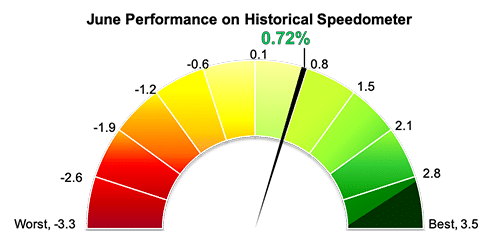

Stockholm (HedgeNordic) – Nordic equity hedge funds gained 0.7 percent in June (82 percent reported), capping off their best first-half performance since 2015. Equity hedge funds, as expressed by the NHX Equities, were up 4.2 percent in the first half of 2019.

Nordic equity hedge funds as a group trailed both local and global equity markets last month. Nordic equities, as expressed by the VINX All-share index, delivered a net return of 4.6 percent in Euro terms in June. The index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs. Global equities, as measured by the FTSE World Index, rose 4.3 percent in Euro terms last month. Eurozone equities gained 5.2 percent, whereas North American equities advanced 4.7 percent in Euro terms.

Based on preliminary estimates, the equity-oriented funds within the Nordic Hedge Index trailed global long/short equity funds last month and performed in line with their European counterparts. The Eurekahedge Europe Long Short Equities Hedge Fund Index, which reflects the performance of 160 European equity hedge funds, gained an estimated 0.6 percent in June based on reported data from 14 percent of its index constituents. European long/short equity managers are up 3.5 percent in the first half of this year. The Eurekahedge Long Short Equities Hedge Fund Index, a broader index comprised of 939 global funds, advanced 2.5 percent last month based on reported data from 12 percent of index constituents. This group gained 7.2 percent in the first six months of 2019.

Exactly half of the 50 equity-focused funds in the Nordic Hedge Index with reported data for June had positive returns last month. Rhenman Healthcare Equity L/S, a long-biased hedge fund focused on the healthcare sector, was last month’s best-performing member of the Nordic Hedge Index with a gain of 10.1 percent. This brought the fund’s performance for the first half of 2019 to 18.8 percent.

Proxy Renewable Long/Short Energy, a long-biased fund focused on the renewable energy and energy tech sectors, advanced 5.8 percent last month. The fund is up 30.3 percent in the first half of 2019, currently ranking as the third best-performing member of the Nordic Hedge Index in 2019. Atlant Sharp and the two value-oriented funds under the umbrella of Helsinki Capital Partners – HCP Focus and HCP Quant – were also among last month’s top five best-performing constituents of the NHX Equities. After gaining 4.7 percent in June, HCP Focus reclaimed its position as the best-performing member of the Nordic Hedge Index in 2019. The fund is up 33.7 percent year-to-date through the end of June.

Photo by Walter Walraven on Unsplash