Stockholm (HedgeNordic) – Growing signs that price pressures are easing suggest inflation may have peaked, which has some market participants wondering whether equity markets are about to bottom out. At various points in the past, the top of an inflation cycle was a great time to catch a bull market. After inflation peaked at 12.2 percent in December 1974, the S&P 500 gained 37 percent in 1975 after incurring a loss of about 26 percent in the prior year.

“The 1974 equity bear market bottom has come up recently in conversations with clients,” says Lars Wind (pictured), the CIO of Wavebreaker – a hybrid of systematic trend-following and discretionary macro. “In September of 1974, US equities bottomed out when yields peaked and inflation was topping out,” he elaborates. However, Wind does not consider that the argument for buying equities on peak inflation is valid today for a number of reasons.

“In September of 1974, US equities bottomed out when yields peaked and inflation was topping out.”

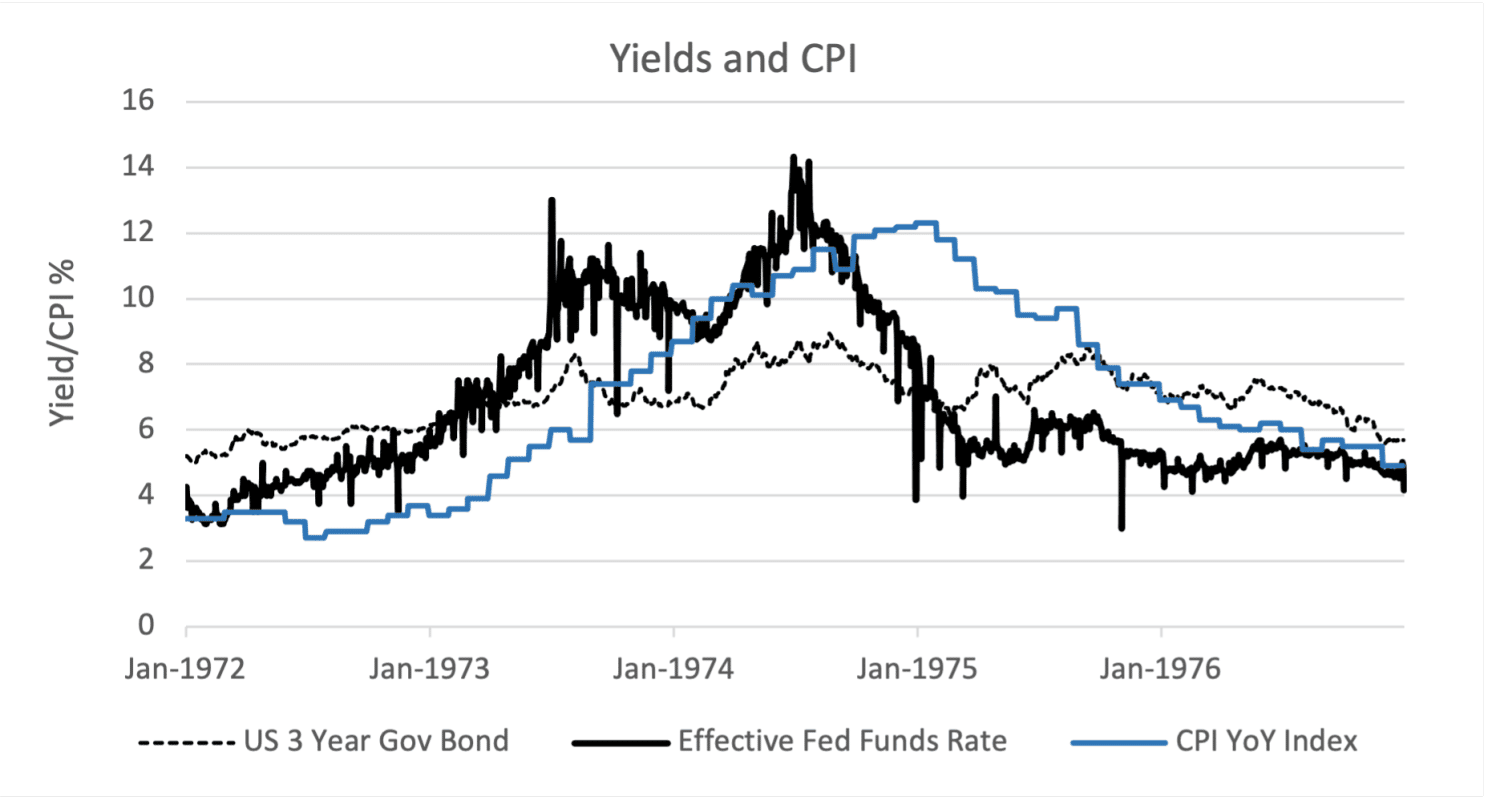

“Firstly, in 1974 the FED had allowed money market conditions to ease during the late summer,” starts Wind, who launched Wavebreaker at the start of 2022. The Federal funds rate and bond yields declined significantly during the initial stages of the rally in late 1974, which provided monetary stimulus to support an economy that had been in recession for three quarters. “This is at odds with the message from the FED today,” says Wind. “At best, we can expect the FED to stop the hiking cycle in the spring of next year, but Chairman Powell continues to emphasize that this does not mean that rate cuts will follow soon after. The rate hikes already done will continue to work their way through the economy, creating more drag.”

