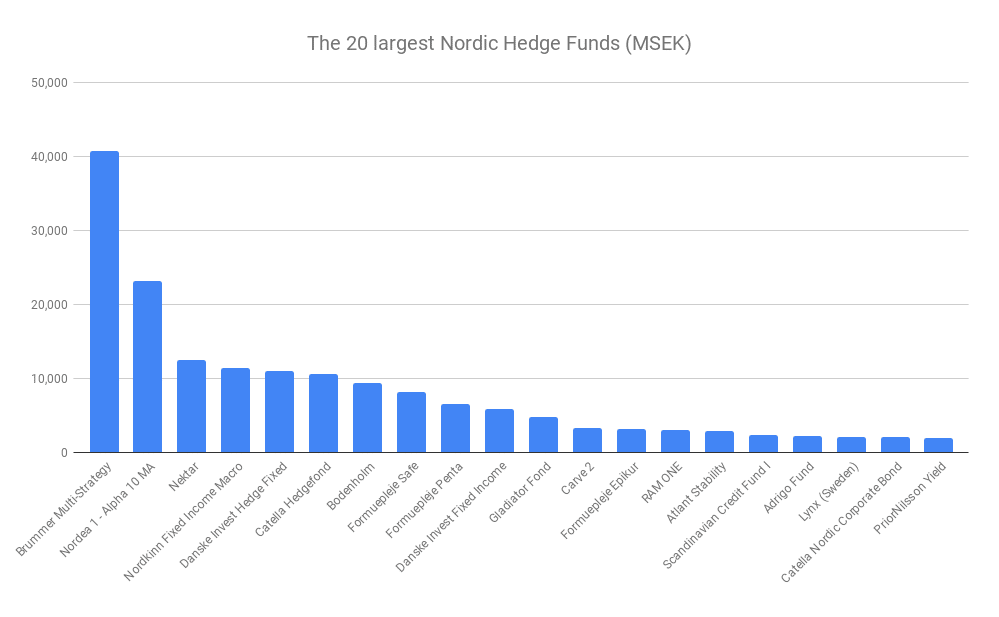

Stockholm (Hedgenordic) – The largest Nordic hedge funds have been successful in raising assets during the last two years, despite challenging conditions with reportedly increased fee pressure and in many cases weak performance numbers. According to Hedgenordic data, the 20 largest Nordic managers have amassed a collective 12.8 billion SEK in net inflows since January 2017. However, for some of the big names, AuM numbers are far off peak levels.

The Nordic hedge fund universe is heavily concentrated to a few big names, among those, Brummer & Partners are dominating the field. The Brummer Multi-Strategy fund (BMS) is in top position holding 41 billion SEK, other Brummer funds such as Nektar and Bodenholm are also among the top ten names. Another Brummer fund worth highlighting is Lynx. Lynx has total reported assets of 46.4 billion SEK, thereby being bigger than BMS, however in this comparison we only include the Lynx Swdish special fund with assets of around 2 billion SEK.

Nordic hedge funds gain assets despite Nektar drop

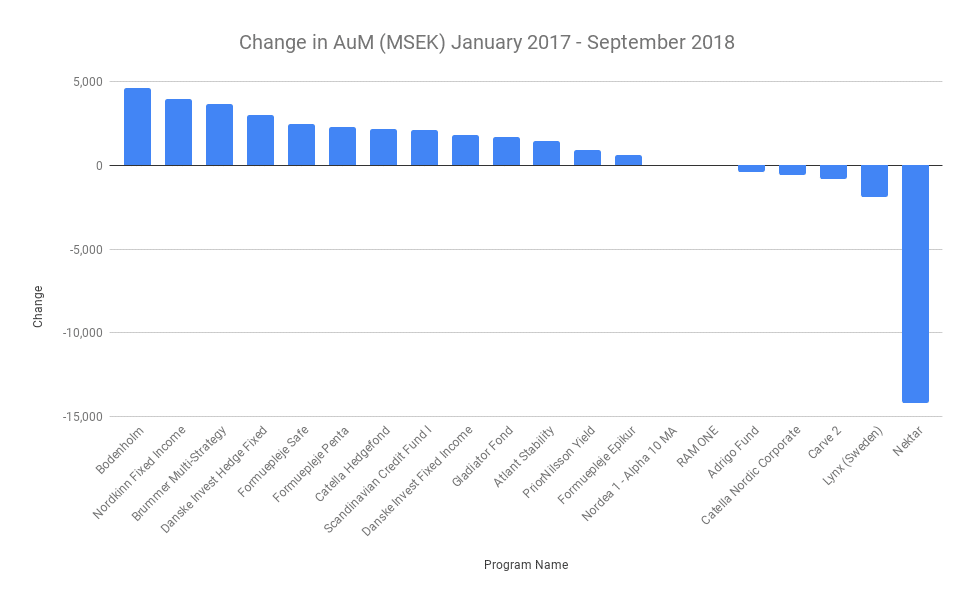

Looking at absolute levels of change in assets since January 2017 for the 20 largest Nordic hedge funds reveals a great dispersion. Overall there has been inflows, but a significant drop for the Brummer-backed Nektar fund overshadows a lot of the gains elsewhere.

In January of 2017, Nektar had an AuM level of close to 27 billion SEK, in September of 2018 that level was down to 12.5 billion SEK – a drop of more than 14 billion SEK. The manager’s assets peaked at 32 billion SEK in February 2016.

