Stockholm (HedgeNordic) – Swedish hedge fund giant Brummer & Partners saw its flagship fund Brummer Multi Strategy (BMS) give back a large chunk of January’s gains in February as markets turned increasingly volatile causing losses for systematic macro strategies in particular.

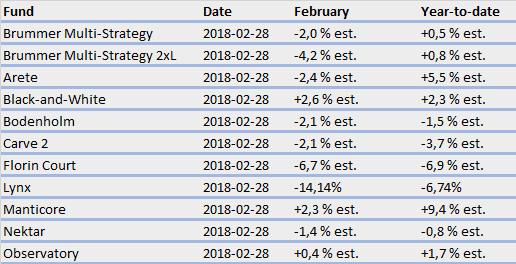

According to estimates on the Brummer website, the BMS fund had lost 2 percent by month-end, translating into a 0,5 percent gain for the year. The leveraged version, BMS 2XL, was down 4,2 percent on the month (+0.8 percent for the year). Among the nine underlying hedge funds that Brummer invest in, six were negative on the month.

The worst performing funds were by far the systematic macro/CTA strategies Lynx and Florin Court, both employing systematic trend following systems to exploit market trends in global financial markets (see Hedgenordic article on CTA strategies in February).

Lynx had its worst month in its entire history dating back to 2000 as they suffered significant losses following the volatility spike on February 5, which consequently made many markets reverse sharply. In a comment to the month’s performance, Lynx states that the market moves seen during this event were the “largest and most loss-bringing ever experienced for the program”. By month-end, Lynx had lost 14.1 percent while Florin Court was down 6.7 percent.

On a brighter note, the two long/short equity funds investing into the technology, media and telecommunications (TMT) sectors, Black-And-White and Manticore gained 2.6 and 2.3 percent respectively on the month. Manticore has gained 9.4 percent already this year. The credit hedge fund Observatory, to which Brummer increased its allocation in January, added 0.4 percent on the month.

A summary of Brummer´s performance numbers for February and the year to be found below. Data based on estimates from Brummer & Partners.

Table. Brummer & Partners February performance

Source: Brummer & Partners

Picture (c): isak55-shutterstock.com