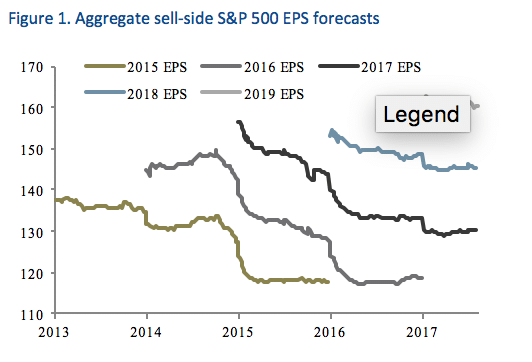

(Man Group: Views from the Floor): One school of thought supporting a potential leg up for the market is that there seem to be very few sell off catalysts on the horizon. Indeed with global growth expectations rising (in June the Organisation for Economic Co-operation and Development (OECD) forecast that the world economy would experience its fastest growth in six years), monetary policy moving towards more normal territory and politics becoming more cohesive (at least for now) in continental Europe, were it not for recent tensions between the US and North Korea, we believe it would be reasonable to believe an extension of a bullish equity environment is a distinct possibility. Reflecting this, we have seen earnings per share estimate revisions stabilise and improve over the last six months, as can be observed in Figure 1. On that basis, we believe there is potential for a considerable pent up stock of good news to be released.

Brexit – The long and short of it

As Brexit negotiations intensify, the tea leaves of Brexit are becoming harder and harder to read. But while the politics and diplomacy may be complex, we believe there seem to be some potential opportunities, on both the positive and negative sides, where the prudent investor might benefit from asymmetrically positioned risk. On the long side, for example, the average UK REIT is trading at an average discount to net asset value of 30%, on fears that the financial institutions that occupy some of London’s most valuable real estate are on the verge of exodus. Even if this were to happen, many of these REITs have instruments – convertible bonds in particular – which have fallen so far that a significant amount of adversity already appears to be priced in. Conversely, in the event of a negative Brexit scenario, financials may be impacted by a breakdown in trade talks given the highly integrated nature of the industry across the EU. Even in the event of a positive Brexit outcome, however, with the cost of funding appearing more likely to increase and various adverse regulatory changes on the horizon (the Financial Policy Committee’s capital buffer increases, for example), it is unclear where the next leg of challenger growth might come from. The mainstream may strive in vain to predict the outcome of Brexit, but that doesn’t mean there aren’t more simple potential opportunities for the shrewd investor.

US CREDIT CARD DEBT – This time it’s different?

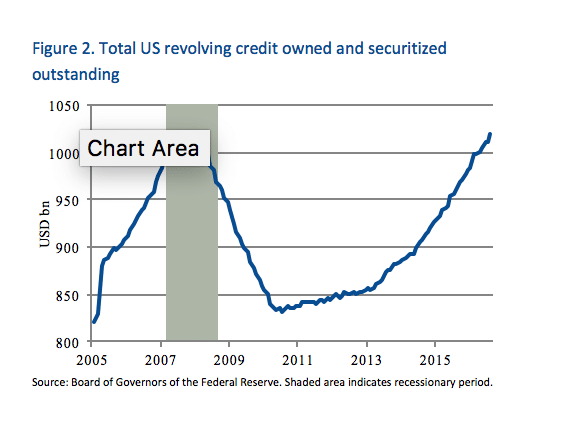

We have previously challenged some of the fears around increased credit card delinquency rates, by putting these rates into the context of the dramatic fall experienced in the metric since the Global Financial Crisis. To put a bit of nuance on this observation, however, it is interesting to observe the progression in the total amount of US revolving credit outstanding, which is shown in Figure 2. This shows that the level outstanding is now nearly identical to its peak during the Great Recession. This does not change our view, which is that we believe the substantial difference in delinquency rates in the two periods should not be ignored – but we believe investors should keep a close eye on the space as, if things do start to heat up, there could potentially be just as much fuel for a fire as there was in 2008.

With contributions from: David Kingsley (Man Solutions Portfolio Manager), Ben Funnell (Man GLG Portfolio Manager – Long Only), Chris Huggins (Man GLG Portfolio Manager – Credit), Andrew Freestone (Man GLG Credit Analyst), Brian Broesder (Man GPM Co-Head of US Private Debt), Wes Lovy (Man GPM Co-Head of US Private Debt), Henry Neville (Man Equity Analyst)