Stockholm (HedgeNordic) – Systematic futures trading strategies, widely referred to as CTAs, have rebounded strongly in February following a period of lacklustre performance, early estimates suggest.

The SG CTA index, which is the primary industry benchmark composed by Societe Generale Prime Services, had made gains of 2,48% as of February 20, more than compensating for a 1.13% loss from the previous month and following from a negative 2016 when losses amounted to 2.89%.

Nordic CTA managers seemingly bucked the positive trend in February with indicative numbers on the respective company websites of Lynx and RPM showing intra-month gains of 5.11% for Lynx and 4.36% for the RPM Evolving CTA Fund (as per February 20). This turns Lynx performance to a positive 3% on the year, while the Evolving fund from RPM still is in negative territory year-to-date recovering from a 6.5% drop in January.

Bouncing off from muted performance in recent years

The rebound should be welcomed by managers and CTA investors alike. Having experienced sideways performance during the last couple of years, CTA managers are seeking for markets to work in favour of their strategies again.

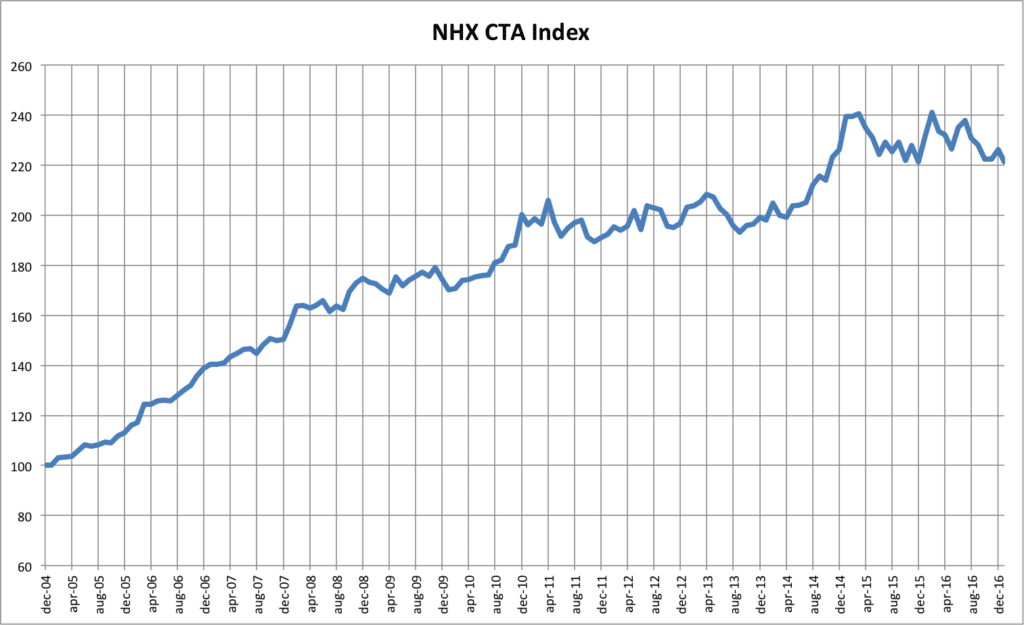

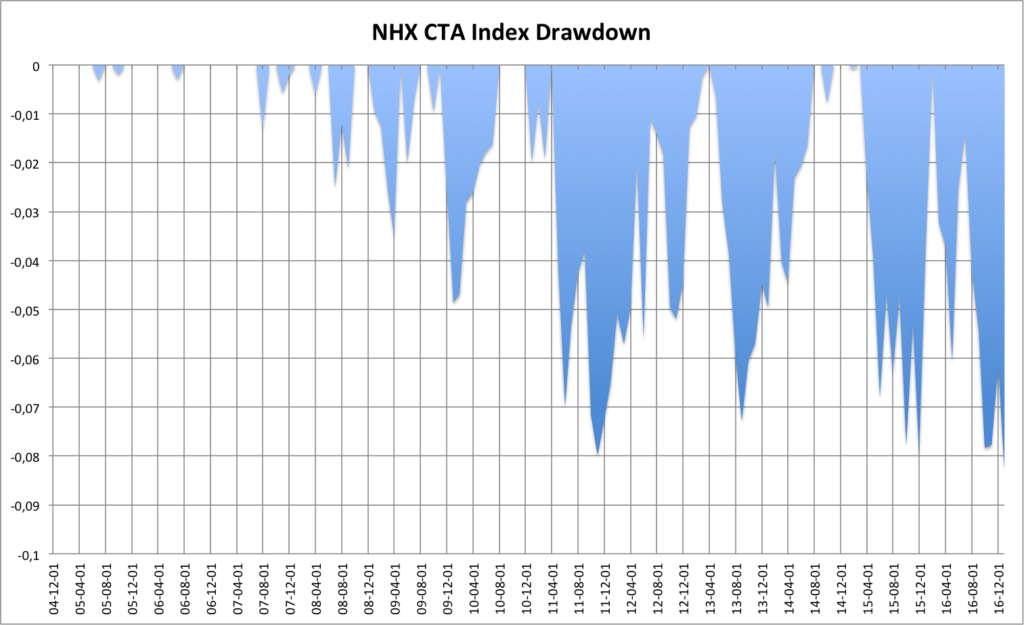

For managers in the Nordics, the market environment has also been challenging. Even though the Nordic CTA universe as a group gained 2.2% last year, the drawdown seen since the highest level recorded in February 2016 amounts to 8.3%, taking the January 2017 figure into account.

NHX CTA index since launch in December 2004. Source: HedgeNordic

NHX CTA index Drawdown since launch in December 2004. Source: HedgeNordic

Picture: (c) ramcreations -shutterstock.com