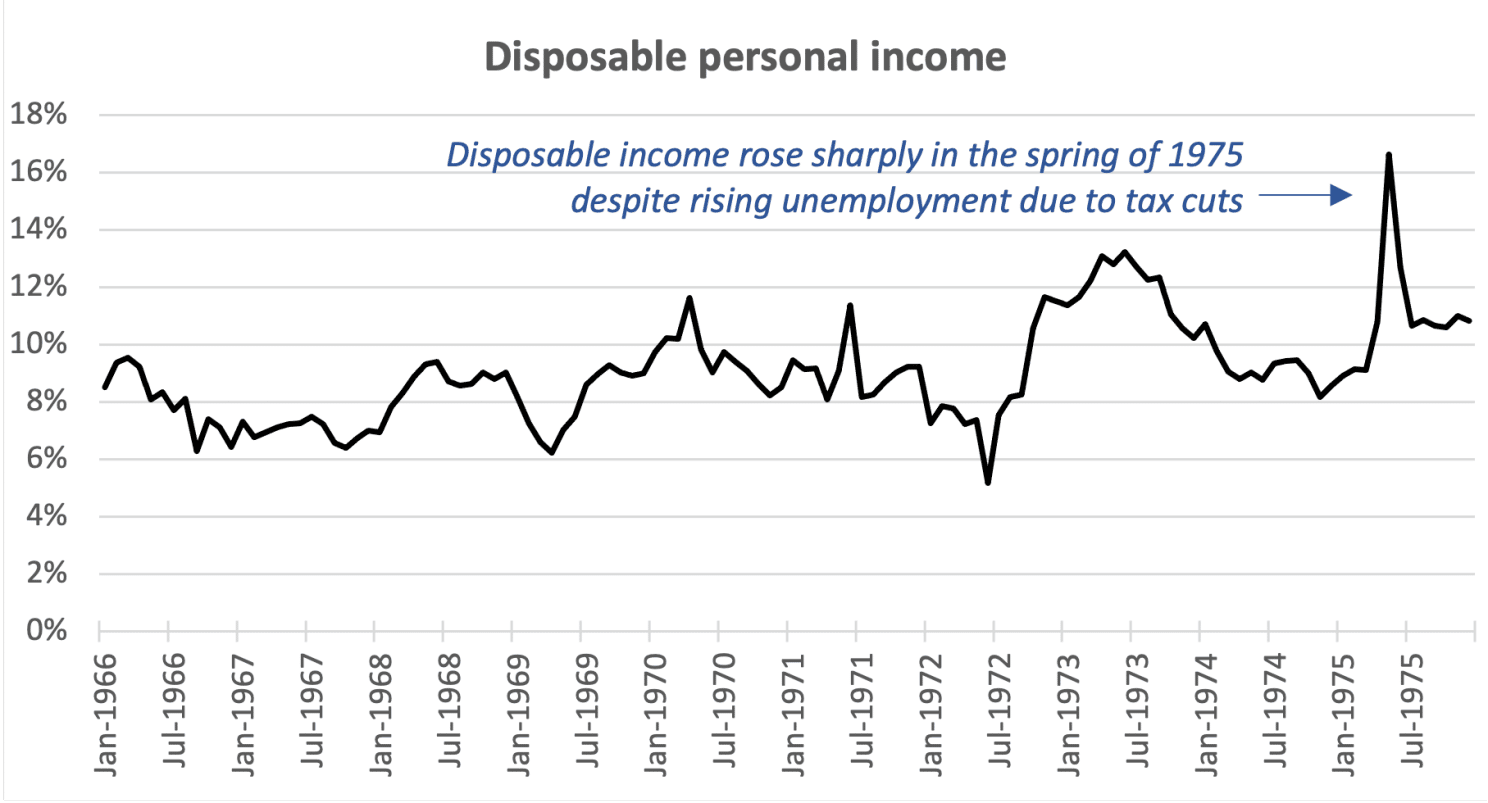

“Secondly, back then, there was significant fiscal support from the “Tax Reduction Act of 1975,” which improved consumption and helped turn the economy around,” continues Wind. “Today, a divided US congress and the recent UK fiscal policy debacle make such stimulus incredibly unlikely in the short term.” And finally, stock-market valuations were at much more attractive levels in 1974 due to the 48 percent decline since the start of the 1973-74 bear market, according to Wind. Stocks were trading at a cyclically adjusted price-to-earnings ratio (CAPE Ratio) of around 16 back in 1974 versus 32 today.

“The one bullish similarity I see today is that US inflation has likely peaked, which increases the chance of a soft landing,” says Wind. He still does not believe a recession can be avoided due to significant headwinds stemming from declining construction and consumer spending coming under pressure. “The monetary lesson learned from 1974 is that too much easing happened too rapidly, which yes; set the stage for the ensuing equity rally, but also for the next inflation wave which began in 1977,” concludes Wind. “Central Banks should be keen to avoid the same mistake again.”