Much of Novus´work involves calculating the risk of crowded trades for hedge funds and their investors. But why is crowding on the rise? Especially in US equities, the answer is simple: there are less stocks and more hedge fund managers than ever before.

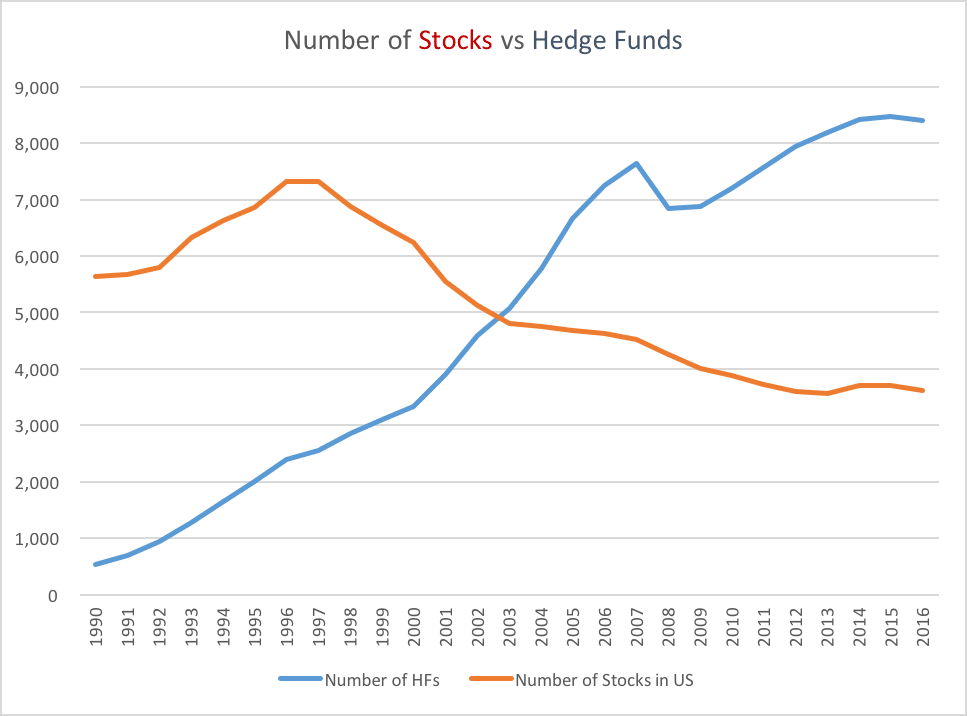

The following chart tracks the number of hedge funds against the number of publicly traded stocks. The hedge fund count is sourced to HFR, while the equities count is the number of stocks in the Wilshire 5000. As of 2016 year-end, it’s a lot less than five thousand.

Source: HFR, Wilshire Associates

Looking at this chart, we see a growth in hedge fund managers while the number of public US companies to invest in declines. This trend, driven by privatization, business closings, and M&A activity has caused a 50% drop in the quantity of public securities since 1997. At the same time, the hedge fund incentive system has caused more and more talented managers to start out on their own. Today, there are three times more hedge funds than twenty years ago.

