Stockholm (HedgeNordic) – Nordic fixed-income hedge funds delivered positive returns at an aggregate level for the 23rd consecutive month in January, enjoying the longest streak of positive performance since the inception of the NHX indices in 2005. Fixed-income strategies, as measured by the NHX Fixed Income, gained 0.5% on average last month (100% reported), their best monthly gain since mid-2017.

Despite having underperformed their international peers every month since June 2017, the 7.2 percent delivered by Nordic fixed-income hedge funds last year matched the performance of their counterparts. Nordic players trailed peers again in January, as the Eurekahedge Fixed Income Hedge Fund Index, which comprises 358 fixed-income hedge funds, advanced 0.9% last month (64% reported as of February 21).

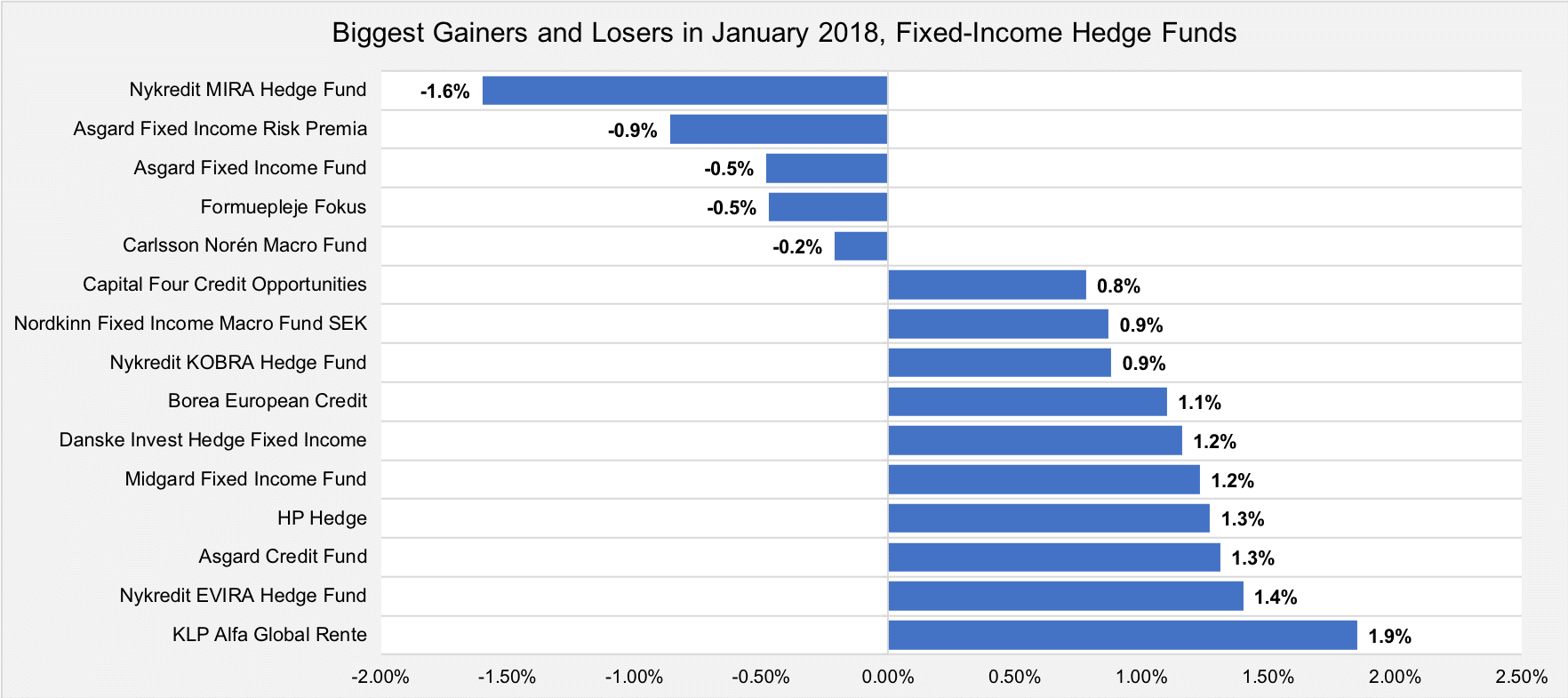

KLP Alfa Global Rente, a Norwegian fund seeking to exploit mispricing in fixed-income and foreign exchange markets, notched its biggest monthly gain since the first quarter of 2016 after gaining 1.9% last month.

Two young fixed-income funds also rewarded investors with strong gains in January. Nykredit EVIRA, a hedge fund that predominantly invests in European corporate bonds, advanced 1.4% last month. Asgard Credit Fund, a replica of Asgard Fixed Income’s classic income arbitrage strategy, has enjoyed strong performance since launching in October 2016. The fund was up 1.3% in January and delivered an annual compounded return of 7.9% through the end of January.

Nykredit MIRA, a relative-value fixed-income fund focused on Danish mortgage bonds, suffered an unusually high loss of 1.6%. The other two funds from the Asgard family also lagged peers. Asgard Fixed Income Risk Premia, a fund launched by Copenhagen-based Moma Advisors A/S in October 2017, and Asgard Fixed Income, three-time winner of our “Best Nordic Fixed Income Focused” award, lost 0.9% and 0.5%, respectively.

Picture © Fotolia.com