Stockholm (HedgeNordic) – Nordic equity hedge funds recorded their worst monthly performance year-to-date, as Nordic equity markets got hammered in November. Equity-focused hedgies, as measured by the NHX Equities, tumbled 0.7% last month (96% reported), trimming their average year-to-date gains to just 2.8%.

Nordic equity hedge funds performed much better than the overall market in November, as Nordic equity markets, as measured by the VINX Benchmark Index in Euro terms, plummeted 4.4% during the month. Eurozone equities fell 1.9% last month after markets reached a two-year high at the beginning of November, driven by strong gains in the previous ten months (17%). North American equities advanced 2.9% in U.S. dollar terms (0.5% in Euro terms), with market indices hitting new record highs and the Dow Jones Index breaking above the 24,000-level.

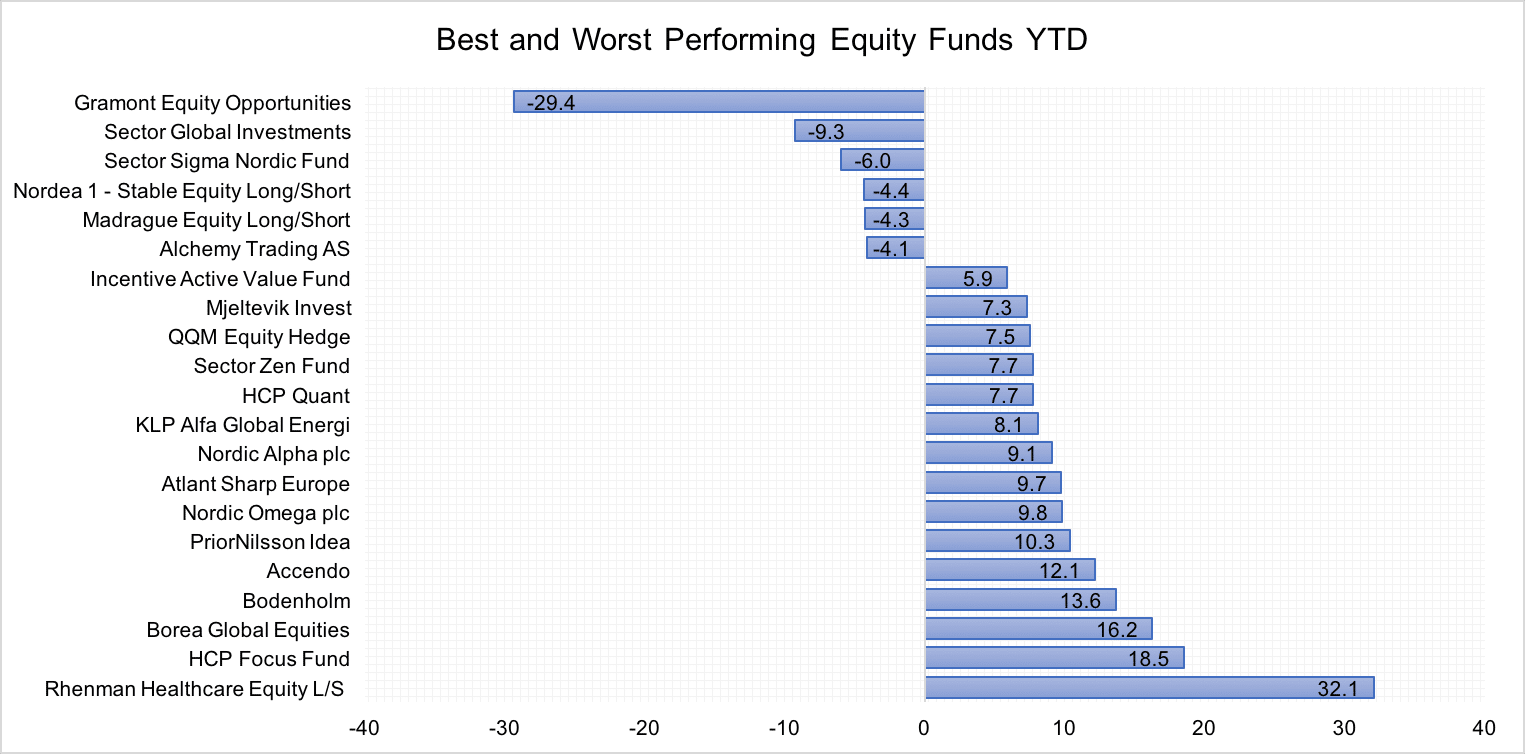

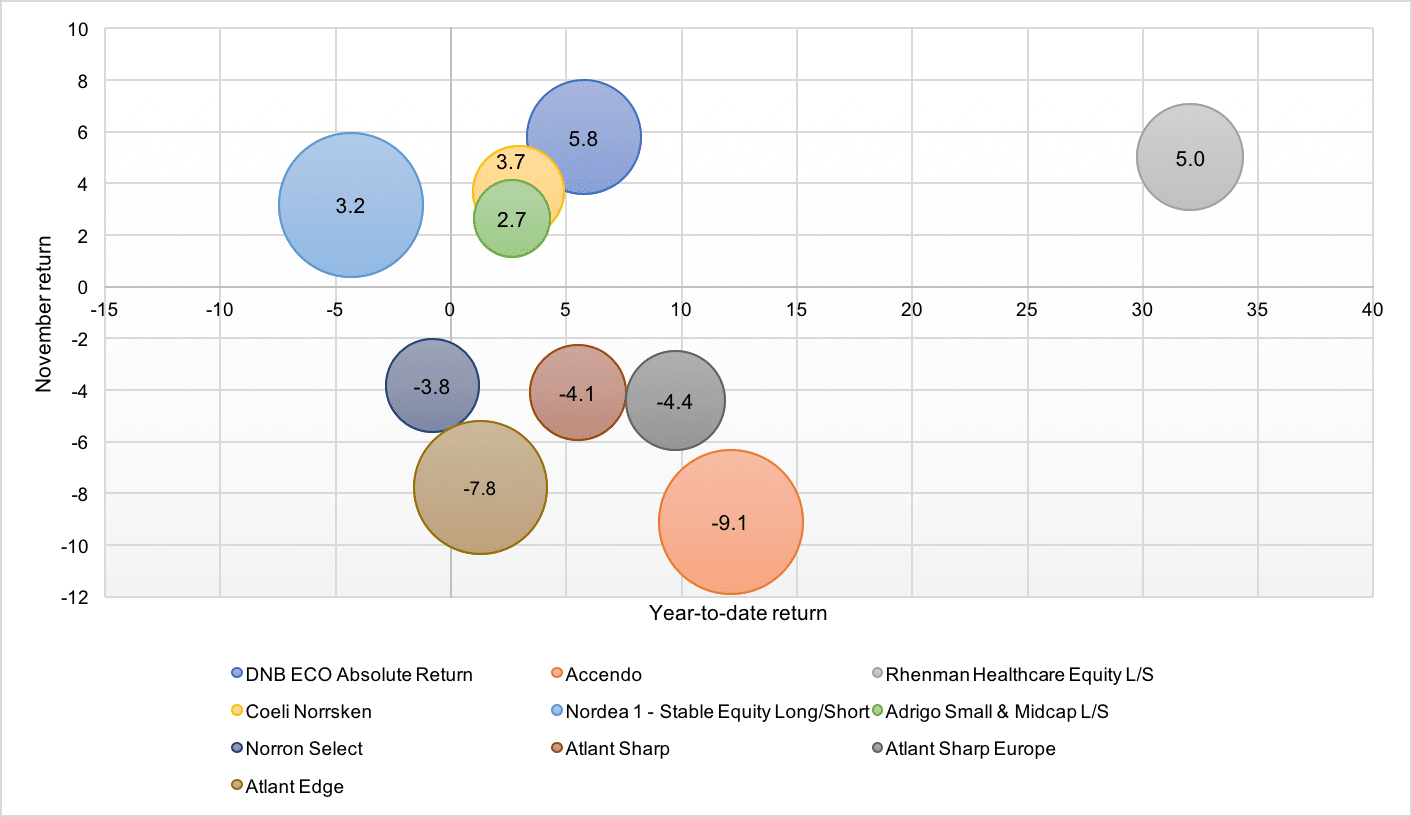

Although two-thirds of the 55 Nordic equity hedge funds ended the month in the red, several funds stood out of the crowd. DNB ECO Absolute Return, a market-neutral fund investing in companies operating in or associated with renewable energy, was the best-performing fund within the NHX Equities category, gaining 5.8%. The mid-single-digit return pushed DNB’s absolute return fund into positive territory for 2017 (5.8% YTD).