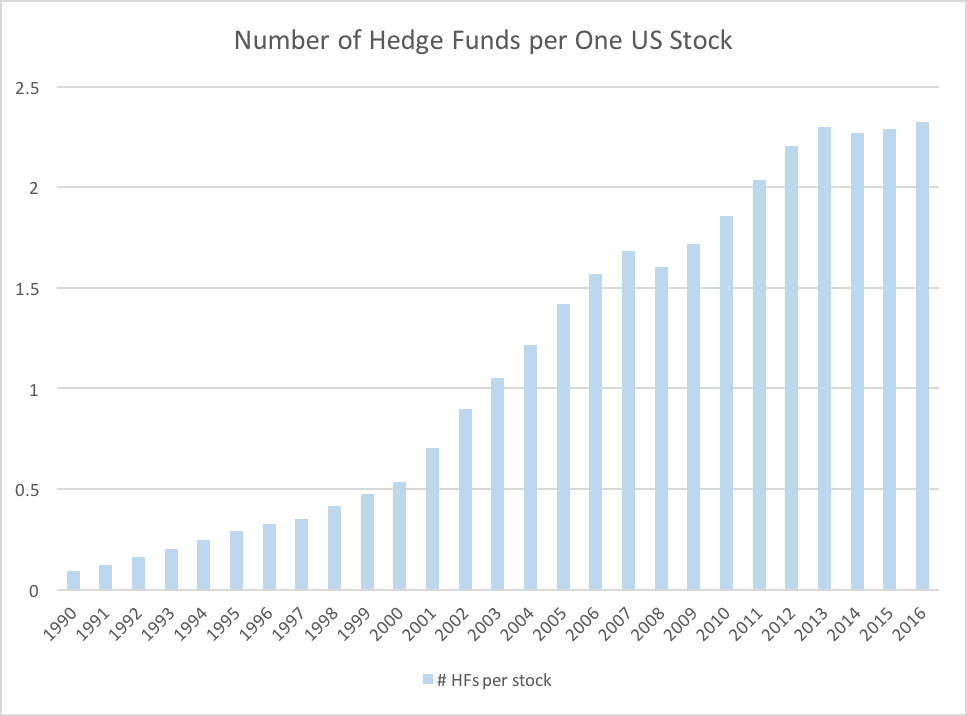

Charting the number of hedge funds for every stock by year shows a clear trend:

This isn’t exactly apples to apples since we’re only talking US equities, and the hedge fund numbers are global. Still, most hedge funds have a least some presence in the US, the world’s largest equities market. In 2004, there was one hedge fund for every stock. Now, there are 2.3 hedge funds for each publicly traded equity. This movement helps explain the increase in crowding and falling liquidity.

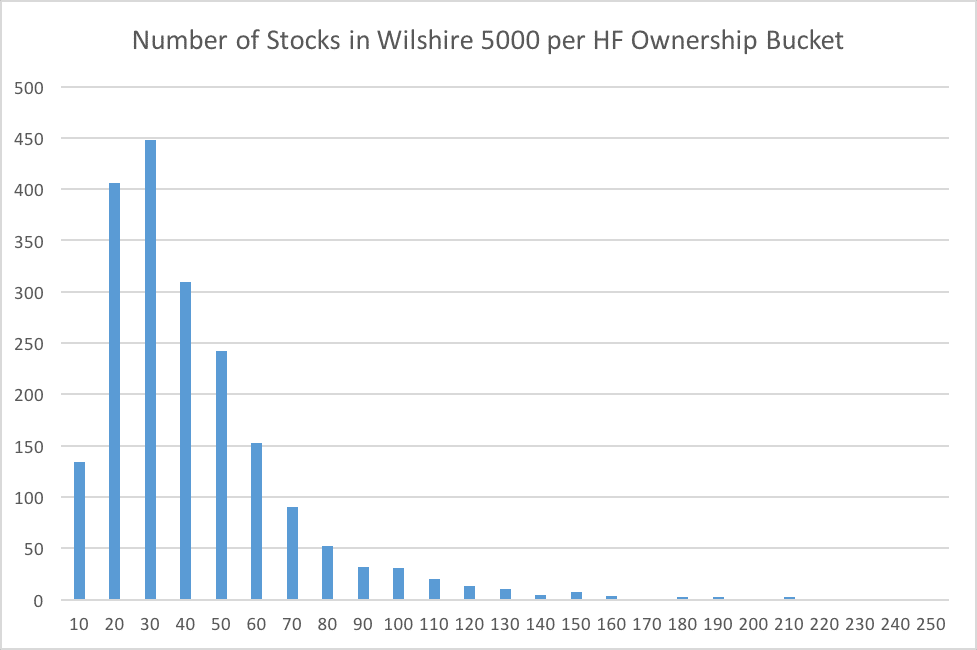

It’s important to remember that hedge funds don’t simply buy every stock in the index. In fact, they all have processes that identify companies most likely to outperform their competitors. This leads to some companies being more concentrated with hedge funds than others.

We looked at the largest two thousand stocks in the Wilshire 5000 Index to gauge HF ownership in the market. Our findings were interesting. Only 134 US equities have fewer than ten HF managers invested, and one—FB—has 237.

Of those we were able to identify through public filings, most US equities have between twenty and fifty hedge fund manager holders. Since HFR tracks many more funds, we believe our number understates the true participation. Only managers over $100M in US equities are required to file Form 13F HR, from which we sourced the data in the above chart.

With this many managers invested in most of the US stocks, it’s no wonder crowding is playing an increasing role in volatility, especially for the few securities in the right tail of the distribution. For more information on crowding, please see the below reports.

Republished with kind permission from Novus: original publication

Picture © agsandrew—shutterstock