Stockholm (HedgeNordic) – We incessantly hear about the trillions of sovereign and corporate debt with negative yields, but this relates to sovereign, and some investment grade corporate, credit, mainly in Europe and Japan. We hear much less about the trillions of dollars of corporate and asset backed securities, and associated structured credit, that still offer positive yields of roughly between 1% and 7% (or possibly much more for the junior tranches of structured credit vehicles, naturally with commensurately higher risk).

Additionally, there is plenty of emerging market sovereign debt paying yields comparable to developed market corporate and asset backed debt. Headline yields can be enhanced by capital appreciation from spread compression, which, all else being equal, happens automatically as investors ‘roll down’ upwards sloping yield curves. Leverage can also be used to augment returns.

For long-biased, long-only, or buy and hold investors, providing default losses can be contained, unleveraged returns from alternative credit are respectable while inflation and risk free interest rates remain subdued. Some credit assets offer a floating rate yield that should track increased interest rates. Hence many of the largest family offices, and tier one institutions, are actively allocating to – and increasing allocations to – a range of alternative credit asset classes and strategies, according to surveys by Prequin.

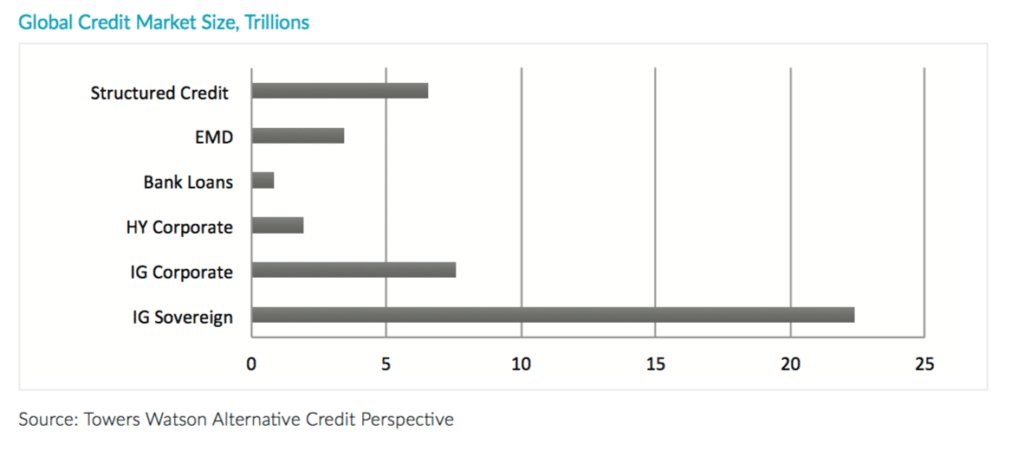

Investment consultants Willis Towers Watson define ‘alternative credit’ to be high yield corporate debt, bank loans, emerging market debt and structured credit. A chart showing the relative sizes of different parts of the credit market appears below.

Willis Towers Watson claims that “alternative credit represents over 25% of the global credit universe; yet Towers Watson clients have only invested 8% of their total credit portfolios into alternative credit and less than 1% into illiquid credit”. It seems that many allocators are still very much “underweight” of alternative credit.

Institutional investors can access credit, and alternative credit, in various ways: ETFs, index funds, long only funds, absolute return funds, UCITS hedge funds, and offshore hedge funds. Passive, or index tracking, investing approaches have become very popular in equity markets but remain less so in credit. When credit indices can contain thousands, or tens of thousands, of issues, replicating index performance is not a straightforward task. Indeed, some high yield ETFs (exchange traded funds) seem to have lagged behind high yield credit indices by a massive margin over the past few years. Part of the problem is that offering intra-day liquidity is not well aligned with the widely documented, and deteriorating, liquidity conditions in many parts of the credit markets. This problem may be exacerbated for the largest ETFs. By contrast active funds with disciplined capacity ceilings, and fund liquidity terms appropriately aligned with portfolio liquidity, are better equipped to navigate liquidity conditions. UCITS funds are widely used for more liquid credit strategies, but do not always have enough flexibility in terms of instrument types for all types of hedge fund strategies.

This article was written for the HedgeNordic Special Report on Fixed Income Strategies. You can view the the full article on pages 16-19, here: https://hedgenordic.com/wp-content/uploads/2016/09/FI.pdf

Picture: (c) Saida-Shigapova—shutterstock.com