Stockholm (HedgeNordic) – In Wednesday´s edition of EFN TV’s “Börslunch Special”, a local Swedish television show covering financial markets, RPM’s executive Vice President Per Ivarsson (pictured) talked about the recent weak performance of CTAs and what would be required for it to turn around.

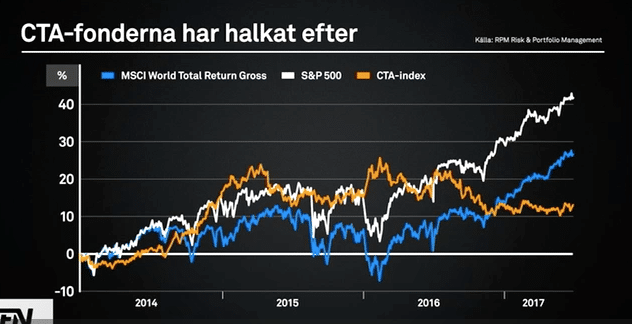

Walking through the most recent development for the CTA industry, Ivarsson pointed to the fact that these strategies, since mid-2016, have underperformed the MSCI World Total Return Gross index as well as the S&P 500 (see chart below).

According to Ivarsson, this is to a large extent explained by the low volatility that has characterised financial markets, as well as the fact that CTAs hold exposure to a vast number of different markets, not all of which have offered opportunities for systematic strategies. Ivarsson mentions energies as one example, where prices have not been able to build on the production cut imposed by OPEC.

Ivarsson does not believe that the recent development should be seen as a disappointment for CTA-investors however, given that these investments are entered into with the expectation for them to perform when equities have a difficult time, thus offering portfolio protection.

“What is worth noticing in the graph (chart below), is that CTAs performed well during the market turmoil in the first two months of 2016. This relationship also holds going back in history. When there have been major setbacks in equity market indices, CTAs have performed.”

Chart 1. CTAs versus equity indices since 2014

Source: EFN TV and RPM Risk & Portfolio Management

Even though Ivarsson mentions the lack of volatility as a possible explanation to the recent lackluster performance for CTAs, he emphasises that high levels of volatility is not good for these strategies by design. What is needed is volatility coupled with price trends, which he refers to as “directional volatility”.

“What we at RPM look for is ‘directional volatility’, meaning volatility that drives markets in a certain direction”.

One thing that could create such an environment is if there was more clarity about the effects of US president Trump’s fiscal stimulus package, Ivarson argues.

“What is needed is some sort of market concensus saying that the US economy is surging ahead, Trump will solve this and create millions of new jobs and so on, then we would have a trend in one direction. The opposite would also be good for market directionality, if the market agrees that this will not go well, this is likely to build negative sentiment which is good for CTAs. We will then have a so called directional volatility, which hopefully will make the strategy perform again”, Ivarsson concluded.

See the full Börslunch Special episode here (in Swedish):

https://www.efn.se/bors-finans/borslunch-special-28-jun-2017/