Rhenman Healthcare Equity L/S, a healthcare-focused long/short equity fund managed by Rhenman & Partners Asset Management AB, was the runner-up on our list of best-performing equity funds. The fund returned 5.0% last month and extended its year-to-date return to a laudable 32.1%. Rhenman Healthcare Equity L/S tops this year’s list of best-performing Nordic hedge funds. Coeli Norrsken, which employs an event-driven market-neutral investment strategy, and Nordea 1 – Stable Equity Long/Short Fund, another market-neutral fund, gained 3.7% and 3.2%, respectively. Adrigo Small & Midcap L/S, a freshly-launched fund investing in Nordic small- and mid-cap companies, was also among the top five performers within the NHX Equities category. The fund managed by Adrigo Asset Management AB returned 2.7% during its first month of operations.

Moving on the crowd of funds that lagged peers in November, activist fund Accendo lost its position as the second-best performing equity fund in 2017 after losing 9.1% in November. The fund continues to rank among the five best-performing equity funds with a year-to-date return of 12.1%.

Three funds from the Atlant Fonder family were also among the worst-performing equity funds last month. Atlant Edge incurred a loss of 7.8% (1.3% YTD), Atlant Sharp Europe and Atlant Sharp fell by 4.4% and 4.1% (9.7% and 5.5% YTD), respectively. Nordic-focused long/short equity fund Norron Select recorded a negative return of 3.8%, bringing the year-to-date loss to 0.8%.