Stockholm (HedgeNordic) – CTAs once again showed their worth as portfolio diversifiers during the equity market turmoil in January. Major industry benchmarks such as the Barclay BTOP and the SG CTA Index (formerly known as the NewEdge CTA Index) jumped 3 and 4.2 percent respectively according to early estimates. This means that the losses experienced by many CTAs in December, were more than recovered during the first month of 2016.

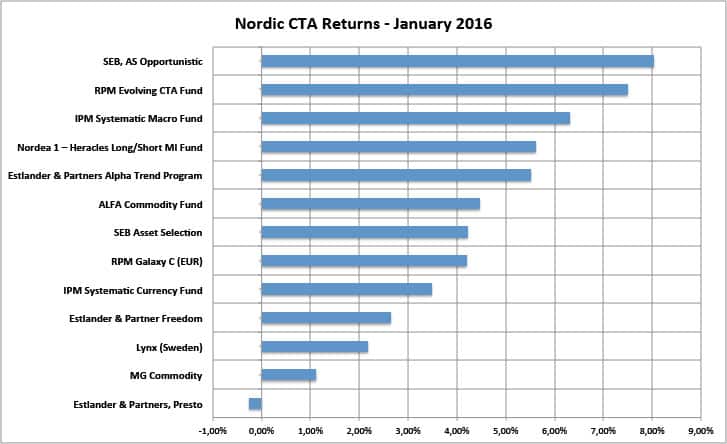

Nordic CTAs also showed strong numbers during the month. Early estimates indicate that the average return was 4.2 percent, wiping out a 2.8 percent loss for the NHX CTA from December.

Among individual names, SEB Asset Selection Opportunistic, RPM Evolving CTA and IPM Systematic Macro stood out as the big net gainers on the month. The IPM-number should be viewed as particularly strong given that the program, unlike the CTA industry, made solid gains in December as well.

Judging from the monthly comments posted by Nordic CTA managers, the month’s performance was primarily driven by the fixed income sector where trend following strategies appear to have benefited from long positions in long-dated government bonds. Short positions in oil also seem to have contributed positively despite a run-up in prices towards month-end on speculations of production cuts from OPEC and Russia.

Picture: (C) kentoh-shutterstock.com