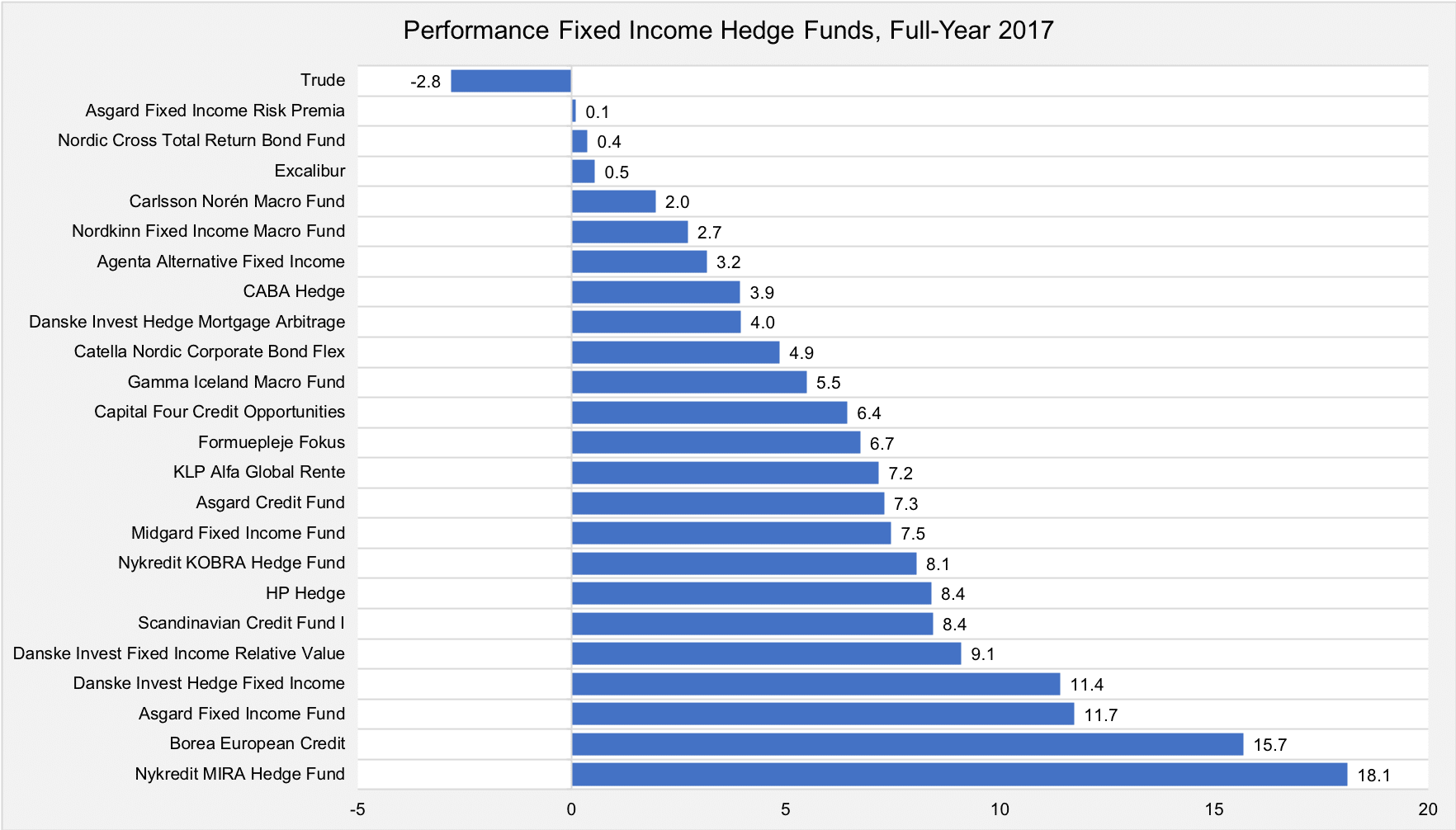

Stockholm (HedgeNordic) – Nordic fixed-income hedge funds, as measured by the NHX Fixed Income, returned 7.1% on average in 2017, after gaining 0.2% (96% reported) in the last month of the year. Fixed-income strategies delivered positive returns for the 22nd consecutive month in December, with the NHX Fixed Income Index becoming the best-performing NHX sub-category in 2017.

Nordic fixed-income hedge fund players performed in line with their international counterparts last year, as benchmarks tracking the performance of fixed-income strategies delivered mid-single digit gains. For instance, the Eurekahedge Fixed Income Hedge Fund Index, an equally-weighted index of 353 fixed-income hedge funds, returned 6.9% in 2017. The index gained an estimated 0.4% in December, with 66% of all constituents having reported December returns as of January 22, 2018.

Asgard Credit Fund, a replica of the classic income arbitrage strategy implemented by Asgard Fixed Income Fund, was the best-performing player among Nordic fixed-income hedge funds in December, returning 1.8% for the month (7.3% for 2017). KLP Alfa Global Rente, a fixed-income fund seeking to exploit mispricing in global fixed-income and foreign exchange markets, gained 1.4% last month and was up 7.2% for the year. Borea European Credit, the fixed-income fund managed by Norwegian Borea Asset Management AS, advanced 0.8% in December and was up 15.7% for the year. The fund clinched the title of the second-best performing fixed-income fund in the Nordics in 2017.

Several funds lagged peers by an immaterial margin in December: Formuepleje Fokus, which primarily invests in Danish mortgage bonds, lost 0.5% in December, erasing some of the full-year gains to 6.7%. Asgard Fixed Income Fund, three-time winner of HedgeNordic’s “Best Nordic Fixed Income Focused Fund” award, was down 0.5% in December (11.7% for 2017).

Picture (c): shutterstock-andrey-yurlov