Stockhom (HedgeNordic) – Equity hedge strategies was the single largest negative contributor to the NHX index in January (-2.9%) as a result of the sell-off seen in global equity markets during the month.

Given the long bias that is typical for long/short equity strategies, this should come as no surprise. However it is worth looking at at what the winners of the category did in order to gain a better understanding of the diversity of the strategy group.

First of all, there are a few names that employs a more opportunistic approach to their trading strategy. Last years big winner, AAM Absolute Return Fund (managed by Oslo Asset Management) and Finnish Gramont Equity Opportunities Fund (managed by Gramont Capital) are among these names. They both managed to gain significantly during the turmoil.

In the case of AAM (+7% in January), the manager has held significant short exposure to the US energy infrastructure sector for quite some time now according to the manager´s monthly comments. A trade that has benefited from the massive fall in the oil price. Gramont (+4.7% in January) has gained on the back of short equity index exposures as well as from more event driven trades during the course of the month. Also a relative value trade between gold miners (long) and popular US share Amazon (short) added to profits, the monthly commentary states. The manager continues to hold a negative view on equities.

The common denominator is that the two managers have been more opportunistic in trade selection and less tied to a portfolio structure that is long biased by nature.

Coeli Norrsken, QQM and Danske Europe Long/Short Dynamic, three market neutral managers, also stood out in January gaining 2.1%, 1.3% and 1.1% respectively. The non-reliance on market direction is key to the success here. The managers should be able to profit from both positive and negative market sentiments and over time deliver a return stream that is independent of the direction. This apparently worked in their favour during January.

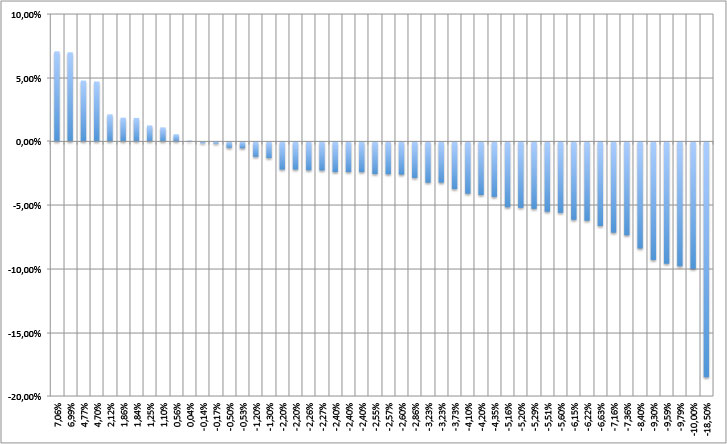

Overall, the month ended deeply in the red for the NHX equity category subset and some strategies suffered severe losses, the range of returns (see chart below) were +7% to – 18.5% which shows that it is important to have a thorough understanding of individual strategies and how they work in a bearish equity market sentiment when selecting funds to your portfolio. You might not get the diversity you seek by adding a long/short equity fund to an already equity-heavy portfolio, it might rather increase your risk as risk aversion kicks in…

Picture: (c) TischenkoIrina—shutterstock.com