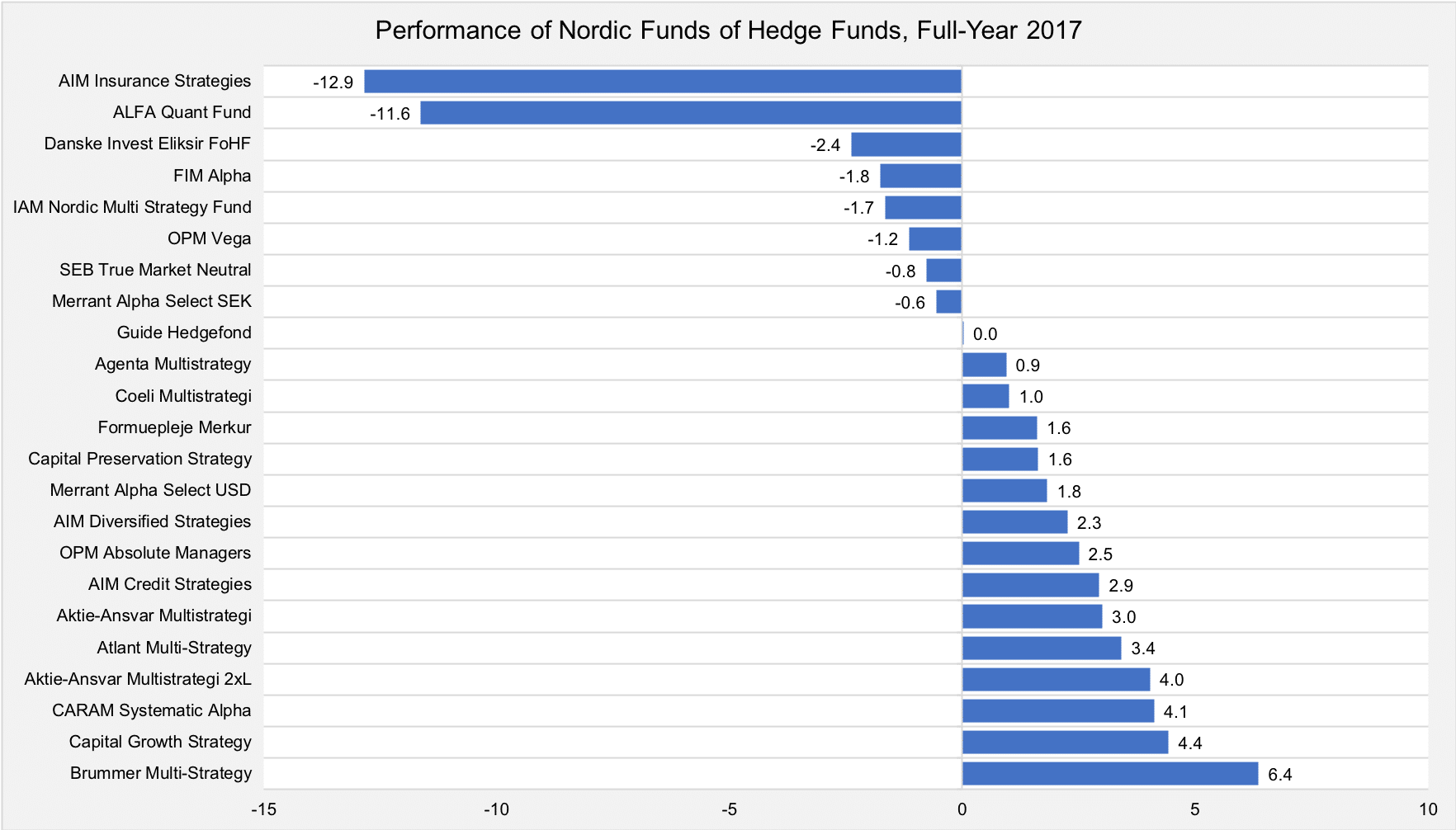

Stockholm (HedgeNordic) – Despite incurring losses in the last two months of 2017, Nordic funds of hedge funds, as measured by the NHX Fund of Funds, ended the year in the black at 0.2% (100% reported). The performance of Nordic FoFs was mixed in 2017, with approximately two-thirds of the NHX sub-index managing to show positive returns for the year. The NHX Fund of Funds was down 0.5% in December.

