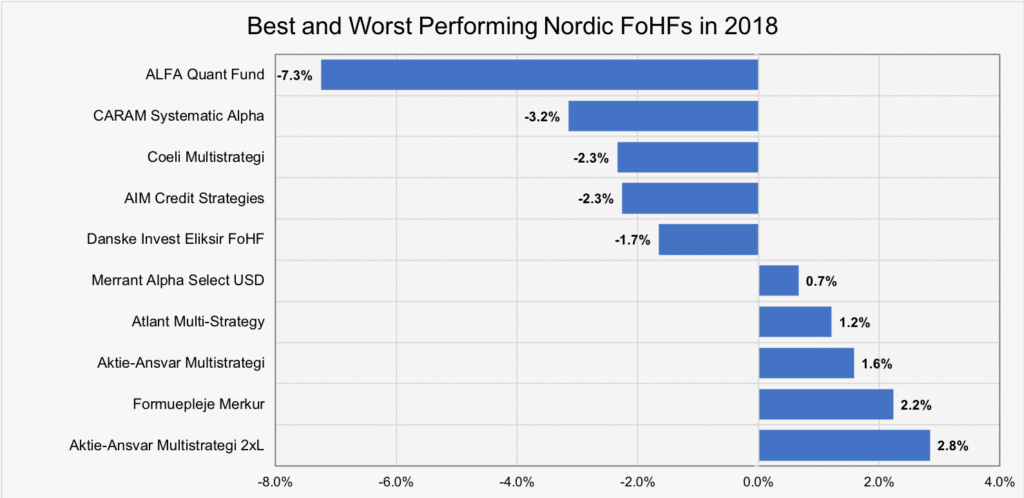

When skimming the short list of winners among Nordic FoHFs, Aktie-Ansvar Multistrategi, a fund investing in various underlying hedge funds managed by separate management teams with different management strategies, and the double-leverage version of the same fund clearly were the strongest performing Nordic FoHFs in February (up 2.3 percent and 1.2 percent, respectively). Danish FoHF Formuepleje Merkur followed suit with a February gain of 1.0 percent.

On the losing end, Alfa Quant Fund, a fund that invests in Alfakraft Fonder’s single-strategy funds, was down 5.2 percent in February. The disappointing February figure comes as no surprise considering Alfakraft’s focus on quantitative trend-following strategies, which, as part of the group of Nordic CTA funds, suffered the worst month on record. CARAM Systematic Alpha and Guide Hedgefond were down 5.2 percent and 3.9 percent, respectively.

Picture © By-sportpoint—shutterstock.com