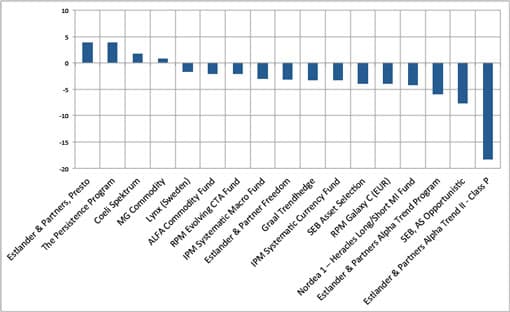

Stockholm (HedgeNordic) – As previously reported, Nordic CTAs had a dificult month in October. Early indications showed a loss of as much as -3,7%. With all programs having reported their monthly returns, the sector managed to claw back some territory, yet with now a 100% conviction, the final number for the NHX CTA index still stands at -3.1% for the month and -2,8% for the year. NHX composite added 0,8% in October and is up by 3% year to date.

Trend followers were the hardest hit among the CTA strategieswith the high leverage version of Estlander’s Alpha Trend II Class P program being down as much as 18 % on the month. SEB Asset Selection also had a difficult month with the standard leverage program down 3.9% and the Opportunistic version down by 7.6%.

Among the better performing programs, short-term strategies such as Estlander Presto and Romanesco Persistence stood out. Both programs are still in the red for the year however.

Estlander & Partners Global Markets and Global Markets XL programs, who are down for the year with -5% and -9,6% respectively by their last recorded returns from August 30, are no longer reporting NAVs.

In a comment to the month´s performance, Lynx writes: ”Several trend reversals caused a negative result for Lynx in October. The commodity sector was the largest negative contribution and losses were primarily attributed to short positions in gold and agriculturals.

In FX markets, the US dollar strengthened against a basket of larger currencies. As a consequence, Lynx suffered losses in the canadian dollar and the euro. Equity markets gained in the second half of the month contributing positively to the overall performance. By the end of the month, the Fed decided to keep rates unchanged, however, the price of bonds fell leading to losses.”

Chart: Nordic CTAs Return October 2015 (Source: HedgeNordic)

Picture: (c) MR.LIGHTMAN1975—shutterstock.com