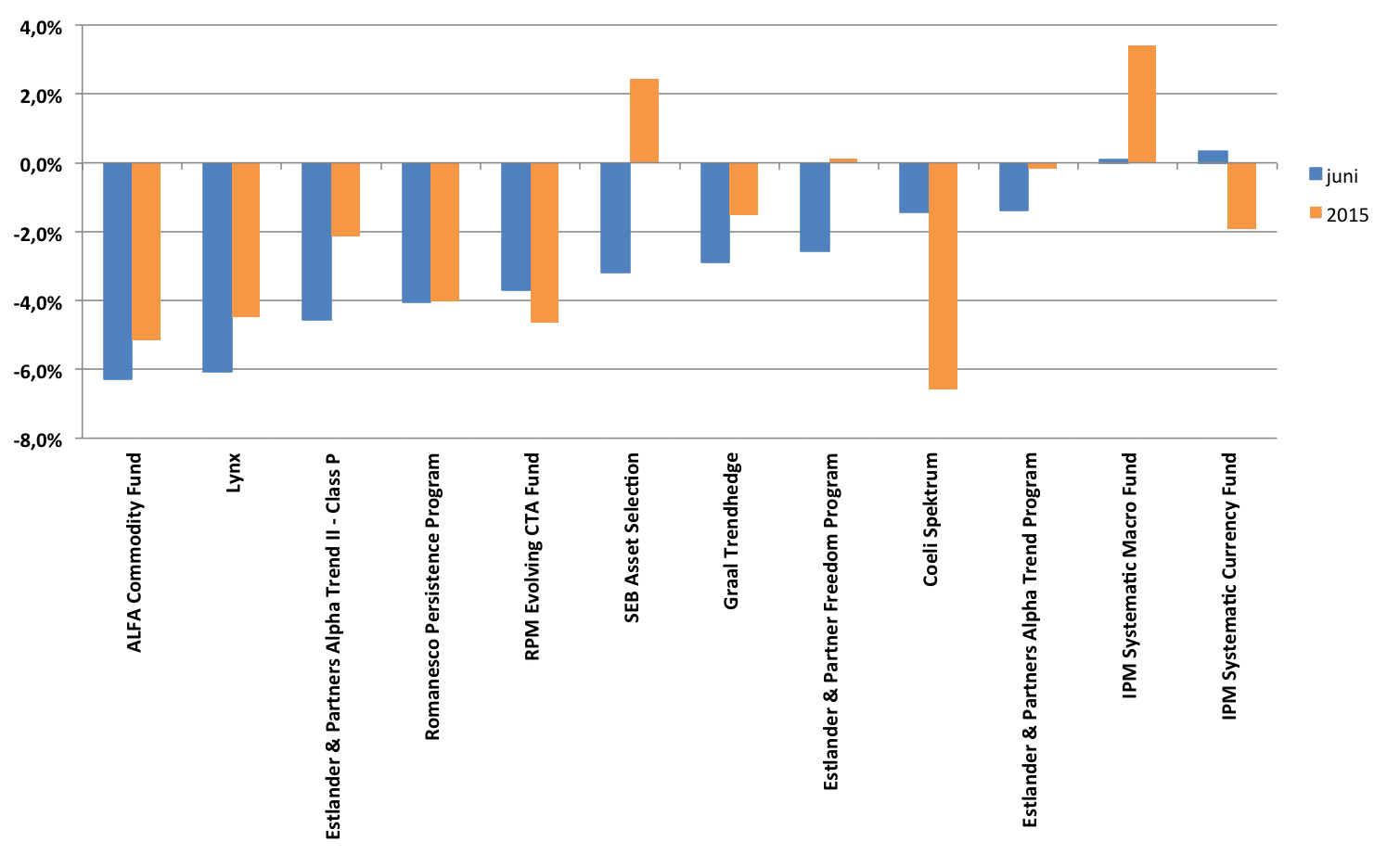

Stockholm (HedgeNordic) – Det var dystra miner för Nordens CTAs under juni månad. NHX CTA/Managed Futures visar preliminärt på en nedgång på 3 procent, därmed är indexet nu i negativt territorium på året (-1,7 procent).

Sämst var utvecklingen för Alfa Commodity Fund och Lynx som var ned 6,3 respektive 6,1 procent. Därmed visar dessa förvaltare röda siffror för året, trots en mycket stark utveckling under det första kvartalet.

Överlag var det negativa siffror under månaden där trendföljande strategier drabbades av nedgångarna på globala aktie- och obligationsmarknader. Estlander Alpha Trend (-1,3 %), Coeli Spectrum (-1,4 %) och SEB Asset Selection (-3,2 %) visade alla på mer eller mindre betydande förluster.

Den kortsiktiga förvaltaren Romanesco lyckades inte heller att dra nytta av uppstället i volatilitet och var ned 4,1 procent. Multi-manager fonden RPM Evolving CTA Fund förlorade 3,7 procent under månaden.

Det enda positiva inslaget stod IPMs fonder för. IPM Systematic Macro Fund och IPM Systematic Currency Fund var upp 0,1 procent respektive 0,3 procent under juni.

Nordiska CTAs – Utveckling i juni och för året 2015

Bild: (c) shutterstock_Thomas Pajot