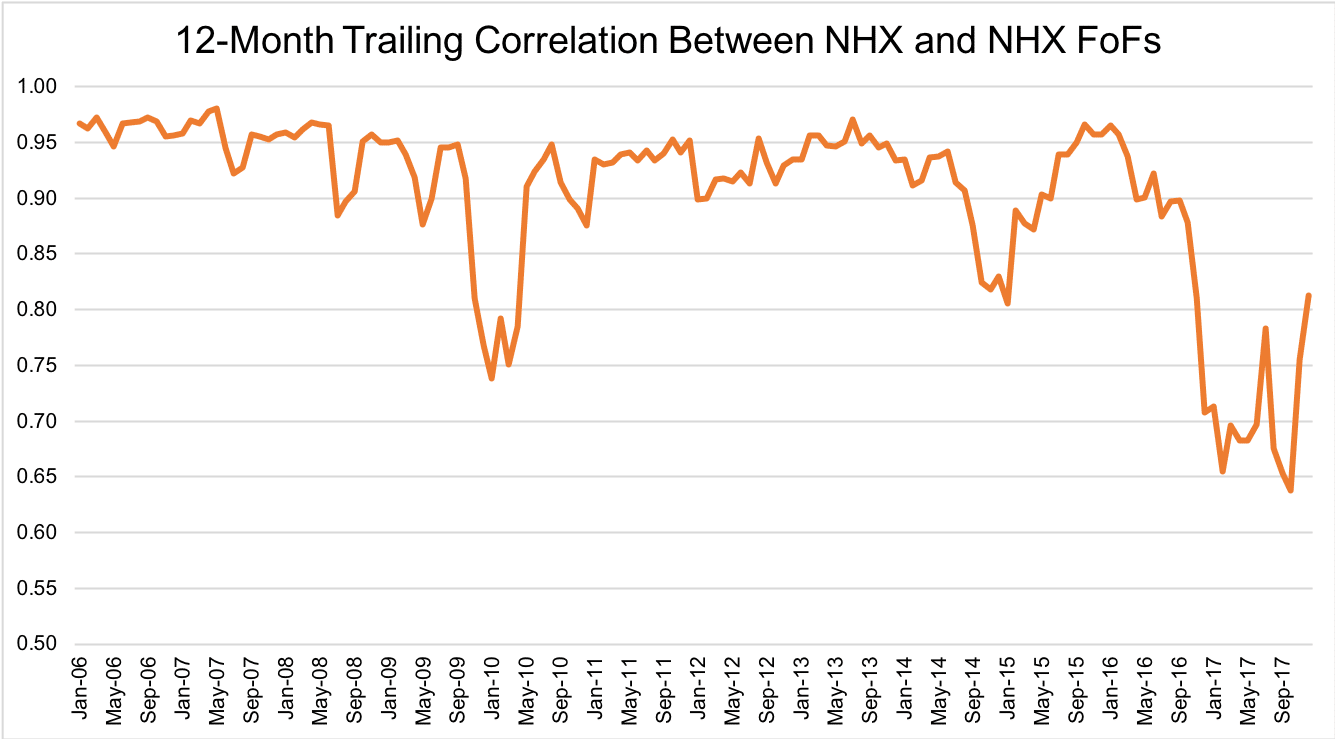

Nordic FoFs trailed their international counterparts by a significant margin last year, likely due to the relative underperformance of Nordic single-manager hedge funds. The Eurekahedge Fund of Funds Index, an equally-weighted index tracking 476 investment managers who exclusively invest in single-manager hedge funds, was up 6.8% last year. Our data shows that the trailing 12-month correlation between the NHX Composite and the NHX Fund of Funds has typically been above 0.8, serving as evidence that their Nordic focus can distinguish most Nordic FoFs.

Three funds of funds under the umbrella of Coelli Asset Management AB conquered the list of the best-performing FoFs in December. Coeli Multistrategi, a fund that invests in both in-house Coeli funds and other well-established Nordic hedge funds, gained 1.1% in December, pushing the performance into positive territory for the year (1.0% for 2017). Capital Preservation Strategy and Capital Growth Strategy, two funds operating under the umbrella of Coeli since October 2017, returned 0.8% and 0.7%, respectively (1.6% and 4.4% for 2017).

Alfa Quant Fund, a multi-strategy fund that invests in Alfakraft Fonder’s single-strategy funds, recorded a loss of 4.8% in the last month of 2017, ending the year as the second-worst performing FoFs in the Nordics (-11.6% for 2017). Aktie-Ansvar Multistrategi 2xL, the double-leverage version of Aktie-Ansvar Multistrategi – a fund that invests in several leading hedge fund managers in the Nordics -, was down 1.8% in December, trimming the full-year gain to 4.0%.

Picture © Sportpoint – Shutterstock