(HedgeFonder.nu) – The year 2012 has ushered a new regime for the global economy and investments markets. On the heels of the most severe financial turmoil in the post- world war two era, the global economy is seemingly on the mend, an assessment derived in great part from a marked improvement in US economic activity, easing liquidity conditions in Eurozone markets (thanks to the LRTO operation), and a resilient Chinese economy that has been prognosticated by many pundits as being at risk of a hard landing.

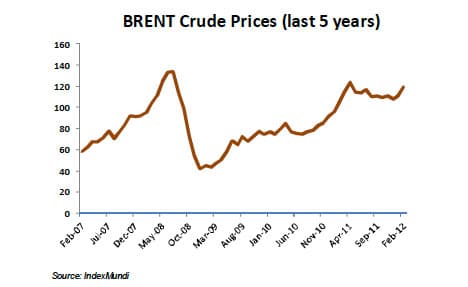

Commodities markets have also returned to the forefront of investors’ radar and the financial press alike. The recent rebound in economic activity and risk sentiment has lifted demand for energy-related commodities, with oil once again taking center stage. On the supply side of the picture, recent geopolitical strains in the Middle-East, coupled with shrinking aggregate inventories have been supportive to price action. Both sets of catalysts have contributed to a sharp climb in oil prices since the beginning of the year, with Brent and WTI advancing more than 20% from their 2011 lows.

As oil prices reach new highs, the newfound sanguineness is showing signs of abatement as investors worry of the impact of higher oil prices on the global consumer, whose spending power will sooner than later get pinched by rising prices at the pump, and pass-through effects of energy costs- induced inflation.

We are looking to address a narrower topic here, emphasizing the impact of rising oil prices on Frontier African economies, from the viewpoints of inflation, fiscal stability, and economic growth. Our analysis covers a select group of economies, viewed as proxy representatives of the broader region: Angola, Botswana, Ghana,Kenya, Namibia, Nigeria, Tanzania and Zambia.

Frontier Africa economies – General Presentation

The African commodities tale is nothing short of conventional wisdom, so the impact of oil prices on these economies appears trivial – well, only on surface. In fact, one of the key attractive characteristics of frontierAfricamarkets is the natural diversification they offer. In fact, African economies are far from being uniform in their makeup, which translates in different reaction functions to various economic scenarios, including that of soaring oil prices.

Oil production and consumption inAfricavary a great deal fromNigeriatoZambia(respectively the continent’s highest and lower producers –Nigeriaproduces over 2 million bpd, vs. a mere 160 bpd for Zambia).

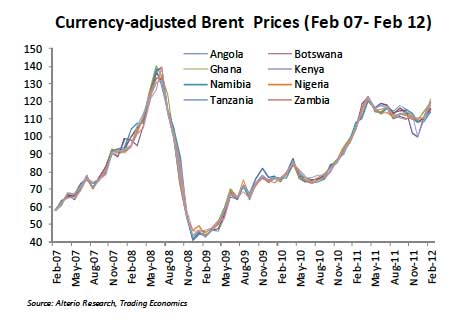

The global reserve status of the greenback has granted it the rights of currency denomination in commodities markets. At the end of February 2012, Brent crude quoted in USD terms around $120, roughly 10% near its record high of $133 seen in June 2008. However, a more insightful analysis should direct us to an assessment of the domestic price crude, on a local currency basis.

From an FX-adjusted perspective, there is some divergence in the relative increase of crude prices among our select African economies. Moreover, we note that notwithstanding the universal rise in crude prices, on a currency-adjusted basis, African economies are experiencing prices that are 16% below their 2008 peak; this accounts for roughly 6% relative gain from aggregate currency appreciation.Kenyafeatures the lowest FX-adjusted crude price within our complex, with an average monthly Brent price of just $115 (over 20% below their 2008 peak)

Economic impact

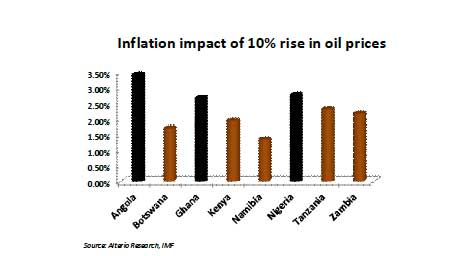

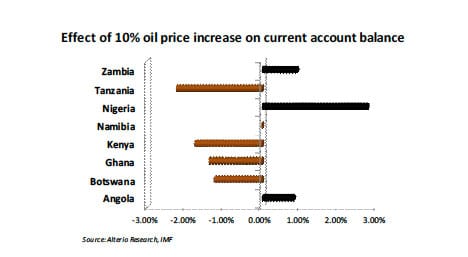

The fundamental question here is the potential effect of a sustained global oil crisis on our Frontier Africa complex; of utmost importance is the behavior of current accounts and inflation. Initial economic conditions, as well as the overall strength and credibility of monetary, fiscal and economic policies are key determinants to their relative success in navigating such a crisis.

We observe on the inflation front, Nigeria, Angola and Ghana are the most exposed to price shocks in oil markets, primarily as a result of their higher import bills for petroleum products, and given the size of their respective economies relative to peers (3 largest economies of our complex on a GDP basis: Nigeria $263bn, Angola $108bn, Ghana $45bn, according to 2012 IMF estimates). Overall, the complex shows inflation sensitivity ranging from 1.5% to 3.5% per annum based on a 10% rise in crude.

Current account sensitivity shows a clear dichotomy between large and low producers of crude. In aggregate, current account impact is expected to vary from -2% to +3% per annum in response to a 10% shock.Nigeriastands as the obvious winner here, boasting the status of the continent’s top producing nation, followed byAlgeriaandAngola. Note thatGhanais somewhat of a special case, because of the current production pipeline that could potentially propel the country to a mid-level producer in the next half-decade; for the sake of the analysis, we refrain from putting too much weight on forecasted production figures (which tend to vary by a wide range).

Conclusion

The potential advent of an oil crisis has captivated the attention of global markets investors. At the global macro level, the run-up in crude prices has casted a dark cloud on the prospects of a sustained recovery in the global economy, as elevated energy prices could slam a break on consumer spending activity in the US, while adding to the headwinds of an increasingly fragile China growth engine.

FrontierAfricacontinues to make strides in its commitment and ability to play a larger role on the global economic scene, thus the impact of rising oil prices on the region should not be dismissed. As a commodity-producing continent, Sub-Saharan Africa however is nowhere close to be a uniform cosmos when it comes to economic makeup and vulnerability to global shocks. Although we perceive notable risks to these economics from an inflation and current account perspective, overall sensitivity remains very much idiosyncratic. More importantly, stronger and more credible monetary policies in Frontier Africa economies have promoted greater steadiness in foreign exchange markets, resulting in a fairly muted impact on currency-adjusted crude prices relative to their developed markets counterparts.

This report was prepared by Alterio Research Ltd, an Africa-focused investment research company based in Vancouver,British Columbia(Canada) for HedgeFonder.nu.

Sourcces

1. Alterio Proprietary Research, Bloomberg

2. IMF, World Bank, IndexMundi, Trading Economics

Bild: (C) shutterstock—astudio