Stockholm (HedgeNordic) – February proved to be a challenging month for a majority of the Nordic hedge funds underlying the Nordic Hedge Fund Index – NHX. With 75 percent of managers having reported their numbers for the month, the index suggest a loss of 1.5 percent, which is in line with the Barclay Hedge Fund Index but better than the HFRX global hedge fund index which shed 2.4 percent during the period. The year-to date figure for NHX stands at -0.7 percent.

Among the worst performing strategies were CTAs, a strategy that was hit hard by the trend reversals seen in connection with the volatility spike on February 5. On this day, the VIX-index spiked by more than 100 perceent creating a market turmoil that was difficult for quant strategies to handle (see separate HedgeNordic article on trend following losses in February). The Nordic funds that were hit the hardest include RPM Galaxy (-17.5%), Lynx (-14.1%), Alfa Sigma Opportunities (-11.3%) and Runestone Capital (-10.0%).

Quantitative macro strategies, however, did relatively well on the month, presumably as a result of them relying on relative trades rather than outright momentum-driven ones. IPM Systematic Macro and Aktie-Ansvar Quanthedge were among the month´s winners with gains of 4.9% and 5.5% respectively.

Equity markets slumped in the first half of the month but recovered strongly in the secod half. Nordic equity-focused hedge funds however showed dismal performance numbers overall with the NHX equity index being down close to 1 percent. Among losing funds, DNB Eco Absolute Return, HCP Quant, Inside Hedge, Origo Quest 1 and Atlant Sharp Europe, all posted losses in the range of 4-6 percent.

The NHX Multi-Strategy Index, encompassing a wide variety of strategies, lost an estimated 0,9 percent on the month. SEB Diversified, Evli Factor Premia and Visio Allocator were among the losing funds.

In the fixed income space, returns were widely dispersed, with the NHX losing 0.6 percent on the month. Winners included KLP Global Rente, Scandinavian Credit Fund and Danske Invest Fixed Income Relative Value while on the losing end, CABA Hedge suffered its worst month since inception last year.

Among fund of funds, typically being late to report numbers, the indicative performance number stood at -0.4 percent.

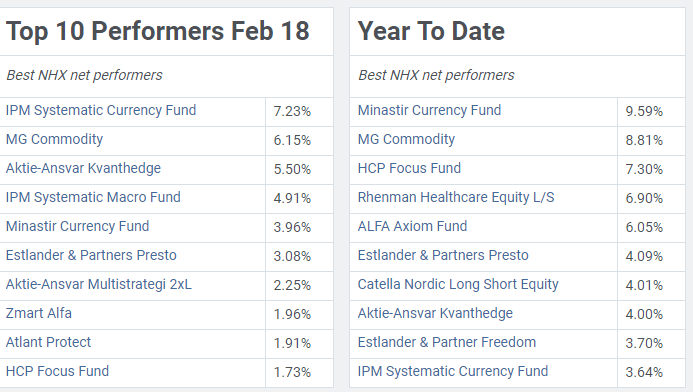

The table below summarizes the Nordic hedge fund industry winners in February as well as for the year, we will get back with our regular monthly review once we have the full data set reported.

Source: HedgeNordic

Picture (c): Sergey-Nivens—shutterstock.com