Stockholm (HedgeNordic) – Nordic equity hedge funds started off 2018 on a positive note despite lagging international peers. The NHX Equities Index advanced 0.7% in the first month of the year (95% reported), reflecting a noteworthy performance spread across funds. Global equity-focused hedge funds, meanwhile, gained 3.4% in January as indicated by the HFRX Equity Hedge Index, the best monthly gain since December 2010.

Nordic equity hedge funds underperformed both local and global market indices in January, as equity markets around the world were on fire during the first month of the year. Nordic equity markets, as measured by the VINX Benchmark, gained 1.4% in Euro terms, whereas global equity markets rose 2.0% in Euro terms. Eurozone equities increased 3.3%, and North American equities rose 5.3% in U.S. dollar terms and 2.0% in Euro terms, respectively. However, equity markets entered a downward spiral towards the end of January, reflecting some profit-taking on the part of investors, worries about the U.S. Federal Reserve implementing more interest hikes in 2018 than previously anticipated, among other things.

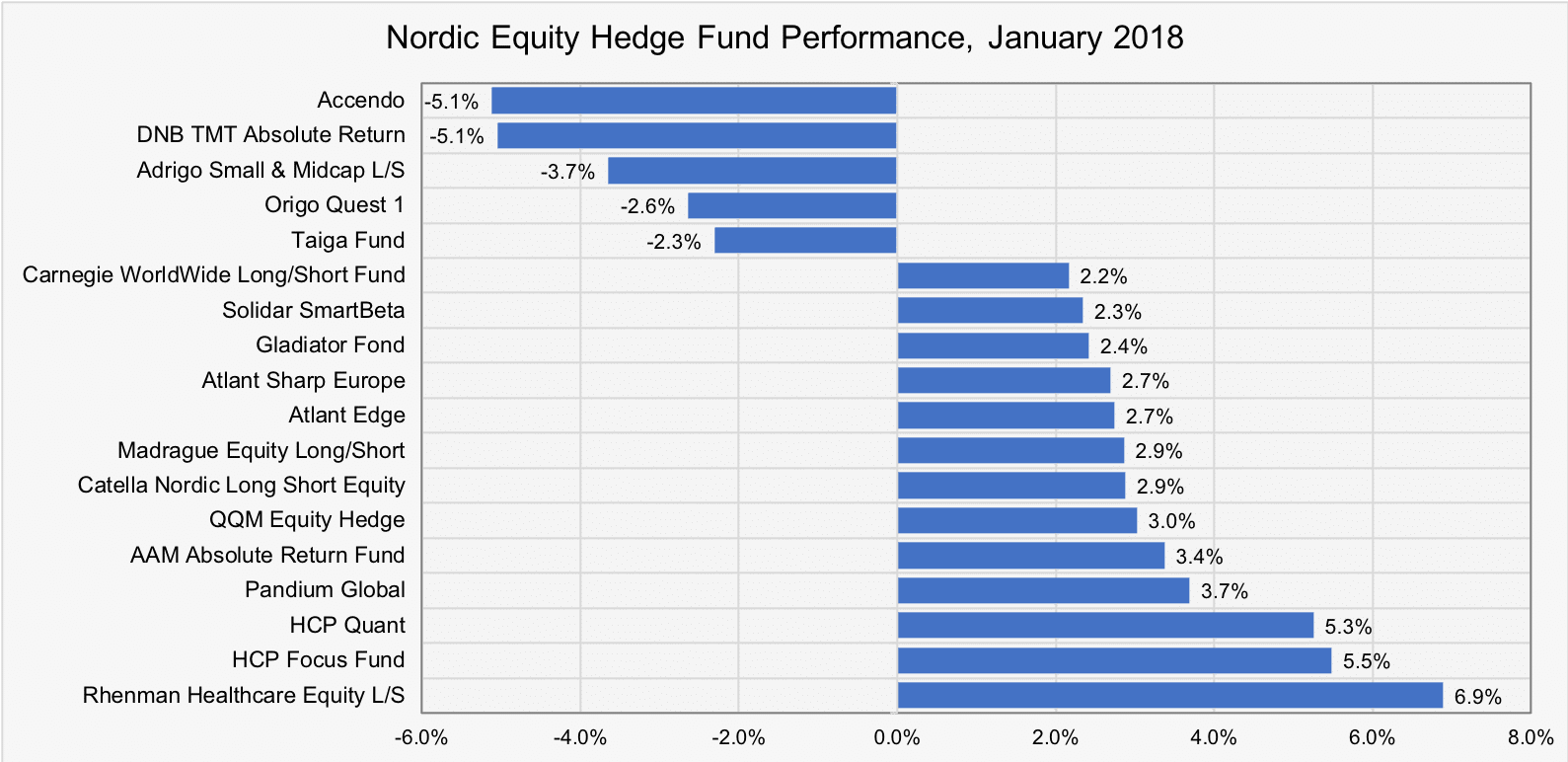

Rhenman Healthcare Equity L/S, the healthcare-focused hedge fund that topped last year’s list of best-performing hedge funds in the Nordics, is back at it again. The fund managed by Stockholm-based investment manager Rhenman & Partners Asset Management gained 6.9% in January.

Three value-oriented hedge funds competed for the runner-up spot in January’s list of best-performing Nordic equity hedge funds, with two funds managed by Finnish asset management company Helsinki Capital Partners gaining more than 5%. HCP Focus Fund, a fund that follows the discipline of value investing, and HCP Quant, which uses quantitative methods to pick undervalued small- and mid-sized companies, advanced 5.5% and 5.3%, respectively. Pandium Global, a Swedish equity fund that also follows the discipline of value investing, returned 3.7% in January.

Three equity hedge funds that impressed to varying degrees last year experienced a rather turbulent January. Activist hedge fund Accendo Capital, 2017’s second best-performing fund within the NHX universe, lost 5.1% in January. Long/short hedge fund DNB TMT Absolute Return, which recorded its best yearly performance in the past four years in 2017 with a 6.5% return, retreated 5.1% during the first month of 2018. Adrigo Small & Midcap L/S, a Nordic small- and mid-cap-focused fund, which enjoyed strong returns during its first two months of operations, suffered its first monthly loss since the fund’s inception, with -3.7%.

Picture © Ollyy – Shutterstock