Among managers that are compensating for the Nektar outflow during the period are another Brummer-backed fund, Bodenholm, as well as the flagship Brummer Multi-Strategy. Presumably, the BMS fund has allocated away from Nektar and into Bodenholm but that would only explain a portion of Nektar´s AuM drop.

Other funds that have been successful in raising assets during the last two years are Nordkinn, Danske Invest Hedge Fixed Income, Formuepleje Safe and Formuepleje Penta. Catella Hedge has also managed to bounce back to above the 10 billion SEK level, having peaked at above 15 billion SEK.

The net total inflow for these funds over the period is 12.8 billion SEK.

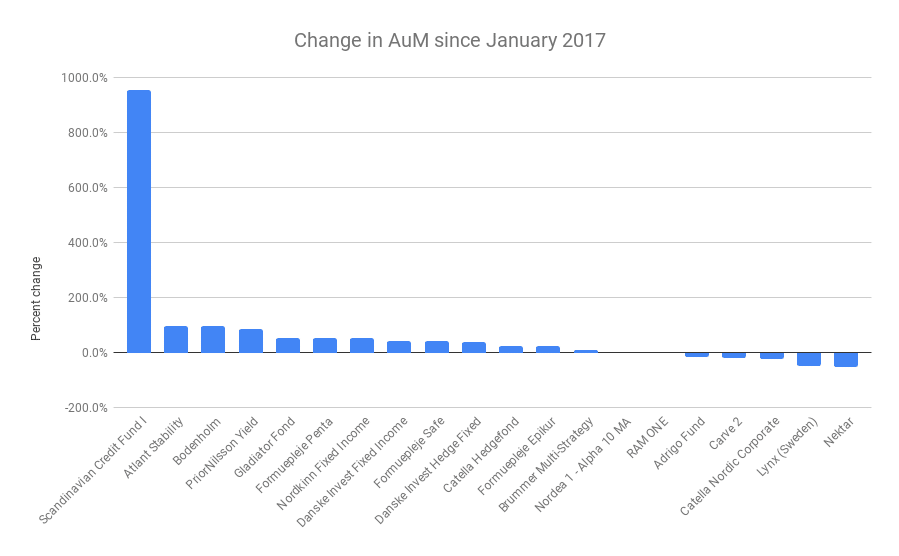

Focusing the analysis on percentage gains and losses instead of changes in absolute terms reveals a clear winner. The Scandinavian Credit Fund has had inflows of 2.1 billion SEK over the period, which translates into a gain of 954 percent, given that assets for the fund stood at 220 MSEK in January of 2017. The, fund which launched in 2016, has apparently seen tremendous interest on the back of strong performance numbers since inception.

Focusing the analysis on percentage gains and losses instead of changes in absolute terms reveals a clear winner. The Scandinavian Credit Fund has had inflows of 2.1 billion SEK over the period, which translates into a gain of 954 percent, given that assets for the fund stood at 220 MSEK in January of 2017. The, fund which launched in 2016, has apparently seen tremendous interest on the back of strong performance numbers since inception.

Atlant Stability and Bodenholm have closed to doubled their assets during the period. In the case of Atlant, the manager has come back from recording a 50 percent asset drop between 2015 and 2016. Atlant Stability is now back at record high levels in AuM terms.

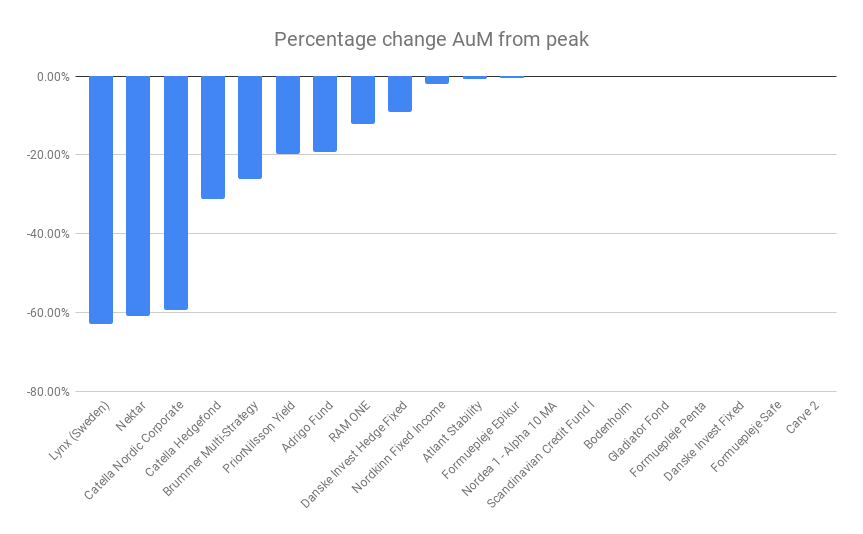

Nordic Hedge Fund Giants Far From Peak Asset Levels

Even though the last couple of years show that Nordic hedge funds are gaining assets, many of the big names are far from peak levels. Among the biggest losers are Lynx (again Swedish fund), Nektar, Catella Nordic Corporate Bond, Catella Hedge and Brummer Multi Strategy. The funds that have lost the most in absolute terms from their respective peak levels are Nektar (-19.3 billion SEK), BMS (-14.4), Catella Hedge (-4.8) and Lynx (-3.5).

Managers that are currently at peak asset levels include Bodenholm, Scandinavian Credit Fund, Gladiator (the fund has closed for new subscriptions due to size), three funds from Formuepleje and Danske Invest Fixed Income Relative Value. We were lacking historical numbers for Carve, Ram One and Nordea 1 Alpha 10 MA.