Sstockholm (HedgeNordic) – The Nordic Hedge Award is set to distinguish outstanding hedge fund managers from and active in the Nordic region. Compared to other industry awards, the Nordic Hedge Award is not a pure performance award.

In order to also capture components of a fund a hedge fund manager that are hard to evaluate in a quantitative model, the organizer introduced a professional Jury to the scoring system. This jury of industry professionals from the Nordic hedge fund space judges funds that have been short-listed based on qualitative criteria. The shortlisted funds for the 2018 Nordic Hedge Award will be announced by March 5th, 2018.

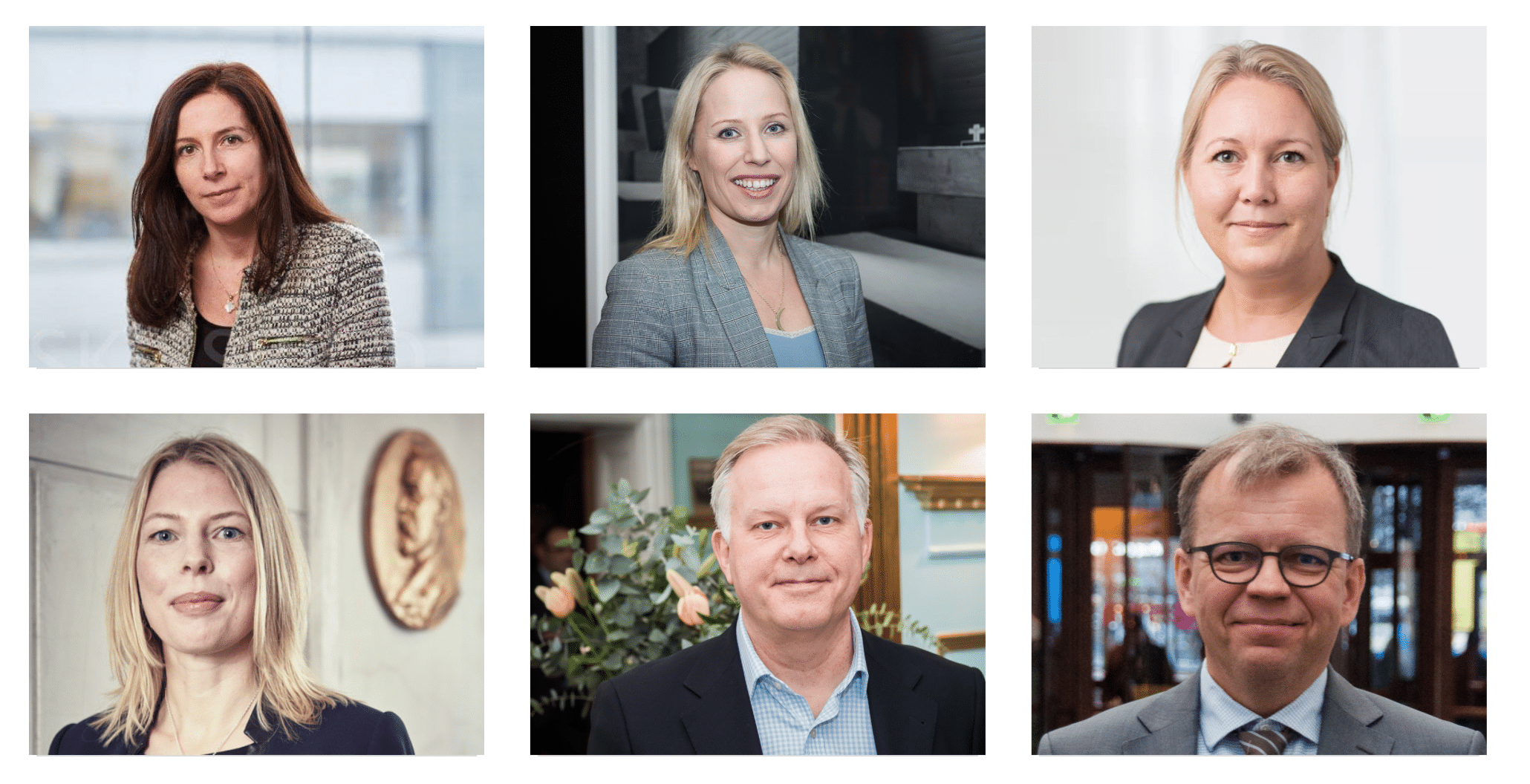

For the jury board to the 2017 Nordic Hedge Award, HedgeNordic is pleased to have secured the support of Claudia Stangehellini, Head of External Management at AP3, Helen Idenstedt, Analyst for Alternative Investments at AP1, Malin Hallén, Senior Portfolio Manager, Manager Selection at Swedbank Robur, Ulrika Bergman, CIO at the Nobel Foundation, Christer Franzén, CIO at Ericsson Pensionsstiftelse and Mikko Niskanen, CIO at Finnish fund of hedge fund specialist AIM Capital.

The final event to the Nordic Hedge Award will take place on April 25th, in Stockholm.

Picture: (c) Lemberg-Vector-studio—shutterstock.com