Stockholm (HedgeNordic) – One of the first distinctions up for grabs in the early stages of a Nordic hedge fund’s lifecycle is the “Rookie of the Year” award, honoring the region’s most outstanding new hedge fund launch. Presented annually at the Nordic Hedge Award, this title is awarded to the most promising hedge fund debut, as determined by a jury of fellow Nordic hedge fund managers. Nine hedge funds have qualified for consideration for the 2024 “Rookie of the Year” award.

The nine hedge funds in contention for the “Rookie of the Year 2024” award were launched during the 12-month period ending in September of last year. Funds launched after September will qualify for next year’s award. To qualify, funds must be listed in the Nordic Hedge Index and meet the necessary listing criteria, though there are no specific requirements regarding assets under management for consideration. The winner of the “Rookie of the Year” award is determined based on the combined scoring of a jury board comprised of Nordic fellow fund managers, making this a peer-group award.

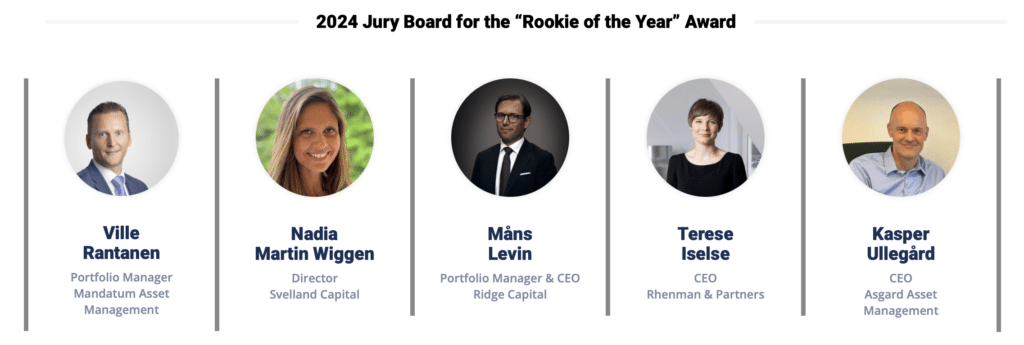

For the 2024 Nordic Hedge Award, the “Rookie” jury consists of Ville Rantanen, Portfolio Manager at Mandatum Asset Management; Nadia Martin Wiggen, Director at Svelland Capital; Måns Levin, Portfolio Manager and CEO at Ridge Capital; Terese Iselse, CEO at Rhenman & Partners; and Kasper Ullegård, CEO at Asgard Asset Management.

The members of the jury select what in their opinion represents the most promising hedge fund debut of the passing year by considering a host of qualitative assessments at their discretion. The jury members are invited to consider questions such as:

- Which fund would I feel most comfortable investing in, despite its short track record?

- Which fund is best positioned to build a long-term, robust track record?

- Which fund has the potential for meaningful impact in the Nordic hedge fund space?

- Which fund could become a billion-dollar fund (if that is even desired or the intention, within the capacity of the strategy)?

The winner will be announced on the 9th of April 2025 at the final event of the Nordic Hedge Award in Stockholm. For more information about the award and previous winners, please visit: Rookie of the Year.

Good luck to all contestants!

The Nordic Hedge Award is supported by these fine entities: