Stockholm (HedgeNordic) – After having enjoyed a strong start to 2018, Nordic CTAs, as measured by the NHX CTA Index, experienced their worst month on record in February. The NHX CTA was down 4.9 percent last month (100 percent reported), as trends broke across all sectors except for fixed income. This NHX sub-category is down 1.8 percent year to date.

The largest global CTA programs performed slightly worse than their Nordic counterparts, with the Barclay BTOP50 Index dropping an estimated 5.4 percent. The Barclay BTOP50 Index tracks the performance of the 20 largest investable trading advisor programs. In a similar vein, the Société Générale CTA Index, which tracks the largest 20 CTAs by assets under management, was down 6.3 percent last month. February marked the worst month for the SG CTA Index since November 2001.

“Clearly, CTAs have had a difficult February, and trend followers were particularly hard hit at the beginning of the month,” Tom Wrobel, Director of Alternative Investments Consulting at Société Générale Prime Services, was quoted as saying on the performance of CTAs. “The recent market movements have led to uncertainty, and as a result, many CTAs gave back their performance following a strong period in January. As the month continued many trend-followers recovered slightly and some non-trend strategies posted positive performance, so it will be interesting to observe how CTAs react to the changing market conditions going forward,” he added.

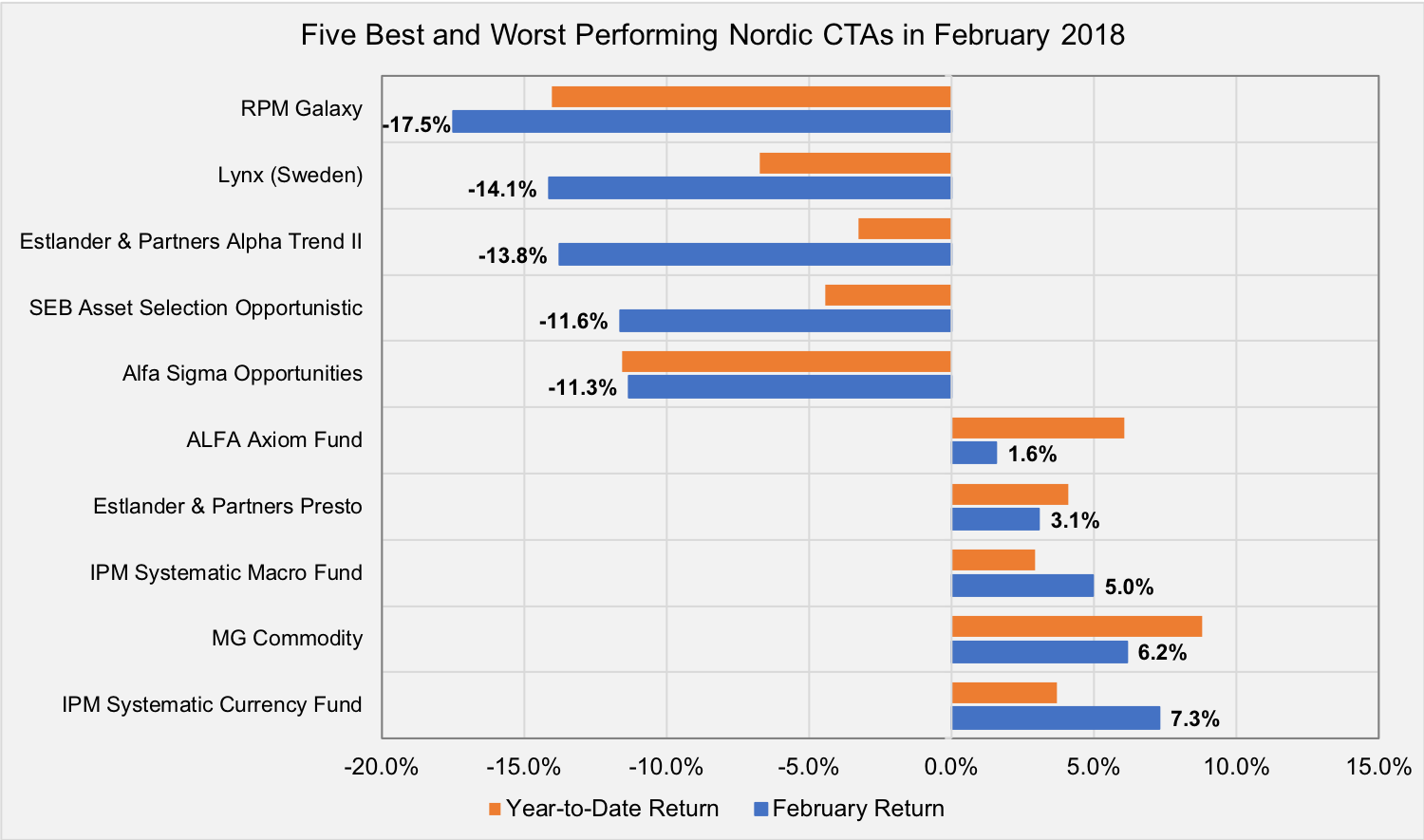

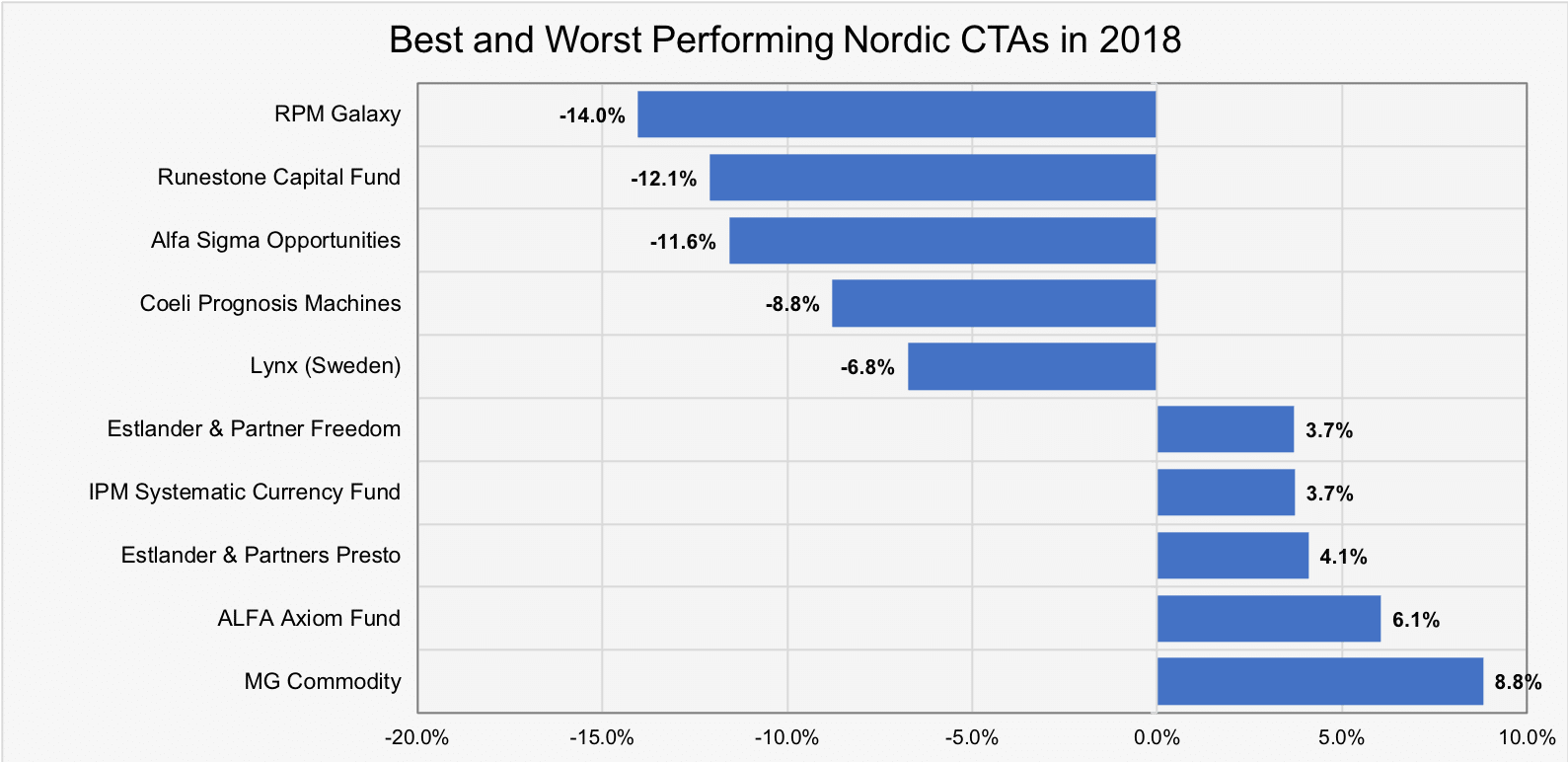

If not for the three funds that gained 5 percent or more, the February performance of the NHX CTA Index would have been significantly worse. Two vehicles managed by Informed Portfolio Management AB were among the best gainers within the NHX CTA Index. IPM Systematic Currency Fund and IPM Systematic Macro Fund gained 7.3 percent and 5.0 percent, recovering the losses incurred in the first month of the year (up 3.7 percent and 2.9 percent YTD). MG Commodity, a Helsinki-based commodity fund, advanced 6.2 percent in February, bringing the year-to-date performance to 8.8 percent.

Six of the 21 members of the NHX CTA Index recorded losses of 10 percent or more in February. Paradoxically, RPM Galaxy, which aims to provide investors with Crisis Alpha (i.e. strong returns in periods of equity distress), lost 17.5 percent in February. Lynx and Estlander & Partners Alpha Trend II – Class P retreated 14.1 percent and 13.8 percent last month, respectively.

Picture © Shutterstock – Ersler Dmitry