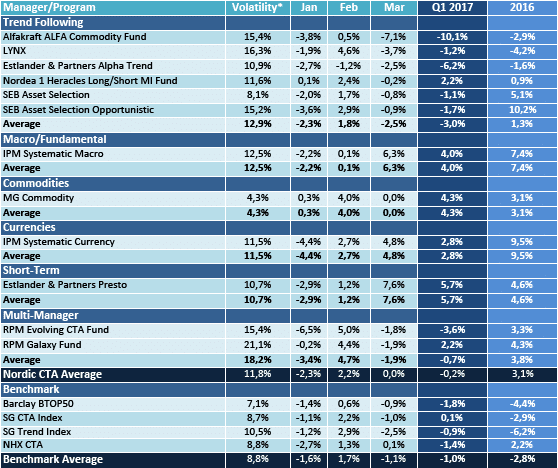

Stockholm (HedgeNordic) – The Nordic CTA industry had another lacklustre quarter in Q1 2017, lagging the SG CTA and Trend indices but outperforming an even weaker showing for the Barclay BTOP50. When the dust settled by the end of March, the NHX CTA index had lost an estimated 1,4 percent during the quarter, to be compared to a net gain of 0,1 percent for the SG CTA Index and a net loss of 0.9 percent for the SG Trend Index. The Barclay BTOP50 ended the quarter down 1.8 percent.

Overall, CTAs started the year on a weak note with trends in currencies reversing (US dollar weakened) while also commodities markets detracting from performance. February offered a more positive environment where long positions in equity indices and long base metals positions contributed. In March, CTAs once again gave back profits from the previous month. A weakening US dollar on concerns for the US administration’s ability to carry through tax reforms and infrastructure investments have been mentioned as explanation to the weak numbers.

In terms of individual winners in the Nordic CTA space, IPM had a strong period with both the systematic macro (+4%) and systematic currency programs (+2.8%) advancing. The short-term CTA program “Presto” from Estlander and Partners also stood out with a gain of 5.7 percent.

Trend following overall had a weak quarter, with the biggest loser being the Alfa Axiom Fund, posting losses of 10.1 percent. The industry giants Lynx and SEB Asset Selection also struggled.

In the multi-manager space, the programs from RPM Risk & Portfolio Management, RPM Evolving and RPM Galaxy, showed disparate returns with Evolving losing 3.6 percent while Galaxy gained 2.2 percent.

Performance numbers for the Nordic CTA industry (2016 and Q1 2017) as well as for major industry benchmarks, are summarized below.

Picture (c): Montri-Nipitvittaya-shutterstock.com