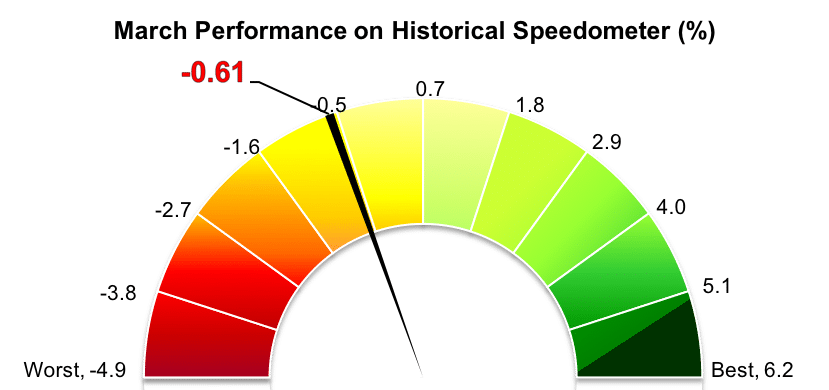

Stockholm (HedgeNordic) – The spell of bad luck continued for Nordic CTAs in March, after having suffered their worst month on record in February. Nordic trend-following CTAs, as measured by the NHX CTA Index, were down 0.6 percent in March (95 percent reported), bringing the performance for the first quarter of the year to a negative 2.4 percent.

The world’s largest global CTA programs performed slightly better than Nordic players in March, with the Barclay BTOP50 Index advancing an estimated 0.2 percent. The Barclay index tracks the performance of the 20 largest investable trading advisor programs, which collectively account for no less than 50% of the investable assets of the Barclay universe of CTA funds in any given year. Meanwhile, theSociété Générale CTA Index, which reflects the performance of the 20 largest CTAs by assets under management in the SG CTA database, was down 0.1 percent in March.

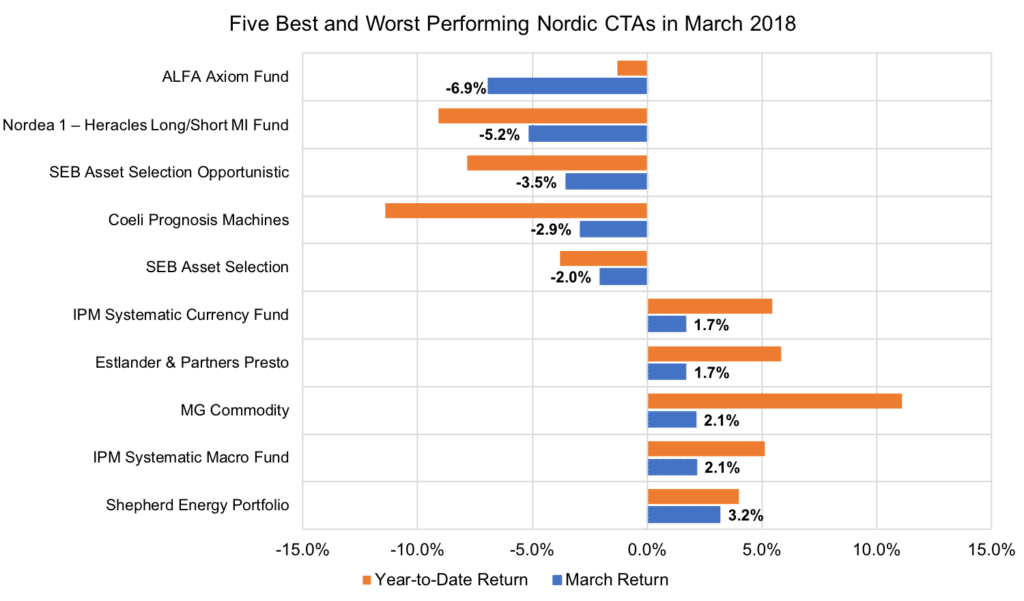

There was an almost equal number of winners and losers in the pool of Nordic CTA funds in March, with power investment fund Shepherd Energy Portfolio topping the list of best performers. Shepherd Energy Portfolio, which trades in Nordic power markets, gained 3.2 percent in March, bringing the 2018 performance to 4.0 percent.

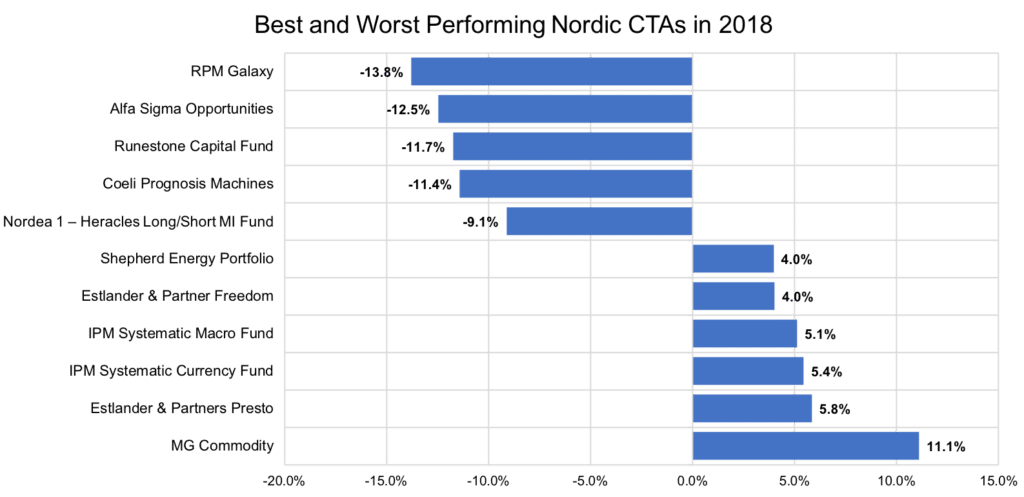

IPM Systematic Macro Fund and MG Commodity closely followed suit, both returning 2.1 percent over the month. The systematic macro fund managed by IPM Informed Portfolio Management AB was up 5.1 percent in the first three months of 2018. Meanwhile, Helsinki-based MG Commodity gained 11.1 percent thus far in 2018, making it the best-performing Nordic CTA so far this year.

Alfa Axiom Fund, which seeks to generate high risk-adjusted returns by trading futures contracts on regulated markets, was down 6.9 percent in March, erasing all the gains accumulated in the first two months of the year (down 1.3 percent year-to-date). Nordea 1 – Heracles Long/Short MI Fund tumbled 5.2 percent last month, extending the 2018 losses to 9.1 percent. SEB Asset Selection and SEB Asset Selection Opportunistic, the leveraged version of the former fund, were down 2.0 percent and 3.5 percent, respectively (down 3.8 percent and 7.8 percent year-to-date). Artificial intelligence-driven Coeli Prognosis Machines lost 2.9 percent last month, which takes the first quarter performance down to -11.4 percent.

Picture: (c) Rawpixel.com—shutterstock.com