Stockholm (HedgeNordic) – Beaten down in September, CTAs made a strong comeback in October as the roller-coaster ride for trend following hedge funds continued.

According to estimates from Barclayhedge, a global hedge fund index provider, CTAs gained 1.7 percent during the month to bring year-to-date performance to just about flat. The SG CTA Index, another widely used industry benchmark, advanced 4.4 percent translating into a positive year to date number (+1.5%).

Nordic CTAs, as tracked by the Nordic Hedge Index (NHX CTA), jumped 4 percent powered by gains from the likes of RPM (RPM Galaxy +13.5% and RPM Evolving +6.8%), Lynx (+5.9%) and Coeli Prognosis Machines (+4.9%). However, the index remains in negative territory for the year (-0.4%)

According to monthly commentaries from leading CTA managers in the Nordics, continued bullish trends in equities coupled with trends in the commodity sector were the main contributions for the month. The dollar strength in recent weeks seems to have made trend positions tilt from short to long.

“Long positions in equity indices were the major contributors during the month where as good as all markets contributed positively. Commodities also had a positive contribution primarily as a result of long positions in energies and metals, but also agricultural commodities, where the fund is holding short positions, added to performance”, Lynx writes.

RPM highlights that trend following was the best performing sub-strategy during the month and that market sentiment seem to have turned bullish, which they believe will continue to support trend followers going forward.

“In RPM’s funds, the tilt towards trend following managers turned out beneficiary as these managers benefited most from the extended trends in October. Fundamental (Systematic Macro) managers were also up with profits in equities and energies, whereas short-term trading managers had mixed performance”, RPM writes continuing:

“From a macroeconomic perspective, market sentiment (finally) seems to have adopted a more bullish view as well and, thus, overall trendiness has picked up further. For the time being, we maintain the shift towards trend following managers keeping portfolio risks at above average levels while closely monitoring portfolio and concentration risks.”

The CTA universe has struggled to deliver any sizeable returns during the last three years to its investors. Low volatility and a general lack of direction across asset classes have weighed on performance according to industry representatives (see for example RPM:s recent comment on directional volatility as key for a CTA-turnaround here).

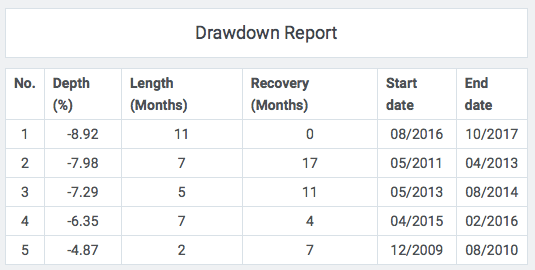

The Nordic CTA industry remains in its longest and deepest drawdown since HedgeNordic started calculating the NHX CTA index in 2005 (see table below). Whether the strong numbers in October will mark the start of a year-end rally and a long-awaited sustained positive performance period for CTAs remains to be seen. Early data points to a good start in November.

Picture (c): kentoh-shutterstock.com