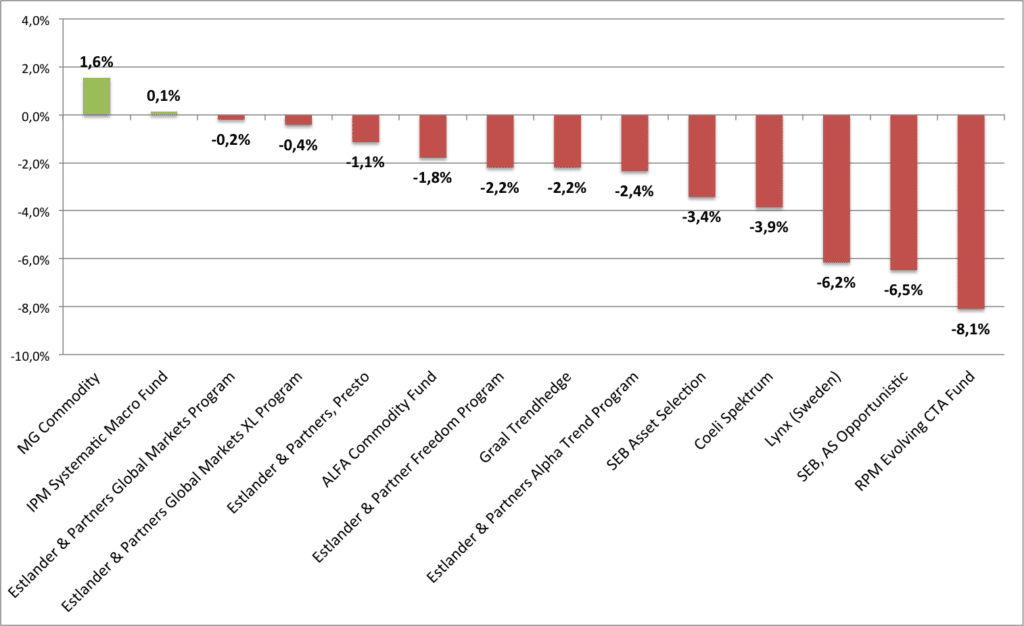

Stockholm (HedgeNordic) Efter att ha noterat en lång period av obrutna uppgångar fick CTAs erfara kraftiga förluster under april. Preliminära siffror gör gällande att Nordic Hedge Index (NHX) CTA var ned 2,86 procent, samtidigt rapporterar det globala Newedge CTA Index en nedgång på 3,2 procent.

Flera av de långa trender som CTAs profiterat på under fjolåret och inledningen av 2015 vände tvärt under månaden. Såväl valutor som energi var problematiska marknader för trendföljande modeller. Till detta kom ofördelaktiga rörelser på räntemarknaderna.

På valutamarknaden vände den amerikanska dollarn ned kraftigt efter att under lång tid upplevt en stigande trend. Det motsatta förhållandet rådde inom energisektorn där oljepriset vände upp från en starkt negativ trend.

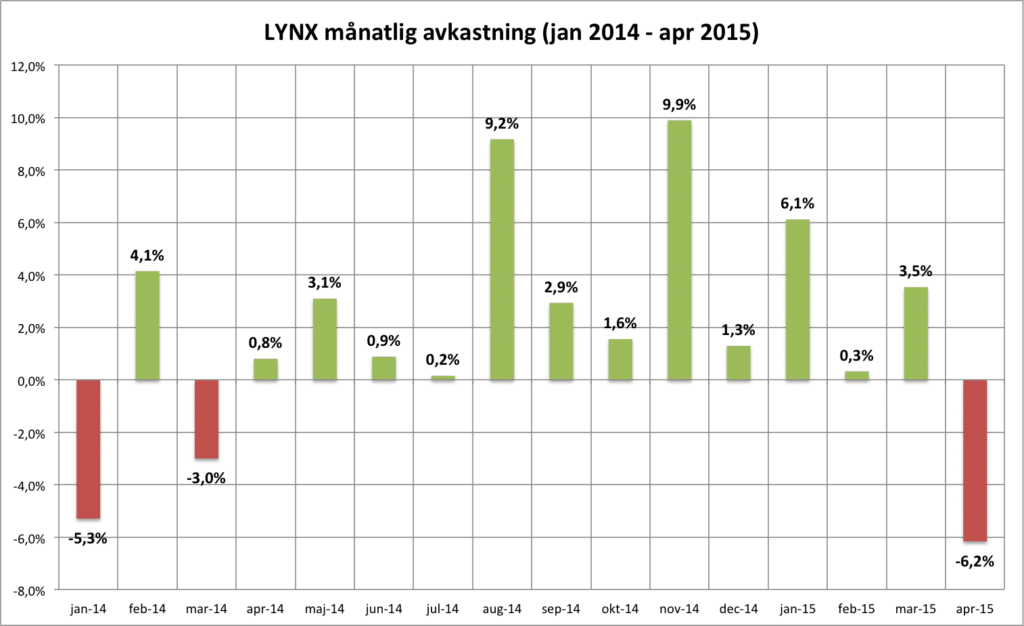

Bland de nordiska CTA-förvaltarna var det överlag bistra miner. LYNX en tung månad med en nedgång på 6,2 procent. Detta följer dock på en lång period av idel uppgångar. Inför april hade LYNX noterat 12 raka plusmånader i rad (se graf 2 nedan). Andra fonder som hade svårt att hantera trendbrotten var RPM Evolving CTA Fund och SEB Asset Selection.

Graf 1. Avkastning april nordiska CTAs (HedgeNordic.com)

Graf 2. LYNX månatliga avkastningar sedan 2013-12-31 (HedgeNordic.com)

Bild: (c) Rrraum—shutterstock.com