Stockholm (HedgeNordic) – In what looked to become a negative second quarter for the CTA industry following weak numbers in April and May, was to become a positive one as financial markets reacted forcefully to the Brexit vote in June. The event reinforced longer term bullish trends in fixed income and precious metals markets while triggering some significant moves in currencies, playing in the hands of the CTA community.

Nordic CTAs, as expressed by the NHX CTA Index, outperformed global benchmarks during the quarter with a net gain of 0.3%. The Barclay BTOP50 Index (-1.6%) as well as the SG Trend Index (-1.2%) posted losses in Q2 while the SG CTA Index (+0.1%) was marginally positive.

On an individual manager basis, the IPM Currency fund stood out with a net gain of 8.9% during the quarter, adding 6.7% in June alone. According to the managers monthly comment, the portfolio enjoyed large positive contributions from its developed currency portfolio, which benefited as investors sold the GBP in favour of safe haven currencies like the JPY and CHF (see separate HedgeNordic article here).

MG Commodity was the second best performer on a risk-adjusted basis, adding to its recent strong showing. The program had a very strong 2015 (+12.5%), especially considering its low volatility profile and has added another 4.3% in the first six months of 2016.

On the trend following side, Lynx put in a remarkable June (see separate story) adding 10.3%, which brought Q2 performance to +5.1% and year-to-date numbers to +10.1%, significantly outperforming global peers. SEB Asset Selection Opportunistic and Nordea Heracles also had a strong June with net gains of 8.5% and 7.5% respectively.

On the multi-manager front, the two funds from RPM; Evolving and Galaxy, gained 0.7% and 1.4% during the quarter, holding on to solid returns for the full year with Evolving being up 10.9% and Galaxy up 6.2%.

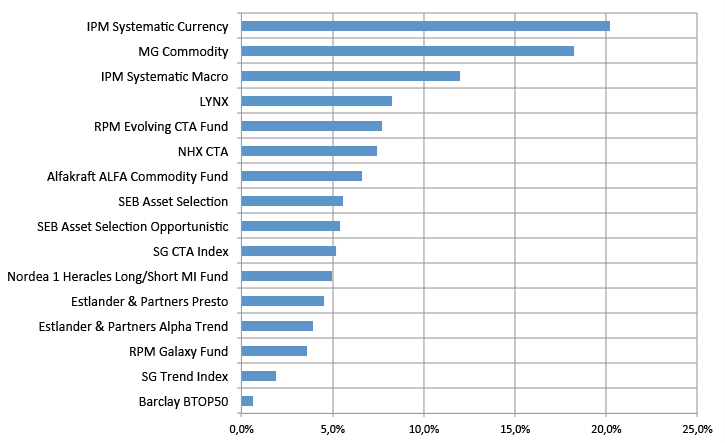

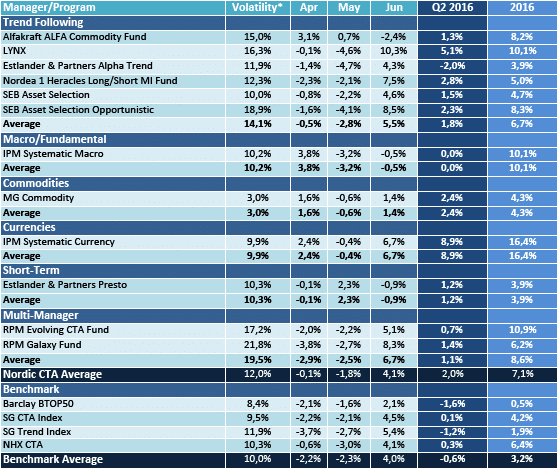

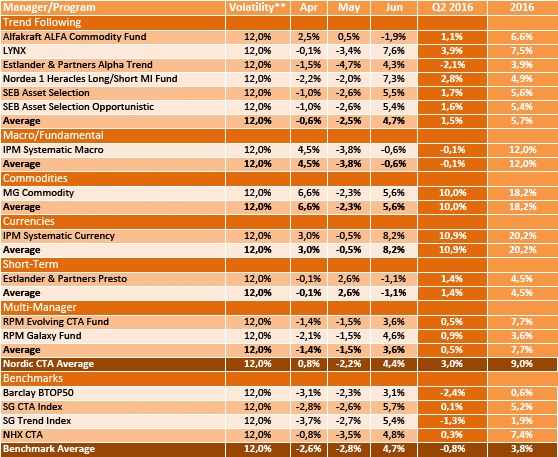

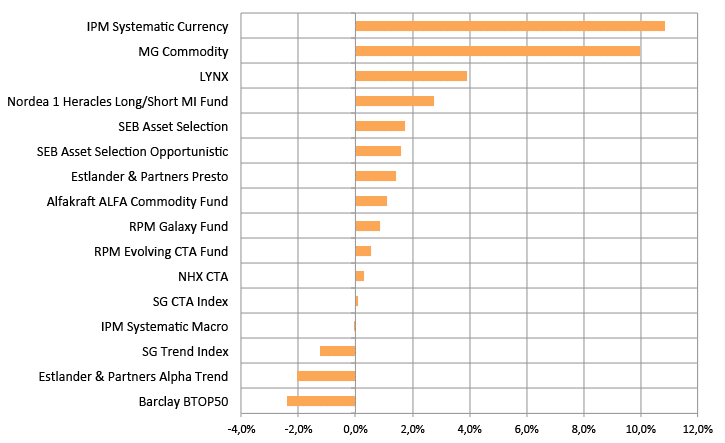

The complete rankings of Nordic CTAs, compiled by HedgeNordic and compared both in absolute and risk-adjusted terms, are shown below.

Nordic CTAs – Performance overview, Q2 2016

Nordic CTAs – Performance overview risk-adjusted, Q2 2016

Nordic CTAs – QTD performance ranking risk-adjusted, Q2 2016

Nordic CTAs – YTD performance ranking risk-adjusted, Q2 2016